Volume Profile Formula Review – What is Volume Profile Formula?

Volume Profile Formula is an introductory course about volume profile trading created by Aaron Korbs at Tradacc. This formula is what Aaron claims is the one proven method that makes him a consistent $10,000-$15,000 per month trading about 2-4 hours per day.

Within this detailed Volume Profile Formula review, I’ll discuss whether or not these claims are true and if the course is worth pursuing. By the end, you should have a clear understanding of what Aaron Korbs, Tradacc, and Volume Profile Formula are all about.

For starters, Aaron Korbs is an active intraday trader with about a decade of market experience who specializes in volume profile and order flow. He’s essentially the face of Tradacc – a trading education company that he co-founded alongside Ruben Davoli.

Volume Profile Formula is the introductory course that Tradacc offers to explain the basics of Aaron Korbs’ trading methodology – which is a framework rooted in auction market theory, volume profile, and order flow trading concepts.

There are 5 main sections of the course containing 3+ total hours of on-demand video: 1) The 6-Figure Volume Profile Strategy, 2) View the Market in Matrix Mode, 3) Volume Profile Formula, 4) Next Level Trade Management, and 5) The 6-Figure Trader Mindset.

There are also a few bonuses that come with it: TradingView Charts Setup Cheatsheet, Plan of Attack Template, and Private Community.

What is Volume Profile Trading and Does Volume Profile Trading Actually Work?

There are so many indicators and charting studies that retail traders blindly rely upon for entry & exit signals (moving averages, Bollinger bands, Fibonacci retracement, MACD, and the list goes on-and-on). But this is an ineffective, surface-level approach.

Most (if not all) of these classic trading indicators lag behind price and aren’t robust enough to produce consistent profits on their own. They all work some of the time by sheer chance, but markets are far too dynamic for simple indicator strategies to be practical.

I don’t mean to be the bearer of bad news – especially if you’re currently one of those people making trading decisions based on all kinds of useless indicators. But if it were as easy as following a fixed, rule-based indicator strategy, the failure rate wouldn’t be 90%.

Aaron Korbs doesn’t even like to categorize volume profile as a technical indicator/chart study – which might be a bit of a stretch. But he says this because volume profile – if used correctly – is just different. It adds an extra dimension to market analysis.

- What is Auction Market Theory – Trading Value vs. Price

- What is Profile Trading – Volume Profile & Market Profile

It doesn’t spit out “buy here” or “sell here” recommendations just because some lines crossed. Instead, it displays real-time market-generated information in regard to participation. Not all price levels are created equal; the “quality” of price depends on volume.

There’s no doubt in my mind that gaining competence and skill around profiling is far more powerful than traditional indicators.

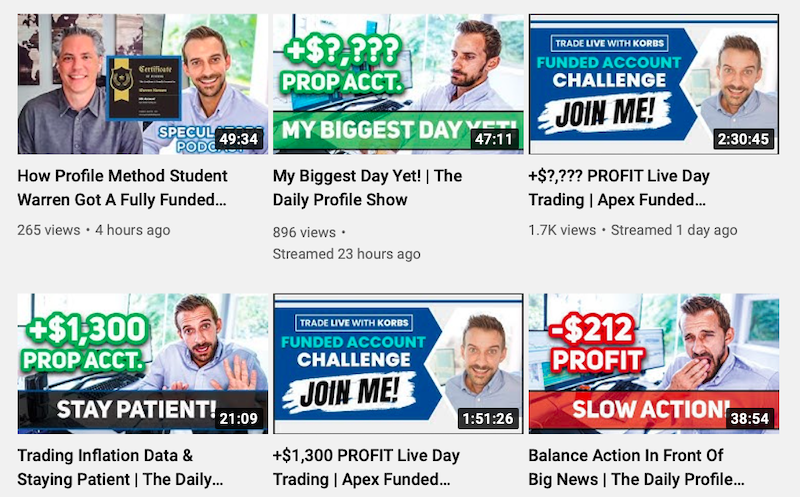

What is Korbs YouTube – Check Out His Channel For Education and Live Case Studies:

The Volume Profile Formula page is definitely a bit “sales-y” – which I don’t particularly love. In fact, my knee-jerk reaction to it was “scam”. It just gave me an uneasy feeling reminiscent of sketchy programs I’ve experienced in the past.

But unlike all of those sketchy programs, what Aaron Korbs has to offer actually has substance behind it – and what convinced me to actually give the Volume Profile Formula a shot was his YouTube channel. There’s some incredible content there.

Not only does he share a ton of solid information in regard to auction market theory, volume profile, and futures trading – but he also puts what he teaches on display through live case studies and trading challenges. He actually practices what he preaches.

Here are some of the case studies/challenges that he’s done in the past or is currently pursuing:

His Daily Profile Show is also a great opportunity for anybody to connect with him and discuss the trading day. It’s essentially an open Q&A at the close of every trading session. So it’s clear that Aaron Korbs is out there “living” his volume profile methodology.

My initial hunches on scams are typically right. But in this case – with Aaron Korbs and Volume Profile Formula – I was wrong.

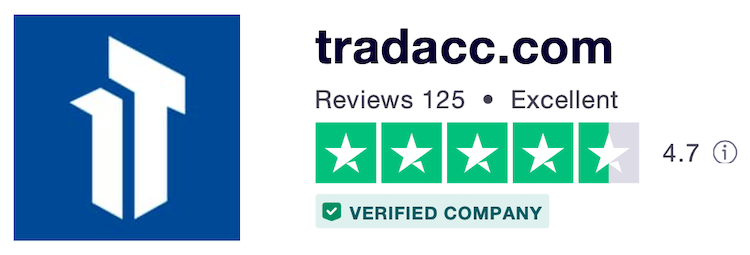

Volume Profile Formula Reviews & Testimonials From 100+ Students on TrustPilot:

In the conclusion (the next section) I’ll wrap up with my personal overall thoughts on Aaron Korbs and the Volume Profile Formula. But I always think it’s important to hear the thoughts/opinions/experiences of numerous others for a well-rounded perspective.

If you check out the Tradacc reviews on TrustPilot, the vast majority are positive (over 95% are great or excellent) – which is a solid sign that most students are more than satisfied with what Tradacc has to offer:

“Well worth the price”.

“Truly a hidden gem”.

“Korbs is a great teacher”.

“Excellent introduction to volume profile”.

“I recommend Volume Profile Formula course to anyone”.

“Goes above and beyond in supplying value”.

“Best program that I’ve been a part of”.

But it’s important to browse through the negative reviews as well. The “bad” and “poor” reviews are generally quite telling – and in this case, it seems like the biggest complaints are about the marketing (not the actual education and training itself):

“They sell a big game”.

“Marketing, marketing, marketing”.

“Bonus videos very generic”.

“The Volume Profile Formula is not exactly a formula”.

Conclusion – Final Thoughts on Aaron Korbs, Tradacc, and the Volume Profile Formula:

While the Volume Profile Formula course sales page is a little over the top for my taste (from a marketing perspective), I think the course itself is well worth the cost for anybody with the desire to become a self-sufficient, consistently profitable trader.

But understand that this course alone won’t get you there. It certainly puts you on the right track, in my opinion, in terms of market framework (being rooted in auction market theory, volume profile, and futures trading). But it’s only an introductory course.

|Take Your Trading Approach From 1D to 3D With the Volume Profile Formula|

|Learn a Reliable Market Methodology and Become a Consistently Profitable Trader|

|Learn a Reliable Market Methodology and Become a Consistently Profitable Trader|

If you actually have ambitions to make trading a significant portion of your income or potentially trade for a living, then next-level training is required. Don’t expect free YouTube content or a basic $47 course to magically turn you into a millionaire trader.

Volume Profile Formula is a great starting point (it’s virtually risk-free because of the price – and on top of that offers a 30-day money back guarantee), but the Profile Method is where the real training is. The Volume Profile Formula is merely a primer.

Overall, I highly recommend Korbs YouTube and the Volume Profile Formula course for starting to build yourself a robust market framework. But please don’t expect it to be some push-button system that automatically generates massive profits in perpetuity.

Volume profile is simply a tool (albeit a powerful one) that takes time and effort to build competence and skill around.

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- How is Tradacc Trading For Beginners – My Personal Take

- What is Trade With Profile – Best Trader Training Program?

- Best Futures Trading Method – The Volume Profile Method

- Free Futures Trading Education – Top 5 Educational Resources

- What is the Volume Profile Method With Aaron Korbs? [REVIEW]

It seems like it would be a great starting point for someone that wants to get in to the trading business. I am going to look at the program little a more myself. The price is very reasonable for a starter course. I would need to buy a more advanced course eventually. I do agree with if you don’t know the foundation or the basics you are bound to fail.

Hi Reggie – I appreciate you sharing your thoughts on the Volume Profile Formula course.

Starting with proper foundations is absolutely critical for beginners, so I think the VPF course is a great stepping stone into the full-blown Profile Method training and mentorship program.

As a complete beginner, I would also highly suggest Aaron Korbs’s YouTube channel – he offers a lot of great content there, as well as my own free Trading Success Framework course – which breaks down exactly what being a real/committed/self-sufficient/consistently profitable trader truly entails. Individuals who skip the proper education, training, and mentorship phase are bound to fail, just like you said.

Volume Profile Formula seems like a great way to learn and get started in trading if you have determined that you want to trade for a living and need to know the progression of steps in order to be successful. Having the opportunity to gain further training is significant also and Aaron Korbs spends time to answer questions and to help you to learn how his system works. I think that it is very significant for him to demonstrate availability to help his students to become successful traders. How much is required as far as starting capital for investment?

That’s a great question. A handful of years ago, my answer to the starting capital question would’ve been a minimum of $50,000 in order to realistically trade for a living (if not much more). But these days, with the proliferation of various funded trader programs like Topstep, you don’t necessarily need to risk any of your own money. Proper education, training, and mentorship like Profile Method and/or Profile Pathway are going to cost a couple thousand dollars or so – but once you attain a high-degree of competence/skill, there are numerous programs available for funding. So access to capital is no longer an issue like it used to be. If you have the skills and can prove you can grow an account and properly manage risk in a simulated environment, there will be various programs willing to fund you with 5, 6, and sometimes even 7-figures worth of buying power. So the biggest barrier to trading for a living (or at least making it a significant portion of your income) isn’t access to capital – it’s acquiring the habits and skills for long-lasting success.

Ok, back in the day, 2007, I started micro trading. I did it all day long in between working through aligning cars. I put up 800 and after about 16 months I was at 1200. Then 2008 hit. Thankfully, I had read the tea leaves correctly and got myself and my parent’s retirement completely out when it hit. So I started experimenting in small trades and quickly figured the market was too volatile to roll those dice. I never went back. 2008 was a crazy time, confidence in market valuations was tossed due to the irresponsible way the banks saw fit to play the game, then were bailed out no less. So all that to ask this, this market has more tea leaves screaming at me now than other time I can recall. What can you point to that says, in cold hard facts, this is a good time to work the market? I have never seen so much chaos. Looking forward to your reason because I miss the market quite frankly!

I really appreciate you sharing your experiences because I’m sure a bunch of other people feel the same way about markets being too “chaotic” and “volatile”. And I truly don’t mean any disrespect, but what you’re describing is the classic surface-level, retail view/approach to trading – which is characterized by an extremely limited understanding of market behavior and what it means to be a real/legitimate trader. Most people only view trading from a limited, one-dimensional perspective where buying and then selling is their only option. They just buy-and-hold a stock, for example, and hope it continues to go up forever. And this approach often works pretty well during bull market periods – making the general populace think they’re great “traders”. But when market context/posture/conditions change, these people have no idea what to do besides complain about the economy, policy makers, the fed, the president – you name it. And they do this because they don’t actually know how to trade – all they know how to do is “buy the dip” and have “diamond hands”. So when that ignorant/reckless approach no longer works, they simply feel, angry, frustrated, and confused – and blame the market for not fulfilling their desires.

So my suggestion for you – which is also my suggestion for anybody who visits this site – is to generate a more robust market framework through the lens of powerful tools like volume profile and market profile. These are tools that organize critical market-generated information in ways that actually make sense and remove the mysticism from market movement. They bring meaningful order to what most people see as chaos. The reality is that there are often long/bullish and short/bearish trade opportunities every single day as the market rotates around value (or breaks out away from it). So when people complain about markets being “random”, “chaotic”, or “too volatile” – it’s extremely telling. It’s typically a sign that their market framework is weak/ineffective and that they’re not skilled/competent intraday/short-term traders at all. Generally speaking, short-term traders actually love volatility because it provides larger ranges/opportunities. Again, my intention isn’t to single you out because you’re far from alone in your current market view/approach. And everybody pretty much starts out with that same ineffective perspective – as did I. But you have the choice to either continue to feel angry/confused about market behavior and avoid it altogether or make the decision to become a legitimate trader by developing competence/skill around the auction process. If your choice is the latter, here are some helpful resources:

What is Profile Trading – Volume Profile & Market Profile

Volume Profile Trading – What Does Volume Profile Tell You?

What is Auction Market Theory – Trading Value vs. Price

Molding Your Market Framework – How Do You View Markets?

Free Futures Trading Education – Top 5 Educational Resources

I have the belief that when a person trades stocks without learning the basics, they are doomed to fail. As with any other endeavor a person undertakes, they must first educate themselves on the language, timing, and interest in the subject involved.

If a person becomes a day-trader they must at the very least learn the terminology involved in day-trading. Without this information they not only would be at a disadvantage, but they would also lose all the money or stocks to buy or trade. It is like building a structure, if you don’t have a good foundation then your structure will most likely collapse upon itself. Another example, when trading you must as you stated know what is under the hood so you can time your trade at the best time.

If you’re looking for a comprehensive guide to volume profile trading, then you should definitely check out Aaron Korbs’ course Volume Profile Formula. This course is packed with information on how to use volume profile to identify and high-probability trade setups. It’s also jam-packed with real-world examples, so you can see how the volume profile can be used to find and trade winning setups. Overall, I think new and even intermediate traders would find this course to be extremely useful and would most highly recommend it to anyone interested in increasing their edge.

Hi Oliver – I appreciate you sharing your thoughts and experiences with Aaron Korbs’ Volume Profile Formula.

I think the Volume Profile Formula course is an incredible value and a great introduction to Aaron Korbs’ specific approach. But the “comprehensive” training/mentorship comes through his Profile Method program. Volume Profile Formula is great for what it is, but it’s just a low-cost introductory course. He definitely offers some great information and a handful of real-world examples within it. But for developing traders serious about building a six-figure trading business using volume profile methodology, it requires the next-level immersion and feedback of the Profile Method program. So if you thought Volume Profile Formula was great, Profile Method is lightyears above and beyond that – so I’d be highly interested in hearing your thoughts if/when you experience that program.

Thanks again for sharing your experiences!

Hi Matt,

I am very impressed with your education and recommendations on this site, especially the Volume Profile Formula – and it flows nicely into the full-blown Profile Method training. You have a lot of insight to provide for beginners with trading through your articles and Trading Success Framework course. Even the Volume Profile Formula upsells are great too (live trading showcase, rapid setups pack, next-level risk management, etc.). I am still a beginner with all of this and hope to have my trading business running as well as yours at some point. I certainly see success for myself 100% using these great training and mentorship resources. Great job actually pointing new traders like me in the right direction.

Hi Jovea – I really appreciate the feedback!

I understand how confusing and downright deceptive the trading education industry can be at times. There tends to be such an enormous focus on enticement/entertainment instead of legitimate education, training, and mentorship. So I’m happy to help individuals like yourself get on the right track with my Trading Success Framework course and additional resources. Having proper expectations, cultivating the right mindset, and developing a real understanding of how markets work are extremely critical. Far too many individuals get sucked into the abyss of guru chat rooms, newsletters, and alert services (looking to blindly copy somebody else’s trades), but this approach is entirely ineffective. I’ve been there, done that – and it simply doesn’t work (and I’ve seen it go terribly wrong for a number of others as well). The reality is that becoming a consistently profitable trader requires legitimate competence/skill/self-sufficiency – and that’s what a mentorship program like Profile Method can help students develop. There truly aren’t that many programs out there like it, so I can’t recommend mentors like Aaron Korbs enough.

Please keep me posted on your trading journey as it progresses. Sounds like you’ve been through the Volume Profile Formula introductory course already (as well as a few of the other foundational courses that go along with it) and are currently working your way through the Profile Method training. I would love to hear how things go as you get closer to completing the lessons within it, gaining live market experience, and building that competence/skill/self-sufficiency I previously mentioned. It’s hard work, but well worth it in the end. Everyone wants the results (massive trading gains), but not many people actually want to put the appropriate time, energy, and focus into education/training in order to actually achieve it. I always say – if you approach trading the right way, the biggest cost will be your initial training/mentorship. But if you approach it the wrong way, your biggest cost will be market losses and enormous psychological pain. Most people take the second route because they don’t want to spend their time and money on proper training. But then go and lose a bunch of money in the markets (usually more than proper training would’ve even cost) trading randomly/impulsively. It doesn’t make much sense, but I see it all the time. So I applaud you for being on the right track.

Hi Matt Thomas, thank you very much for this review of the Aaron Korbs, Tradacc, and the Volume Profile Formula. I did try currency trading sometime back and it is true that predicting accurately markets using charting studies for entry & exit signals (such as moving averages, Bollinger bands, Fibonacci re-tracement, and MACD,, among others), is very difficult and many, a time, by the time one takes action it is a bit late and thus loses revenue. Honestly, since I did not proceed with trading, I do not know all of the Volume Profile Formula. Your review, according to me, is vital to those who have a little of the old and can simply add on this to perfect their trading. Thank you, too, for revealing that Aaron Korbs’, Volume Profile Formula, is not in itself an all-around and complete course on market trading, but a good introductory course that anyone interested takes in order to add on. I wish the promoters of the course themselves to create hype about making 50k/month simply to get many students! Thank you very much for this review.

Hi Hawumba – thanks for sharing your past trading experiences with all kinds of different indicators/charting studies.

I’ve been through a number of approaches myself since I started trading and none of them have been anywhere near as robust as volume profile. It’s a powerful tool for organizing/interpreting market behavior that just makes sense. Nothing else even comes close, in my opinion, except maybe market profile. But trading without these tools would feel like trading blind. I don’t feel like I have any meaningful edge without them – and I wouldn’t go back to trading any other way that I have in the past. These tools completely changed the game for me.

Most people get sucked into trading with all sorts of nonsense indicators because they’re so easy to follow. Just “buy here and sell there when this line crosses that line” and theoretically make millions of dollars. But this simply isn’t how markets actually work. They’re not purely mathematical constructs, but emotional constructs as well. And that’s why a tool like volume profile is so meaningful – because it tracks the cumulative behavior of all market participants and provides clues in regard to their interest/participation at specific prices. Really solid trade plans/decisions can then be constructed around this context. And this is exactly what “being a trader” means – being able to interpret context, build solid trade plans with asymmetric risk-reward, and execute with good decision-making. Blindly following some arbitrary indicator that lags and doesn’t know how to properly read context is ineffective (yet this is what most people do). Real traders, however, develop competence/skill/experience around the auction process.

So with all that being said, my point is that I believe Aaron Korbs is on the right track by specializing in volume profile trading and teaching students to do the same. There’s really not enough training on this and I wish his Volume Profile Formula and Profile Method programs were around nearly a decade ago to point me down this path right from the start. Instead, I essentially wasted years of time and money chasing guru alerts, stock signals, and all sorts of other nonsense before shaping up and cultivating the right market framework. But the opportunity cost was astronomical (and unnecessary in a lot of ways). So my hope is that I can help others avoid the same mistakes I made and get on board with the the best training/mentorship right from the start. I could’ve purchased every course that great futures trading mentors like Aaron Korbs, Josh Schuler, and Merritt Black have to offer for less than what I lost trading foolishly over the course of multiple years. I wasted far too much time and money when I could’ve pursued proper training/mentorship and recouped the costs in less than a year. Hindsight is always 20/20, but I just hope others are able to learn from my own missteps.

I completely agree with you about an over-the-top sales page. It always makes me doubt the validity of any online program or money-making scheme. I agree with you that the material offered on YouTube has a lot of value which is a good indicator that the creator of this course knows their stuff and that you will have success if you try the program. I also like that Trust pilot has so many positive reviews, although they do not seem detailed at all. You never know if they gave an incentive for people to leave a review or something so I question those too. Thank you for reviewing this program tho. I think it is a great beginner training or starting point for learning and being successful with volume profile trading.

Hi Ashley – I appreciate you sharing your thoughts on Aaron Korbs, his YouTube channel, and Volume Profile Formula course.

You also make a great point about the TrustPilot reviews. Sometimes users of products/services are incentivized to provide a review/testimonial in return for an “upgrade” or additional reward from the product/service provider. So you definitely have to be careful in regard to which reviews you trust. Everyone has a bias, so you have to make sure you’re receiving a comprehensive view of the product/service in question (both the good and the bad). That’s personally what I try to do with every single one of the products/services that I review/recommend so that potential users understand exactly what they’e getting into.

I think Volume Profile Formula is good for what it is – a beginner-level, introductory course on volume profile for under $50. This cost is basically nothing in the grand scheme of things, but most importantly, I think it puts people on the right track in terms of auction market theory, volume profiling, and futures trading. The real training, however, is through his Profile Method course and mentorship program. Volume Profile Formula is simply a low-cost stepping stone to that full-blown training program. It’s more expensive, but Profile Method is one of the best trader training/mentorship programs currently available for individuals who are serious about making trading a substantial portion of their income. It’s not about “dabbling”, being a “hobbyist”, or “playing” the market – it’s about acquiring real competence/skill and building a legitimate six-figure trading business.

As free/low-cost options, I highly recommend Korbs YouTube and Volume Profile Formula – but understand that these resources will only take you so far. It requires hard work and dedication, but real training and mentorship is required for becoming a skilled, self-sufficient, and consistently profitable trader.

I followed a trading guru one time but I didn’t have the courage to put real money into his calls, only theoretically.

I’ve never heard of the Volume Profile Formula. It seems like Aaron Korbs focus on acquiring skills and abilities, which I failed to do. The YouTube channel has incredible content which makes the course very appealing. He practices what he preaches through live trading challenges. 4.7 rating on TrustPilot says a lot. Truly a hidden gem.

Hi Vasile – I appreciate you sharing your experience with Aaron Korbs and his Volume Profile Formula in relation to other gurus/courses.

A lot of people wrongfully assume that they can achieve massive trading success by simply subscribing to some guru alert/call/signal service and blindly copying their trades. But it just doesn’t work. It sounds great in theory to not have to put any time and effort into building competencies/skills, but all this approach does is undercut your own development. The only way to achieve long-lasting, sustainable trading success is by becoming self-sufficient (and this requires hard work and dedication). I completely agree that Korbs Youtube and the Volume Profile Formula course are great places to start, but the real hidden gem is the next-level Profile Method mentorship program. That’s where the real training takes place.

I think this review on Volume Profile Formula was good because it involved both the pros and cons. As someone who has heard people talking about trading, you don’t always see unbiased reviews that paint a comprehensive picture. Considering the 90% fail rate I think trading is risky, but for the low price of this course I think it’s not such a big risk. I wanted to ask if this was your first trading course?

Hi Sabelo – I appreciate the kind words. I always try to cover both sides of every course, program, service, or mentor that I write about (the good AND the bad). There are pros and cons to everything, so providing a comprehensive perspective is absolutely critical.

To comment about the 90% failure rate making trading “risky” – I think this is myth that many people wrongfully believe. I think the 90% failure rate is drastically skewed thanks to the large number of individuals who enter markets completely unprepared. We’re talking about an environment with virtually no barriers to entry, yet offers the possibility of generating limitless riches. This mix (ease of entry, plus the potential for massive financial gains) attracts hordes of people regardless of competence/skill/experience. So to me, it’s no surprise that 90% of individuals fail. I don’t even want to use the term “traders” in that sentence because most market participants aren’t traders. Sure, these individuals are placing trades – but there’s a drastic difference between randomly/impulsively clicking some buttons in a brokerage account and being a skilled/self-sufficient/consistently profitable trader.

Of course there’s risk involved with trading (just like any other endeavor worth pursuing), but that risk also comes with potential reward. It all boils down to being a good risk manager and capitalizing on asymmetric risk-reward opportunities. I’ve experienced dozens of trading-related products/services in the past and Profile Method is one of the best training/mentorship programs available (and Volume Profile Formula is a great low-cost preview to Profile Method). If a program like Profile Method was the first trading program I ever came across then I probably wouldn’t have needed to go through any others. I wasted a lot of time at the beginning on basic/lousy/nonsense courses when I should’ve been focused on strong training programs like Josh Schuler’s Profile Pathway, Merritt Black’s NADRO, and Aaron Korbs’ Profile Method right from the start. Granted – many of these programs didn’t even exist yet back when I first started. But if I were a new trader starting from scratch today, these are the only training/mentorship programs I would look toward – and I would ignore everyone/everything else.