Volume Profile Formula Review – What is Volume Profile Formula?

Volume Profile Formula is an introductory course about volume profile trading created by Aaron Korbs at Tradacc. This formula is what Aaron claims is the one proven method that makes him a consistent $10,000-$15,000 per month trading about 2-4 hours per day.

Within this detailed Volume Profile Formula review, I’ll discuss whether or not these claims are true and if the course is worth pursuing. By the end, you should have a clear understanding of what Aaron Korbs, Tradacc, and Volume Profile Formula are all about.

For starters, Aaron Korbs is an active intraday trader with about a decade of market experience who specializes in volume profile and order flow. He’s essentially the face of Tradacc – a trading education company that he co-founded alongside Ruben Davoli.

Volume Profile Formula is the introductory course that Tradacc offers to explain the basics of Aaron Korbs’ trading methodology – which is a framework rooted in auction market theory, volume profile, and order flow trading concepts.

There are 5 main sections of the course containing 3+ total hours of on-demand video: 1) The 6-Figure Volume Profile Strategy, 2) View the Market in Matrix Mode, 3) Volume Profile Formula, 4) Next Level Trade Management, and 5) The 6-Figure Trader Mindset.

There are also a few bonuses that come with it: TradingView Charts Setup Cheatsheet, Plan of Attack Template, and Private Community.

What is Volume Profile Trading and Does Volume Profile Trading Actually Work?

There are so many indicators and charting studies that retail traders blindly rely upon for entry & exit signals (moving averages, Bollinger bands, Fibonacci retracement, MACD, and the list goes on-and-on). But this is an ineffective, surface-level approach.

Most (if not all) of these classic trading indicators lag behind price and aren’t robust enough to produce consistent profits on their own. They all work some of the time by sheer chance, but markets are far too dynamic for simple indicator strategies to be practical.

I don’t mean to be the bearer of bad news – especially if you’re currently one of those people making trading decisions based on all kinds of useless indicators. But if it were as easy as following a fixed, rule-based indicator strategy, the failure rate wouldn’t be 90%.

Aaron Korbs doesn’t even like to categorize volume profile as a technical indicator/chart study – which might be a bit of a stretch. But he says this because volume profile – if used correctly – is just different. It adds an extra dimension to market analysis.

- What is Auction Market Theory – Trading Value vs. Price

- What is Profile Trading – Volume Profile & Market Profile

It doesn’t spit out “buy here” or “sell here” recommendations just because some lines crossed. Instead, it displays real-time market-generated information in regard to participation. Not all price levels are created equal; the “quality” of price depends on volume.

There’s no doubt in my mind that gaining competence and skill around profiling is far more powerful than traditional indicators.

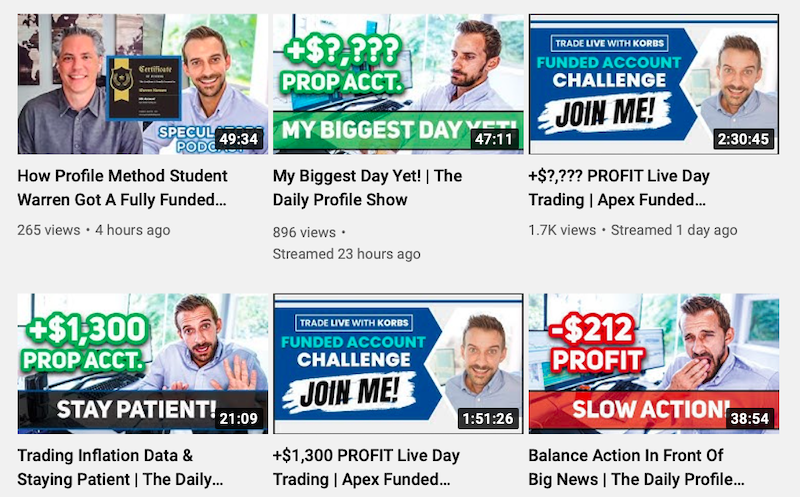

What is Korbs YouTube – Check Out His Channel For Education and Live Case Studies:

The Volume Profile Formula page is definitely a bit “sales-y” – which I don’t particularly love. In fact, my knee-jerk reaction to it was “scam”. It just gave me an uneasy feeling reminiscent of sketchy programs I’ve experienced in the past.

But unlike all of those sketchy programs, what Aaron Korbs has to offer actually has substance behind it – and what convinced me to actually give the Volume Profile Formula a shot was his YouTube channel. There’s some incredible content there.

Not only does he share a ton of solid information in regard to auction market theory, volume profile, and futures trading – but he also puts what he teaches on display through live case studies and trading challenges. He actually practices what he preaches.

Here are some of the case studies/challenges that he’s done in the past or is currently pursuing:

His Daily Profile Show is also a great opportunity for anybody to connect with him and discuss the trading day. It’s essentially an open Q&A at the close of every trading session. So it’s clear that Aaron Korbs is out there “living” his volume profile methodology.

My initial hunches on scams are typically right. But in this case – with Aaron Korbs and Volume Profile Formula – I was wrong.

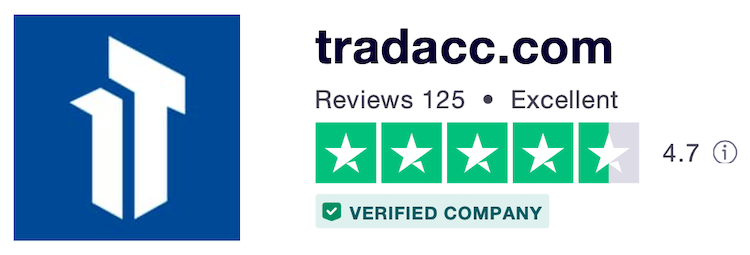

Volume Profile Formula Reviews & Testimonials From 100+ Students on TrustPilot:

In the conclusion (the next section) I’ll wrap up with my personal overall thoughts on Aaron Korbs and the Volume Profile Formula. But I always think it’s important to hear the thoughts/opinions/experiences of numerous others for a well-rounded perspective.

If you check out the Tradacc reviews on TrustPilot, the vast majority are positive (over 95% are great or excellent) – which is a solid sign that most students are more than satisfied with what Tradacc has to offer:

“Well worth the price”.

“Truly a hidden gem”.

“Korbs is a great teacher”.

“Excellent introduction to volume profile”.

“I recommend Volume Profile Formula course to anyone”.

“Goes above and beyond in supplying value”.

“Best program that I’ve been a part of”.

But it’s important to browse through the negative reviews as well. The “bad” and “poor” reviews are generally quite telling – and in this case, it seems like the biggest complaints are about the marketing (not the actual education and training itself):

“They sell a big game”.

“Marketing, marketing, marketing”.

“Bonus videos very generic”.

“The Volume Profile Formula is not exactly a formula”.

Conclusion – Final Thoughts on Aaron Korbs, Tradacc, and the Volume Profile Formula:

While the Volume Profile Formula course sales page is a little over the top for my taste (from a marketing perspective), I think the course itself is well worth the cost for anybody with the desire to become a self-sufficient, consistently profitable trader.

But understand that this course alone won’t get you there. It certainly puts you on the right track, in my opinion, in terms of market framework (being rooted in auction market theory, volume profile, and futures trading). But it’s only an introductory course.

|Take Your Trading Approach From 1D to 3D With the Volume Profile Formula|

|Learn a Reliable Market Methodology and Become a Consistently Profitable Trader|

|Learn a Reliable Market Methodology and Become a Consistently Profitable Trader|

If you actually have ambitions to make trading a significant portion of your income or potentially trade for a living, then next-level training is required. Don’t expect free YouTube content or a basic $47 course to magically turn you into a millionaire trader.

Volume Profile Formula is a great starting point (it’s virtually risk-free because of the price – and on top of that offers a 30-day money back guarantee), but the Profile Method is where the real training is. The Volume Profile Formula is merely a primer.

Overall, I highly recommend Korbs YouTube and the Volume Profile Formula course for starting to build yourself a robust market framework. But please don’t expect it to be some push-button system that automatically generates massive profits in perpetuity.

Volume profile is simply a tool (albeit a powerful one) that takes time and effort to build competence and skill around.

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- How is Tradacc Trading For Beginners – My Personal Take

- What is Trade With Profile – Best Trader Training Program?

- Best Futures Trading Method – The Volume Profile Method

- Free Futures Trading Education – Top 5 Educational Resources

- What is the Volume Profile Method With Aaron Korbs? [REVIEW]

Thank you for sharing with me Korbs YouTube and his Volume Profile Formula course. I very well agree with you that a single introduction course will not contain all required details to make one a trading pro. But the challenge is to find a course and accompanying training and mentorship that is good. Most course are over priced and without relevant information and feedback. I am excited to sit and learn from a guy like Aaron Korbs who has spent such a long time trading this methodology and consistently practices what he preaches.

I really appreciate you sharing your thoughts on Korbs YouTube and the Volume Profile Formula course.

As you stated, Aaron Korbs practices what he preaches on a daily basis through live trading sessions with his Profile Method students. But he also shares a whole lot of similar content (trading challenges, case studies, and other educational materials) for free on his YouTube channel. These sorts of things – like his Apex Funded Account Challenge and Daily Profile Show – are invaluable for beginners. In my eyes, his YouTube channel, low-cost introductory course (Volume Profile Formula), and next level training/mentorship program (Profile Method) make him one of the best futures trading mentors available online. I wish more trading educators/coaches/mentors/gurus did more of what he does. It’s truly top-notch education and support.

I’m not huge on trading but I’ve had friends to tell me to do some research on it, this is some pretty good info for the program, I do know a lot more than I did before and now I might give it a chance just for the knowledge aspect of things for $47 that’s not to bad. Other places would probably charge double that for less information.

Hi Tiger – I definitely agree that the price point on Volume Profile Formula is a steal (even if you ultimately decide that the approach isn’t a good fit for you). I highly suggest traders head in the general direction of auction theory and profiling (volume profile and market profile) when it comes to building their own individual market view and approach. But with that being said, these things don’t resonate with absolutely everyone. To me, it very clearly makes the most sense – and more importantly, is most effective when it comes to creating and executing on trade ideas/plans. But some people still prefer to go in other directions (like blindly following guru alerts or lagging price indicators). For only $47 and a 30-day refund policy, the downside risk on learning the Volume Profile Formula is extremely low.

This is a comprehensive and raw review of the Volume Profile Formula. You seem to give your honest and unbiased opinions here mixed in with some cautions.

I do have an interest in trading and always have an ear open for the latest information out there. Trading is not so easy but very risky, especially if you don´t know what you´re doing. You said it yourself the failure rate for trading is 90%. It seems like this training from Aaron Korb is a great tool but not the end of all of one´s trading journey. I do, however, appreciate that it offers a cheat sheet, plan of attack templates, and of course the support of a private community.

Hi Dana – Yes, I always share my honest thoughts, opinions, and personal experiences with all of the trading courses/services that I write about and review. There’s typically some good and bad (pros and cons) to everything – and Volume Profile Formula is no exception to that.

I think the most important part is that everyone go into it with the right expectations. Volume Profile Formula is merely an introductory course to the power of volume profile and Aaron Korbs’ approach – but it doesn’t dive too deep into the specifics/nuances. It’s simply meant as a low-cost primer for interested individuals to see if it’s something they want to pursue further. If the methodology resonates (and I personally believe it to be an extremely strong way to trade futures on an intraday basis), then that’s what Profile Method is for. This is where advanced training and next-level mentorship is provided (specialized lessons, live trading sessions, bi-weekly Q&A’s directly with Korbs, and more).

If people pursue Profile Method and take it seriously, I actually do think it can be the last trading course/program they ever have to take. It’s legitimately powerful training that’s designed to make you a skilled/self-sufficient, consistently profitable trader. But thinking that the trading journey ever ends is the wrong way to approach markets. It disregards their dynamic, ever-evolving nature. There is no fixed mathematical formula that will work for all eternity. Being a trader requires continuous learning and adaptation over time – and a strong training program like Profile Method provides the framework to do just that. I highly recommend anyone interested in generating robust market edge to start with Volume Profile Formula (because it doesn’t cost very much), but understand that the real training/mentorship program is Profile Method.

I have to say any course I have bought on trading has been pure ……. Trading actually takes research unless you are only looking for pennies per trade. The funny part is the people looking for these quick trades lose the money that they deserve to lose. I am tired of the AMC (stock symbol for those who don’t know) mentality in the market. Good luck trading look to hydrogen if you’re smart.

Hi Chris – thanks for sharing your personal experiences with trading and trading courses.

I definitely agree that the vast majority of trading courses out there contain nothing more than surface-level information (like what a candlestick is, what a trend is, what some cookie-cutter patterns like double-tops/bottoms are, etc.) or they’re just complete nonsense. But there are definitely some really solid training/mentorship programs out there in the active trading space – there often just extremely difficult to find because real training isn’t what most people want (because it requires legitimate work and dedication). The vast majority of individuals who dive into trading just want thrills and excitement, and as a result, blindly chase “shiny objects” like GME and AMC. They don’t really know what they’re doing – they’re just compulsively gambling. There’s a gigantic difference between good and bad trading – and unfortunately, good trading is rare. But there’s a ton of opportunity for individuals who are actually committed to approaching it the right way.

I trades options of US stocks but I am in Canada. Will this volume profile formula works for stocks, and options? Will I get access to tools or where will I find real time volume information or open interest etc.? In Canada, I believe we have limitations in getting services/information, that US clients gets in US.

Hi Ash – great questions.

Volume profile is a powerful tool used to organize and analyze meaningful market-generated information – and it can be applied to pretty much all products/instruments that offer sufficient price and volume data. I used to trade mainly stocks and options as well, but I’ve personally been transitioning exclusively to futures over the past several months because they’re simply superior products (they’re well-regulated, transparent, and have a centralized exchange, among many other reasons). Those who trade Forex, for example, have to deal with multiple exchanges and subpar regulation – which opens the doors for fragmented information and manipulation. Because of this, price and volume data from broker to broker at the same exact moment in time can vary. For these reasons, I’ve never touched the Forex market (even though it’s extremely popular).

But back to your particular situation trading stocks and options – volume profile can certainly be used to trade both of them. Volume profile would be applied to your stock charts and then you could use your analysis to place stock and/or options trades. If futures didn’t exist, stocks and options would be the main products I’d be trading on a daily basis (that’s what I used to do before really looking into futures). I’m not well-versed on the limitations in getting services/information from Canada (or other countries), but I would suggest reaching out directly to your current brokerage platform and charting/trading platform (or ones you’re considering) – that’s probably the best way to get the most accurate, personalized answers on that. But you can also try reaching out directly to Aaron Korbs and the Tradacc team as well (email: support@tradacc.com). With thousands of students in multiple countries, they might be able to provide some assistance as well.

Just to give you some ideas on charting/trading platforms that offer volume profile – the most popular one for retail traders is TradingView. It’s probably the most cost-friendly platform to get started with it. They offer 30-day free trials on all their packages, can be connected to quite a few brokers, and support stock, options, and futures trading. For more serious traders who want professional-level functionality, there are platforms like Sierra Chart and EdgeProX. There are numerous brokers and charting/trading platforms to choose from and potentially mix-and-match to suit your needs – so this could be a never-ending topic of conversation. But I personally like Edge Clear as a broker and their EdgeProX trading platform, but Aaron Korbs I believe uses AMP Futures as a broker and Sierra Chart as a trading platform. Just keep in mind that both mine and Aaron’s intraday trading is geared toward futures (e-mini S&P 500, e-mini Nasdaq 100, etc.), so these platforms might not work for your purposes of trading stocks and options.

Your broker and charting/trading platform aren’t included with the course or anything like that. These are things that every individual trader needs to choose for themselves. But Aaron Korbs does cover setting up volume profile on TradingView within the Volume Profile Formula (introductory course). He also shares his personal volume profile chart setup that he uses every single day on Sierra Chart within the Profile Method (advanced training program). So as long as these are platforms that will serve you (being that you’re located in Canada), these are topics that Aaron Korbs openly shares step-by-step in his courses/programs. Hopefully these answers helped in some way – but if you have additional questions, definitely let me know.

Seems like an interesting program, and the price definitely seems like a steal, only paying $47 to unlock secrets to make huge trading profits that can reach beyond $20,000 in a month. That is incredible value right there! Like you mentioned, however, it’s not a millionaire maker, but for a good introduction for huge potential profits, and unlocking the imagination into the world of trading, this seems like a good purchase!

Hi David – thanks for sharing your thoughts on the Volume Profile Formula course.

It’s important to keep in mind that it’s merely an introductory/foundational masterclass covering Aaron Korbs’ trading methodology. But it’s definitely worth the price because it points developing traders in the right direction in terms of market framework (auction market theory, volume profile, futures trading, etc.) and it also includes quite a few helpful bonuses. The advanced/next-level training, however, is with the Profile Method. This is where legitimate competence and skill can be cultivated for generating consistent trading profits. Volume Profile Formula is essentially a primer for Profile Method. It should be viewed as a cost-friendly trial opportunity to see if the methodology resonates with you. There are also several add-on resources with the VPF course that I find great value in as well: Futures Masterclass, Rapid Setups Pack, Live Trading Showcase, S&P 500 Secrets, and Next-Level Risk Management.

Hey thank you for sharing about the Volume Profile Formula!

I’ve never heard of auction market theory, volume profile, and futures markets which seem to be the basics of Aaron Korbs’ trading methodology. This was very informative!

I traded a lot in the last 2 years and I learned so much about moving averages, Bollinger bands, Fibonacci retracement, MACD, etc…

With Korbs, who has over 10 years trading experience, I think this would be something good to follow!

Hi Lorenz – thanks for sharing your thoughts and experiences!

Your experience seems kind of like the typical path of a new trader – to start learning about all kinds of indicators like moving averages, Bollinger bands, Keltner channels, Fibonacci retracement, MACD, RSI, etc. That’s exactly what I did as well. There’s nothing necessarily “wrong” with learning about these things – some traders make money with them (and they can be helpful in certain ways). But I don’t think any of them can be relied upon as some sort of “buy here, sell here” system (which is how most people attempt to use them).

As beginners, we tend to think that there’s some sort of holy-grail mathematical formula or magical indicator that exists – like “if this line crosses that line, I automatically buy – and then I sell when it crosses back the other way” – as if this is what being a real, professional-level trader truly entails. But markets don’t operate in this clean, fixed way. They’re dynamic – and context is the name of the game. What’s going on “under the hood” of price is what really drives markets (not price itself). Most people get so enamored by price and lagging price-based indicators that they have virtually zero chance at achieving a consistent/sustainable level of trading success. Price is merely an advertising mechanism; what really matters is “value” (price, volume, and time) – and this is where powerful tools like volume profile and market profile come into play.

Overall, viewing the market as an auction and utilizing profiling tools to analyze market structure/context/posture is far more robust than any other indicator(s). The only tools I use at this point to organize/analyze market-generated information and manage my trades are volume profile, market profile, and VWAP. Everything else is unnecessary/insufficient, in my opinion. Auction market theory and profiling tools completely changed the way I look at markets (absolutely for the better). But with that being said, everyone has to decide for themselves how they want to approach markets. I just feel like it would be wrong of me not to share these types of things because they’ve had such a large positive impact on me and my own approach.

Hi Matt,

Thank you for bringing the Korb’s way of intra-day trading into my awareness. At its core, it teaches you the technique of trading successfully the market auction using volume profile and futures trading. It is important to know that he practices what he preaches.

With a 95% positive reviews, it is a good place to put your time in through YouTube learning with him and using the question-answer method I can personally benefit. The amount you spend on the Volume Profile Formula masterclass is quite affordable and there is a money-back guarantee. You can use it for quite a few days to test out your expectation and it is definitely worth spending on it.

Hi Anusuya – I appreciate you sharing your thoughts on Aaron Korbs and his Volume Profile Formula.

His Korbs YouTube channel (which is free) along with the Volume Profile Formula course itself (which is currently $47) are great opportunities for developing traders to check out his methodology and see if it’s something that resonates with them. I personally think going down the route of auction market theory and profiling (volume profile & market profile) within futures markets is the way to go.

In my experience, it’s simply the most robust way of viewing/analyzing markets and locating great trade opportunities – and I think it can benefit an enormous amount of hopeful traders if they commit to building competency and skill around it. These are concepts/methodologies that (sadly) I hadn’t come across until about a year and a half ago, but I could’ve saved so much time by going down this route from the start (and avoiding guru alert services, magical indicators, etc.). What Aaron Korbs teaches is how real, professional-level traders operate. Not by blindly following indicators or somebody else’s alerts/signals/hot picks – but by generating their own high-quality trade ideas and executing on them based on real-time market-generated information (through the lens of auction market theory, profiling tools, and order flow analysis).

Volume Profile Formula is brilliant for people who have a level head and are not ruled by their emotions and are searching for a strong market framework with clarity.

One thing I understand most about trading, is that it is best to start small, and always set a stop-loss. This basically means setting the point where you want the trade to stop to prevent a further loss in profits.

Korbs has 10 years trading experience. He is doing his best to be a blessing to people. I am sure a lot more people will learn from him.

Hi Stella – thanks for sharing your thoughts!

I do agree that Volume Profile Formula is a great starting point for traders looking for a more robust market framework and increased clarity in regard to market structure/dynamics. Because what I see happen a lot is new traders getting involved with markets and initially taking a surface-level approach – which tends to include all kinds of cookie-cutter setups/chart patterns and nonsense indicators. But months/years down the road, they still feel like something is missing – like they can’t get a grip on how markets actually move and how to build effective strategies/systems. But once they uncover the concepts of auction market theory and tools like volume profile, it’s like lifting blinders from their eyes. Market movements that once seemed extremely chaotic and random actually start to seem a lot less so. That’s the power of viewing markets through the lens of profiling. It’s hard to view markets any other way again because it just makes sense.

I am fairly new to trading and so far have only invested in some ETFs and the odd share in medicinal cannabis. But I have been looking around for a way to get more knowledgeable about trading, so found this review on Volume Profile Formula very interesting. It is not a trading strategy that I have heard of before, so can you tell me a bit more about how it actually works? Or is there a specific YouTube video that I can watch to take me through it?

It is interesting to see that you say most indicators do not work and that volume profile trading is actually different and rather another dimension to market analysis. With the high ratings from students and Trustpilot, it seems that Aaron Korbs and Volume Profile Formula is worth exploring more.

Great questions. To answer your first one about how volume profile works, I’ve written a short blog post about it here. But it’s essentially a histogram that tracks the number of transacted shares/contracts at specific prices – so it’s a visual representation of what price levels buyers & sellers are willing to participate (or not). It essentially shows the strength or weakness of price. This is why I say that price alone can be quite deceiving because not all price zones/levels are equal in “quality”. Certain prices are much stronger than others based on volume. This is a very basic explanation of what the volume profile is, but the implication is this: instead of being so enamored by price (a one-dimensional view), what tells the real story is “value” (price, time, and volume – a three-dimensional view). Great trading opportunities present themselves when price breaks away from value or reverts back to it. Profiling tools are simply a great way to organize meaningful market data in order to see when these opportunities exist. Aaron Korbs has a dedicated playlist of volume profile videos on his YouTube channel if you want even more details on it.

Just to comment on other indicators “not working”, my point is this – it’s not that they don’t work at all. Every indicator works some of the time, even if it’s just by sheer chance/luck. But the major issue with indicators is that they don’t really explain why the market is moving in one direction or another. Market participants tend to gravitate toward all kinds of nonsense indicators because they make trading seem easy: “Oh, all I have to do is buy here when this line crosses that line and then sell when it crosses back the other way – and I’ll be a millionaire trader!” But blindly following indicators doesn’t work long-term. It’s a surface-level approach that disregards context. Entering a position just because one moving average crosses another (which is a real way some people trade – even I did in the past) is extremely weak, in my opinion. And on top of that, it’s not nearly as easy as it seems. When you go back and look at a chart, what seems like a clear opportunity based on a moving average cross actually isn’t all that clear in real-time because moving average lines are lagging indicators – they’re waiting on the close of a candle to plot a point/line – so a lot of “fake outs” happen. Volume profile is different because it’s based on real-time market-generated information – and provides a great deal of context surrounding price. It’s not some magical “buy here, sell there” trading system, but it’s a robust tool rooted in auction market theory – which is a framework that all the best traders I know operate within.