The Ultimate Topstep Trader Review – Do You Have What it Takes to Get Funded?

Topstep Trader is a platform that allows individuals all throughout the world to test their trading abilities and potentially earn a funded account. For traders who lack the financial means to fund an account for themselves, Topstep presents an incredible opportunity.

For the average person who chooses to pursue trading on the side or full-time – not only does it take months or years to save up $25,000 or more just to have a realistic shot at meaningful gains, but then they also have their own hard-earned money at stake.

With a program like Topstep, this difficult, time-consuming, and risky process of saving up for your own deposit and then risking your own capital is unnecessary. If you can prove your skills in a simulated environment, then Topstep will fund an account for you.

This privilege of having a funded account does come with some trade-offs though. Topstep isn’t handing out $50-$150K trading accounts just for fun. The catch is that you have to follow their risk management rules, and they also keep a portion of your profits.

Below we’ll dive deeply into the evaluation process for earning a funded Topstep account, the markets and products available to trade, the pros and cons of joining, if the program is a scam or not, reviews and testimonials from real users, and much more.

What is the Topstep Trader Combine – Prove Yourself and Earn a $50K-$150K Account:

The Topstep Trader Combine is an opportunity to prove that you can consistently grow an account while simultaneously managing risk.

It’s a simple concept when filtered down into one sentence. But that doesn’t mean it’s easy to accomplish. Many individuals have tried to pass the Topstep Trader Combine and ultimately failed by breaking one or more of the non-negotiable risk management rules.

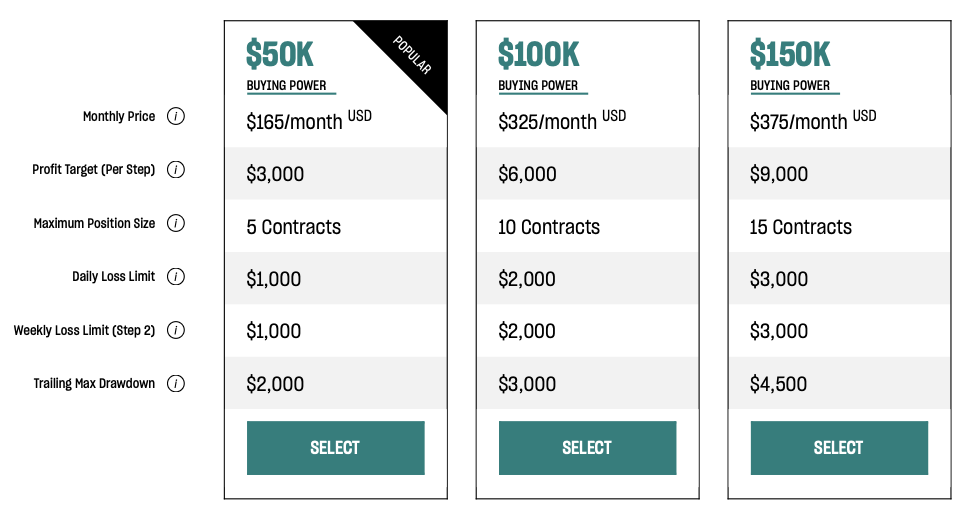

The good news is that you can try as many times as you want and for as long as you want – but that comes with a cost. Taking part in the TopStep Futures Combine costs $165-375 per month depending on the account size you’re shooting for ($50K, $100K, or $150K).

If you break a rule during the tryout process – you lose access to the account. But for those who want to gain access back prior to the next billing cycle, it’s possible to pay a $59-99 reset fee and keep trying. The rules are in place for a reason – disciplined trading.

So if you go into the Combine unprepared, the fees can add up pretty quickly. These small costs, however, are really nothing compared to the incredible financial damage undisciplined traders tend to do to their own trading accounts in live market environments.

How to Pass the Topstep Trader Combine – Major Topstep Trader Rules to Follow:

Passing the Topstep Trader Combine is a 2-step process. The first step requires you to grow a simulated account 6% from your starting balance while following various rules. The second step is to do the same thing again with even tighter risk parameters.

These measures are in place in order for you to: 1) Prove Profitability, and 2) Show You Can Manage Risk.

For the sake of example, the targets and risk parameters discussed below apply to the most popular $50,000 Futures Account.

STEP 1: PROVE PROFITABILITY

TARGETS

- PROFIT TARGET → $3,000 (which is 6% of starting account value)

- Minimum of 5 days of trading activity required to pass

- At least 50% of winning trades must be held for 20 seconds or more

RISK MANAGEMENT RULES

- MAXIMUM POSITION SIZE → 5 contracts

- DAILY LOSS LIMIT → $1,000

- TRAILING MAXIMUM DRAWDOWN → $2,000

- Only able to trade permitted products at permitted times

Once Step 1 is accomplished, your account is reset to $50,000 and you’re eligible for Step 2.

STEP 2: MANAGE RISK

You still have to manage risk in Step 1, but additional parameters come into play for Step 2. The profit target stays the same, but there are a few more risk management rules to contend with. The good news, however, is that there is no minimum trading activity required.

ADDITIONAL RISK MANAGEMENT RULES

- WEEKLY LOSS LIMIT → $1,000 (which is the same as the daily loss limit)

- Do not hold positions 1 minute before or after major economic releases

- Follow the scaling plan – max position size increases based on account growth

Once Step 2 is accomplished, you earn a funded account. But keep in mind that these rules don’t magically go away after completion of the Combine. Your new funded account will basically have the same set of risk parameters to follow.

For the most updated Topstep Trader Combine and Funded Account steps, rules, and FAQs, you can visit the Help Center.

Funding Opportunities – What is Topstep Futures and Topstep Forex?

Topstep Futures provides you with an opportunity to earn a funded account trading popular CME group products such as E-mini S&P 500, E-mini Nasdaq 100, E-mini Russell 2000, Crude Oil, Natural Gas, Corn, Wheat, Soybeans, Gold, Silver, Copper, and more.

An incredible aspect of the Futures program is that it currently integrates with 14 different trading platforms depending on your preference. So if you’re most comfortable trading on NinjaTrader, TradeStation, or TradingView, among many others – you can do it.

Topstep also offers their own trading platform called TSTrader (powered by Tradovate) that has no platform fees and works on any device. This is the platform available for the 14-day free trial where you have the opportunity to test a $150,000 simulated account.

Topstep Forex provides you with an opportunity to earn a funded account trading popular currency pairs such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, NSD/USD, USD/CAD, and many more. Topstep Forex requires connection to the MetaTrader4 platform.

Forex is the world’s largest financial market open around the clock from Sunday evening to Friday evening (US/Eastern time).

**Topstep no longer offers Forex as of April, 2022. Topstep’s entire focus is now on Futures.**

Topstep Trader Pros and Cons List – Main Advantages and Disadvantages:

If I had to choose one section of this review for everybody to read at the expense of all others, the pros and cons list would be it.

In general, I think the pros of Topstep far outweigh the cons, but that doesn’t mean that it’s perfect. There are certainly some advantages that can’t be ignored – free trials, discounts, built-in risk parameters, professional support, and an easy withdrawal process.

TOPSTEP TRADER PROS |

TOPSTEP TRADER CONS |

|---|---|

|

|

But some of the cons are definitely worth nothing – and one in particular stands out to me. But first I want to mention the costs associated with the Combine and potential resets, as well as the profit split once you earn a funded account and start making money.

The only reason I list these as cons is because there are costs associated with them, but I personally think they’re completely fair. Tryout fees and profit splits are to be expected with any funded trader programs – and these stipulations certainly aren’t terrible.

But where I think Topstep can improve the most is by creating a well-structured, comprehensive trading course. Don’t get me wrong, the educational resources like blog posts, podcast episodes, and ebooks are great. But they can’t replace a structured curriculum.

Much of what Topstep offers in terms of support and guidance concentrates on risk management and trading psychology (which is amazing by the way – I fully support it). But what’s missing for inexperienced traders is detailed personal strategy development.

I understand that offering such a course or program would take a lot of work. Admittedly, there are so many different approaches to trading that no program could ever be 100% comprehensive. But I think offering a structured course would be highly beneficial.

Is Topstep Trader a Scam – Top 2 Topstep Trader Complaints:

As with any product or service (trading-related or not), there will always be at least a couple complaints and scam allegations. Naysayers exist in every industry and endeavor. So below I want to discuss the top 2 complaints I’ve heard in relation to Topstep.

1. 90/10 Profit Split – You Keep 90% of Your Profits and Topstep Gets 10%

For individuals who call Topstep a scam just because there’s a profit split are completely delusional. They’re providing you with a $50-$150K account, so of course they’re going to keep a fair share of the profits. They’re literally taking on all the downside risk.

90/10 is also one of the highest profit splits you’ll find being offered by any funded trader program – especially from a well-established one like Topstep. They’re an undeniable leader in the funded trader industry and have been around for over a decade.

If you’re expecting a higher profit split, then you can shop around for other funded trader programs available online. That’s completely up to you to decide for yourself. But nobody should expect a split where the firm keeps only 0-5% of your profits.

If you find a funded trader program that does this, I would actually be quite concerned about it. Taking on the risk of giving you a multi-thousand dollar account without keeping any profits would be a huge red flag. It would be way too good to be true.

If they can afford to do this, it would most likely be a sign that they’re making money off you in some other deceitful way.

2. Fees Associated With the Topstep Trader Combine – Monthly Fee Plus Account Resets

There are reasons for these fees that I completely agree with. First, the monthly Combine cost confirms you have some skin in the game. It weeds out the hobbyists who aren’t serious about success. Second, the reset fees make you respect risk management.

When traders go it alone with their own trading accounts and fail to implement proper risk management practices, the end result is often much worse than a $99 reset fee. This is a light slap on the hand in comparison to a thousand-dollar account blowup.

In all seriousness, if you’re worried about passing the Combine and paying account reset fees, then you’re most likely not prepared to handle a funded account. Those with confidence in their trading abilities simply aren’t concerned about these costs.

A prepared trader with legitimate skills and an understanding of the rules should take no longer than a few months to pass without incurring a single reset fee. Keep in mind that passing the Combine is just the start. Think long-term and prepare yourself.

Passing the Combine means nothing if you can’t repeat that success with a funded account. It’s possible to get a bit lucky during the Combine and earn a funded account, but lack of skills and risk management will eventually get your funded account taken away.

So practice until you’re truly ready. There’s no rush. Topstep will still be there when you’re ready to prove yourself.

Topstep Reviews and Testimonials From Real Topstep Traders:

Trading with Topstep has been a wonderful experience. I have learned so much about my strengths and weaknesses trading the combines. I’m looking so forward to a long career relationship with Topstep. – William

Topstep is a blessing for aspiring professionals. Having the opportunity to prove your abilities, then getting rewarded with an account eliminates your personal liability of one day, potentially, losing everything. Not having this on my mind has helped me trade freely and treat my trading as a business; a professional. – Jeronimo

I really like Topstep. It is allowing me to work toward becoming a successful, full-time day trader without having to risk my own money!! Amazing!! Some may not like the strict rules but in all honesty the rules help you become the best trader possible, and people have to understand that at the end of the day, they are a business who want to make profits so they have to set these rules in place. With all that being said I’m extremely grateful for the service that they offer. – Nigel

Topstep is a great opportunity for new and experienced traders alike. The structure and discipline are important and helpful to anyone looking to improve their trading skills. The risk controls in place can help one to avoid taking unnecessary large losses with their own capital. More importantly, for less than a few hundred dollars a fledgling trader can earn several multiples of their investment in risk capital with a proven methodology. – Scott

The rules are strict and rightfully so – I’ve had several false starts, but a reset is considerably cheaper than blowing my own account, and acts as a welcome slap round the face…A little surprised to see people whining about it not being fair to have a reset when they break a rule…if you were trading live, no one would be there to help you. – Julian

Who is Topstep Trader Best For – Beginners, Veterans, or Traders of All Kinds?

Topstep can be a phenomenal launching pad for individuals at the start of their trading journey. But not absolute beginners.

Since Topstep doesn’t offer a comprehensive course with a strong focus on individual strategy development, I think developing traders need to look elsewhere for that first. My personal recommendation would be Trade With Profile with Josh Schuler.

With that foundation of trading education, skill-building, and personal strategy development in place, that’s when Topstep becomes a phenomenal opportunity for individuals who otherwise wouldn’t have the financial means to trade at a serious level.

Even individuals who have the means, but don’t have the desire to risk tens of thousands of dollars of their own money, can find value in Topstep. With the firm’s capital and rules, you have the guardrails in place to trade safer and ultimately profit without risk.

Psychologically, trading without fear of personal financial loss and having specific risk management guidelines in place can be extremely beneficial. These structured, stress-reducing conditions help create balanced, consistent, and overall profitable traders.

After several years of success with Topstep, however, I can understand why funded traders might choose to go off on their own. They’ve probably wired good trading habits, saved up to fund their own account, and might prefer to avoid any sort of profit split.

Overall, I think Topstep is best for beginners looking to professionalize their trading operations, but traders at all levels can benefit.

Conclusion – Is Becoming a Funded Topstep Trader Worth the Time, Effort, and Cost?

If you’re serious about becoming a professional-level trader, I think Topstep is definitely worth the time, effort, and cost.

In comparison to the costs most people incur by diving headfirst into live markets completely unprepared, the monthly fee for the Topstep Trader Combine is nothing. I personally lost thousands of dollars of my own money trading ignorantly and impulsively at the beginning of my own journey – which isn’t a rare occurrence amongst new traders. But this could easily be avoided.

|Test the Topstep Trader Platform With a Free 14-Day Trial – No Credit Card Required|

|Start the Funding Evaluation Process With 20% Off Your First Topstep Trader Combine|

Through a program like Topstep, you learn how to manage risk like a professional trader. Sadly, most individuals who decide to trade on their own simply don’t have the self-control to properly manage risk. They take giant position sizes trying to nail big wins and remove stops to avoid being wrong, among many other dangerous decisions. These habits typically result in account blowups.

There are reasons the trading success rate is so low – and that has a lot to do with inadequate trading psychology and risk management. I think Topstep does a great job of filling gaps in these two specific areas with professional coaching and support.

Overall, Topstep is a great place for traders to get funded and continuously develop at the beginning of their trading careers.

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Topstep Trader – Frequently Asked Questions (FAQs)

- Jim Dalton Trader Review – Is Jim Dalton a Scam?

- What is Volume Profile – Trading With Volume Profile

- Is Topstep Trader a Scam – My Thoughts as a Topstep Trader

- Molding Your Market Framework – How Do You View Markets?

Topstep Trader Topstep Combine $125 - $375 Per Month

-

Transparency

-

Profit Split

-

Costs and Fees

-

Community

-

Coaching and Support

-

Personal Strategy Development

Topstep Trader Review

The Topstep Trader program offers an incredible opportunity for Futures traders to earn $50,000-$150,000 funded accounts. Saving up enough money to trade at a level that can actually produce meaningful gains ($25,000-$100,000+) is a high threshold to overcome. Even individuals with great talent and strong trading skills might not have the financial means to commit that large of a sum to a trading account. But with Topstep, if you can prove profitability and show you can manage risk in their 2-step Trading Combine, they’ll fund an account for you. Overall, Topstep provides a great opportunity to gain real-world market experience essentially risk-free and potentially earn a multi-thousand dollar funded trading account.

Those people who learn trading can find a platform where they can practice their abilities. Freshers need an opportunity to prove their skills in respective firelds. The top step trader gives that opportunity to the trader and they can earn money by trading.

Wow! I didn’t know this was a thing. Let me see if I got it right. So, as long as I pay a monthly fee of $165-$375, they will loan me, so to speak, between $50,000 and $150,000 to manage an account and then I get to keep 80% of the earnings? Is that correct?

I can see why they established so many rules for those interested. I’ve been looking at some investing options, and while this is interesting, it sounds too complicated. I might give it a try, though, and see how it goes.

Thanks for sharing.

Hi Enrique – great questions!

That’s not exactly how it works. First you have to pay to tryout – which Topstep calls the Combine – in which you’re given a $50K-$150K demo account (for Topstep Futures, but they also fund Forex traders) to prove that you can properly control risk and grow the account. So Topstep isn’t giving you any real capital to work with at this point, but the demo account is based on live market data (so it’s as real as it gets without having real money at stake). To give a specific example, the Combine for a $50,000 futures account will cost $165 per month until you pass – at which point the Combine fee goes away and they offer you a $50,000 funded account. The Combine itself is a 2-step process where you have to grow the $50,000 account up to $53,000 twice (while following all of the risk management rules – 5 contract max position size, $1K daily loss limit, etc.). So once you do that, you get funded. If prepared, it usually takes traders 3, 4, maybe 5 months to get funded. If unprepared, it could take much longer. Once funded, they offer an 80/20 profit split – so you’re correct about that.

It might seem a bit complicated with the 2-step tryout process and all the rules, but these rules are in place to protect both you (from taking wild risks) and Topstep (because all the downside risk in funded accounts is on them). In general, I think funded trader programs like Topstep provide great opportunities for individuals who otherwise wouldn’t have the capital to pursue trading at a serious level and actually get involved with markets in a meaningful way. Many users also like the fact that they’re trading somebody else’s capital instead of their own (which reduces the psychological/emotional charge) and that risk limits are firmly in place to keep themselves disciplined. Many people just don’t have the discipline to cut losses and overall follow their rules within their own individual account, so the structure of a funded account can be helpful in that way (otherwise they run the risk of losing their funded accounts). There are a lot of other options out there (and I’ve really only scratched the surface of what’s available), but I like Topstep because they’ve been in the “online prop firm” space for a long time – they were one of the first (if not THE first) to offer this sort of program.

I hope this helped answer your questions – take care!

Thanks, Matt for giving such a detailed review of the TOP STEP traders platform, and nice to know about a platform that can actually fund you a trading account. Although there are certain rules and regulations to follow. But once I prove the profitability by following the risk management skills successfully then I’m able to claim my funded account. Although they’re pretty strict on their rules and I have an 80/20 Split After the First $10,000 in Profits and pay $99 penalty fees if I failed to follow their rules. But paying $125-375 per month top step traders allow me to trade in Futures or Forex where I have a wide range of CME group products like E-mini S&P 500, E-mini Nasdaq 100, E-mini Russell 2000, etc.

I was looking to get funded and was really lost in the path on how to begin and how to do it. I came into this review and it is really well explained, even giving information in case I do not have the minimum funds to proceed.

I will share it with my friends as well! Thanks again!

Hi Johnny – I’m happy this Topstep review helped you.

I’m currently working my way through step 1 of the Topstep Combine myself just to show how great of an opportunity it can be to earn a funded futures or forex account (I’m personally working toward a $150,000 futures account). I hadn’t traded futures before coming across Topstep (just stocks and options using my own capital), but I’ve really liked trading them so far. What I’ve learned from going through Thomas Kralow’s trading program earlier this year has also helped me prepare quite a bit for futures trading in the Topstep Combine. I’m looking forward to sharing my progress over the course of the next few months in various blog posts/articles.

Feel free to come back and share your progress with Topstep as well. Take care!

I think I have what it takes to get funded in regards to trading but I’ve never worked with futures before. I’ve traded Forex but find it much harder. I usually trade stock options in my own brokerage account but don’t have the funding to really make a lot of money. This sounds like a great opportunity to try out using someone else’s capital.

Hi Frank – it sounds like you’re in a very similar situation to me in terms of the the markets/products we usually trade. I used to trade stocks quite a bit a handful of years ago, but at the moment I almost exclusively day trade SPY options in my own account. But recently coming across a funded trader program like Topstep has inspired me to pursue futures trading as well (I’ve never really liked Forex).

Up until about a month ago when I decided to sign up for Topstep’s 2-week free trial to test their TSTrader platform, I had zero experience with futures. But it turns out that I really enjoy trading them – and there’s a lot that I can take from my SPY options strategy and apply to e-mini S&P 500 futures. So my goal by early next year is to get funded through Topstep with a six-figure futures account.

In the meantime, I’ll be using what I’ve learned from Thomas Kralow and the market replay platform at TradingSim to practice and refine my approach. I want to make sure I go into the Combine ready to capture consistent profits.

After reading this review it’s pretty clear that Topstep is a great offer, but it’s definitely geared towards experience. I’ve considered getting involved with Forex trading in the past, however, lack of training has kept my wallet in my pocket.

You mentioned in the Cons section that there’s no training provided and that is something that would be necessary for my situation. Forex is something that I consider a bit confusing because I don’t completely understand how it all works.

Trading is something I’ve tried once after taking a crash course on the Nadex platform to trade binary options. It didn’t work out so well for me, I lost my small investments twice, but I did learn the Nadex platform and I may visit binary options again.

Topstep seems like a good deal to me, but I wouldn’t venture into something like Topstep unless I had the proper training to completely understand Forex and Futures trading.

Thanks for the informative review, if I had the knowledge and experience needed to get a funded Topstep account, I’d do it.

Hi John – thanks for sharing your thoughts!

I do want to clarify that Topstep does offer some great resources for beginners – blog posts, podcasts, ebooks, video lessons, group coaching led by professional traders, and a free community for interacting with other users. These resources offer tons of great information, especially on the topics of risk management and trading psychology, among many other critical trading concepts. But this can’t compare to a comprehensive and well-organized course with progression from basic to more complicated concepts – like Thomas Kralow’s trading program.

It’s not that Topstep doesn’t offer great information, but there’s no clear structure to it like a great course or trading program would have – if that makes sense. For the sake of comparison, Apteros Trading is another funded trader program, but it offers a great framework course for beginners to build a proper foundation. From there, any video lessons and personal coaching have a much stronger impact. So something like this out of Topstep would go a long way in helping beginners learn and progress in a more structured and faster way.

I have dabbled in managing a portion of my investments myself and have done well… on a small scale. The possibility of being set up with a large trading account is very exciting. I do understand the rationale for the fees and penalties, but don’t feel that I have the experience, at this point, to be successful on my own. Some form of a course would be valuable in terms of identifying trends, timing of trades, etc. I am going to do a bit more research. But, I am bookmarking the page because this seems to be a great opportunity.

Topstep Trader seems to be a legitimate platform because it has been around for a decade. I see that there are a lot of positive testimonies. As someone who is interested in generating a side income online, I believe I will give topstep a shot and see if I can enhance my trading skills and earn as those other people did. I’m hoping to be comfortable with their rules over time. It’s good to know that topstep is a perfect spot for beginners.

Hi Lio – Topstep is definitely a leader in the funded trader space having been around for a decade. But what I think is important for people to understand, especially those new to trading, is that legitimate skills are required in order to achieve long-lasting success. So before diving straight into the Topstep Combine, people should be going through a legitimate training program first, like Thomas Kralow’s University Grade Trading Education, for example. It’s one thing to pass the Combine and get funded, but it’s an entirely different ballgame to keep that funded account and have continued success over a long period of time. Passing the Combine is just the start, so I think it’s best for individuals to be fully prepared for long-term trading success before jumping right in.

I’m not saying that Topstep is a bad option at all for completely new traders – because they definitely offer some amazing resources (blog posts, podcast episodes, group coaching, etc.). But I think not having a comprehensive, well-structured course is one of their biggest weaknesses. Don’t get me wrong, jumping straight into the Combine and gaining live market experience is great, but it will cost a few hundred dollars per month to do so – and you probably won’t make much progress without any legitimate training under your belt. This route is much cheaper than blowing up a thousand-dollar real money account of your own let’s say, but I think most people would be best served investing in some sort of in-depth training course first. Going at Topstep fully prepared will be well worth it in the end.

I’m not too familiar with funded trader programs, so this article breaks it down really well. What a great opportunity. I have been doing research on how to earn extra income doing something like this. I liked watching the video and reading the reviews from real Topstep users. The pros heavily outweighing the cons is great. This is definitely something I will have to look more into.

I appreciate the feedback! Funded trader programs are something I recently started looking into more deeply – and I definitely think many of them are outstanding opportunities for traders. They offer pretty much anybody an objective chance to get funded with a multi-thousand dollar account when maybe they otherwise wouldn’t have the financial means to even trade. Even in instances where individuals have plenty of their own money to work with, these programs offer a much safer alternative. From a psychological standpoint, trading firm capital is much less of an emotional strain than trading your own money. But in addition to that, the clear risk management rules they have in place protect you from blowing up the account.

There are a few trade-offs that need to be made – like of course there will be some sort of profit-split. Otherwise the firm would have no reason to fund you. But for most traders, the profit-split is easily worth it. For example, the average beginner might only have about $10,000 of their own money to start with. If they were able to generate a 100% annual return on that, then they’d make $10,000 – and not have to split it with anybody. That’s great, but it’s not really an amount most people can live on. But if they were funded with a $100,000 account instead and made that same 100% annual return, then they’d generate $100,000 in overall profits – and in the case of Topstep’s 80/20 split, they’d keep $80,000 while Topstep makes $20,000. So while that $20,000 that goes to Topstep might seem like a lot of money on it’s own, the fact that they funded this trader with a $100,000 account (10 times larger than they could’ve traded with using their own money – $10,000 vs $100,000) allowed them to make eight times the annual return in terms of dollars on the same percentage return ($10,000 vs. $80,000).

This would be exciting. Growing a small personal account is difficult. And I know that the same skills you apply to grow it are the same you apply to keep it going once it’s a suitable size, but the process of growing it at the beginning is slow. I would like to go through this kind of a test trading and show my skills to see if they are willing to hand fund me an account.

I agree, Paolo. It’s difficult to grow a small account and make substantial gains (not in terms of percentage, but in terms of dollars). A 50% annual gain on a $10,000 account, for example is $5,000. Which is great – don’t get me wrong, but probably not making a huge difference in anybody’s life. A 50% annual gain on a $150,000 account, however, is $75,000. This is much more in the range of a full-time income depending on living standards and preferences.

Starting with a $10,000 account or less (which is completely normal for beginners) and doubling it every year (which would be an incredible performance – especially for a beginner) would take at least five years of cumulative gains to get to the range of a $150,000 account. It’s possible to do, but like you said – the process is slow. In trading, money is a tool – and without a solid account size, it’s hard to make serious money. In my opinion, Topstep provides an amazing opportunity to obtain a large trading account for achieving meaningful returns as long as you can prove profitability and show you can manage risk.