What is Profile Trading – The Most Powerful Way to View & Analyze Markets:

When it comes to profile trading, there are 2 main types: volume profile and market profile.

Volume profile is a graphical representation of volume (or market participation) at specific prices. And market profile is a graphical representation of time (or opportunity) at specific prices. These are extremely similar, yet slightly different tools.

Typically, the more time a market spends at certain prices, the more shares/contracts will be traded at those prices. As a result, the information displayed within a volume profile and market profile chart that cover the same time period will be highly correlated.

But understand that even though there’s quite a bit of overlap/interconnection between the two (and you’ll often hear people use the terms synonymously/interchangeably), volume profile and market profile are not exactly the same.

So this article is designed to break down each one for clarity, compare/contrast them, and shed some light on how incredibly powerful these profiling tools are. They’re professional-grade trading tools that the average retail trader has little to no awareness of.

I’ve said this many times before, and I’ll say it again – trading without volume and/or market profile is like trading blind.

What is Volume Profile Trading – Observing/Analyzing Volume at Price:

First up is volume profile, which as we’ve already discussed – tracks volume (or interest/participation) at specific prices.

This basic, one-sentence explanation doesn’t sound earth-shattering, so it often fails to grab the attention of holy-grail chasers. But the way volume profile displays critical market-generated information simply can’t be seen through any other tool.

For example, the conventional way that the average trader views volume is at the bottom of their chart (on the x-axis). But this way of viewing volume is subpar. Volume profile, on the other hand, unleashes the full potential of volume data (on the y-axis).

By shifting volume data to the y-axis, the distribution of interest amongst market participants at various price levels becomes extremely clear. It’s like a behind-the-scenes look at how market participants are truly behaving at the purest level.

This authentic view of market behavior is often obscured by weak candlestick patterns, ineffective indicators, and all sorts of other “technical analysis” that people want to believe is helpful. But a surface-level view will only dilute your process and results.

In my opinion, volume profile offers the most transparent view of what actually matters → key levels of interest/participation.

What is Market Profile Trading – Observing/Analyzing Time at Price:

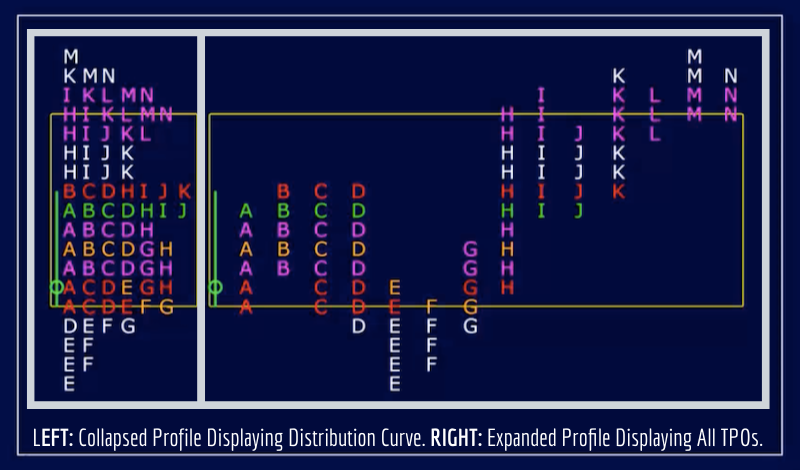

Market profile provides key market-generated information along the same lines as volume profile. But the information being displayed is slightly different. Instead of tracking volume at price, it tracks time at price using something called “TPO’s”.

TPO’s stand for time-price opportunities – and are typically represented with letters pertaining to specific time periods. For example, the letter “A” is used to track TPO’s within the first 30 minute of the session, “B” for the second 30 minutes, and so on.

At first glance, market profile can seem confusing – but it’s really not all that complicated. There are a lot of nuances/complexities that take time and experience to learn, of course. But understanding the basics is fairly straightforward.

I think a lot of developing traders get intimidated by market profile because they don’t immediately understand the letters (or colors in some cases) and what they mean. But I highly suggest overcoming this initial fear and giving market profile a real chance.

Just like volume profile, market profile provides a unique view of market behavior that no conventional form of technical analysis (which typically involves lagging indicators) can match. So in my opinion, it’s well worth the slightly longer learning curve.

Between volume profile and market profile, no better trading tools exist to track the continuous 2-way market auction process.

Volume Profile vs. Market Profile – Which One is Better/More Effective?

I don’t necessarily believe that one is better or more effective than the other. I mainly think it comes down to personal preference.

They both utilize histograms/distribution curves to track related information in regard to market participation. But I personally lean more heavily toward volume profile. This isn’t the case for every profile trader, but that’s just been my own experience.

I’m not sure if this is because I subconsciously avoided market profile at first because it seemed complicated or because I came across volume profile before market profile, and as result, find market profile to be a little redundant in my approach.

But whatever the case may be, I couldn’t trade without profiling. If volume profile didn’t exist, I would be trading with market profile. And if neither one existed, I’m not sure what I would do. It’s hard to imagine going back to trading with conventional indicators.

It honestly makes me cringe to think about how I used to trade before coming across profiling. I eventually achieved a level of consistent profitability, but profits were moderate because I had limited edge and understanding of how markets actually work.

There’s no doubt that auction market theory and volume/market profiling have been complete game-changers for me.

The Wrap Up on Profile Trading – It’s Not About “Triggers”, It’s About Context/Posture:

The classic beginner approach to trading is to lean on some lagging indicator (like a moving average cross, for example) as a buy/sell trigger without any regard to market context/posture/conditions. But this is an unsustainable, ineffective approach.

|Is Your Current Market View Effective/Robust Enough?|

|Discover 5 Ways I Can Help You Become a Consistently Profitable Trader|

The simplicity of buying/selling when one line crosses another is attractive, but it’s too delayed/inflexible to work sustainably. Most hopeful traders are obsessed with finding “winning” setups/strategies, but these things depend upon market context/posture.

You have to understand context/posture first in order to understand what the market is likely to do next. And only once you know what the market is likely to do next can the right setup/strategy be implemented at the right time. Context is king.

So forget about all the fixed, “buy here, sell here” indicator systems that boast huge returns because they’re all nonsense. If the backtested results are good, they’re probably curve-fitted. And if live market results are good, they probably won’t last.

Ultimately, what your trading edge relies upon is your ability to accurately analyze context because everything else is dictated by it (the risk-reward being offered, the ideal setup/strategy to implement, etc.). So don’t make the mistake of disregarding context.

Overall, I’ve found volume/market profile to be the missing piece to the contextual puzzle – both for me and many other traders.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- What is Auction Market Theory – Trading Value vs. Price

- Best Futures Trading Method – The Volume Profile Method

- Volume Profile Trading – What Does Volume Profile Tell You?

- 3 Free Ways to Learn From Josh Schuler at Trade With Profile

- Volume Profile Formula Review – What is Volume Profile Formula?

Many folks rely on the strength of lousy market forecasters because they shy away from understanding and analysing context themselves. As you rightly identified, our ability to learn and understand how to analyze context will determine how our success rate is in the market. Thank you for shedding light on the volume and market profiles. I definitely need to improve my skills with volume profile.

Yeah, you bring up a great point. So many beginners fall into the trap of listening to so-called “expert” market analysts/forecasters on TV or something. But I truly don’t know any successful traders who actually watch and/or care about this stuff. It’s just entertainment. None of these people know for sure what will happen next. They’re just making predictions to garner attention/viewership in order to sell something. So watching that sort of nonsense isn’t really part of trading. Trading is about personal skill & habit development: being able to analyze context, execute the right trades at the right times, understand auction dynamics & order flow, being extremely self-aware, setting yourself up for peak performance (through exercise, meditation, hydration, and good diet), etc.

Thanks a lot / you explain so clearly and comprehensibly. At first, when I started to read about this I had lots of questions but line by line got my questions answered. This makes so much sense. I found so many new information about profile trading here and lots of great additional resources.

Trading is something I’ve been thinking about getting into lately but I have literally 0 income so I haven’t tried to earn some to do it. Does this strategy work for all trading or just things like stocks? I ask because I’ve been getting heavy into crypto and would really like to learn more about the different trades.

Hi Spencer – thanks for sharing your thoughts/experiences – and great question.

Volume and market profiling can be applied to all markets/products/instruments with sufficient time, price, and volume data (which includes stocks, crypto, forex, futures, etc.). But in my opinion, profiling is best applied within futures markets because they’re the most liquid, well-regulated, capital-efficient, and tax-friendly markets available. Technically, forex is the most liquid market, but since each transaction isn’t cleared through the same entity like it is with futures (through the Chicago Mercantile Exchange), forex price and volume data is often discrepant across brokerage platforms. This sort of fragmented/inaccurate view of price and volume data isn’t something I want to be dealing with as a serious intraday trader – so I personally avoid forex. There also tends to be a lot more nonsense (like get-rich-quick type programs) within the forex, stock, and cryptocurrency spaces as opposed to futures – so futures are the clear choice for me. I primarily trade index futures (like the e-mini S&P 500), but if I were to trade foreign currencies or cryptocurrencies on an intraday basis, it would be through futures contracts and not the currencies themselves. I also think it’s important to realize that this sort of specialization (basically in just one single market, instrument, and time frame with one specific tool – volume profile) is what’s required for success. There’s very limited to no money to be made in markets as a generalist, merely dabbling in all sorts of asset classes and never getting specific with your approach. The edge is in narrowing your focus and becoming a specialist.