Volume Profile Formula Review – What is Volume Profile Formula?

Volume Profile Formula is an introductory course about volume profile trading created by Aaron Korbs at Tradacc. This formula is what Aaron claims is the one proven method that makes him a consistent $10,000-$15,000 per month trading about 2-4 hours per day.

Within this detailed Volume Profile Formula review, I’ll discuss whether or not these claims are true and if the course is worth pursuing. By the end, you should have a clear understanding of what Aaron Korbs, Tradacc, and Volume Profile Formula are all about.

For starters, Aaron Korbs is an active intraday trader with about a decade of market experience who specializes in volume profile and order flow. He’s essentially the face of Tradacc – a trading education company that he co-founded alongside Ruben Davoli.

Volume Profile Formula is the introductory course that Tradacc offers to explain the basics of Aaron Korbs’ trading methodology – which is a framework rooted in auction market theory, volume profile, and order flow trading concepts.

There are 5 main sections of the course containing 3+ total hours of on-demand video: 1) The 6-Figure Volume Profile Strategy, 2) View the Market in Matrix Mode, 3) Volume Profile Formula, 4) Next Level Trade Management, and 5) The 6-Figure Trader Mindset.

There are also a few bonuses that come with it: TradingView Charts Setup Cheatsheet, Plan of Attack Template, and Private Community.

What is Volume Profile Trading and Does Volume Profile Trading Actually Work?

There are so many indicators and charting studies that retail traders blindly rely upon for entry & exit signals (moving averages, Bollinger bands, Fibonacci retracement, MACD, and the list goes on-and-on). But this is an ineffective, surface-level approach.

Most (if not all) of these classic trading indicators lag behind price and aren’t robust enough to produce consistent profits on their own. They all work some of the time by sheer chance, but markets are far too dynamic for simple indicator strategies to be practical.

I don’t mean to be the bearer of bad news – especially if you’re currently one of those people making trading decisions based on all kinds of useless indicators. But if it were as easy as following a fixed, rule-based indicator strategy, the failure rate wouldn’t be 90%.

Aaron Korbs doesn’t even like to categorize volume profile as a technical indicator/chart study – which might be a bit of a stretch. But he says this because volume profile – if used correctly – is just different. It adds an extra dimension to market analysis.

- What is Auction Market Theory – Trading Value vs. Price

- What is Profile Trading – Volume Profile & Market Profile

It doesn’t spit out “buy here” or “sell here” recommendations just because some lines crossed. Instead, it displays real-time market-generated information in regard to participation. Not all price levels are created equal; the “quality” of price depends on volume.

There’s no doubt in my mind that gaining competence and skill around profiling is far more powerful than traditional indicators.

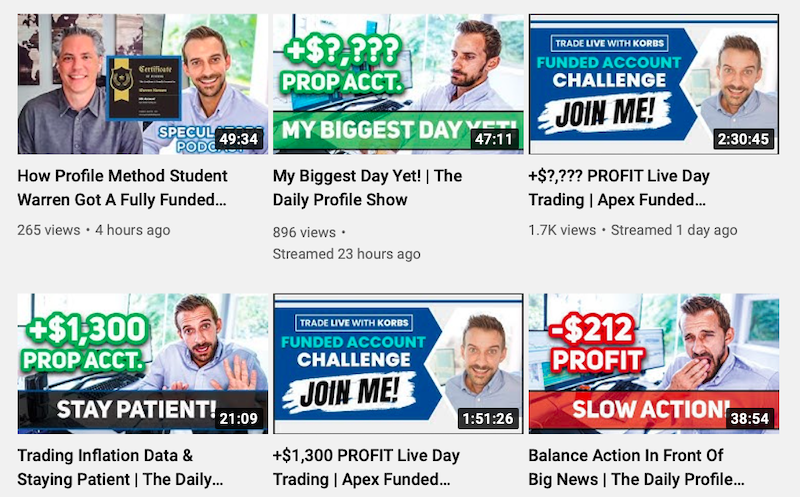

What is Korbs YouTube – Check Out His Channel For Education and Live Case Studies:

The Volume Profile Formula page is definitely a bit “sales-y” – which I don’t particularly love. In fact, my knee-jerk reaction to it was “scam”. It just gave me an uneasy feeling reminiscent of sketchy programs I’ve experienced in the past.

But unlike all of those sketchy programs, what Aaron Korbs has to offer actually has substance behind it – and what convinced me to actually give the Volume Profile Formula a shot was his YouTube channel. There’s some incredible content there.

Not only does he share a ton of solid information in regard to auction market theory, volume profile, and futures trading – but he also puts what he teaches on display through live case studies and trading challenges. He actually practices what he preaches.

Here are some of the case studies/challenges that he’s done in the past or is currently pursuing:

His Daily Profile Show is also a great opportunity for anybody to connect with him and discuss the trading day. It’s essentially an open Q&A at the close of every trading session. So it’s clear that Aaron Korbs is out there “living” his volume profile methodology.

My initial hunches on scams are typically right. But in this case – with Aaron Korbs and Volume Profile Formula – I was wrong.

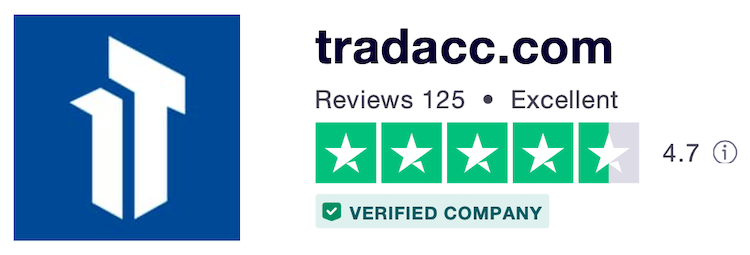

Volume Profile Formula Reviews & Testimonials From 100+ Students on TrustPilot:

In the conclusion (the next section) I’ll wrap up with my personal overall thoughts on Aaron Korbs and the Volume Profile Formula. But I always think it’s important to hear the thoughts/opinions/experiences of numerous others for a well-rounded perspective.

If you check out the Tradacc reviews on TrustPilot, the vast majority are positive (over 95% are great or excellent) – which is a solid sign that most students are more than satisfied with what Tradacc has to offer:

“Well worth the price”.

“Truly a hidden gem”.

“Korbs is a great teacher”.

“Excellent introduction to volume profile”.

“I recommend Volume Profile Formula course to anyone”.

“Goes above and beyond in supplying value”.

“Best program that I’ve been a part of”.

But it’s important to browse through the negative reviews as well. The “bad” and “poor” reviews are generally quite telling – and in this case, it seems like the biggest complaints are about the marketing (not the actual education and training itself):

“They sell a big game”.

“Marketing, marketing, marketing”.

“Bonus videos very generic”.

“The Volume Profile Formula is not exactly a formula”.

Conclusion – Final Thoughts on Aaron Korbs, Tradacc, and the Volume Profile Formula:

While the Volume Profile Formula course sales page is a little over the top for my taste (from a marketing perspective), I think the course itself is well worth the cost for anybody with the desire to become a self-sufficient, consistently profitable trader.

But understand that this course alone won’t get you there. It certainly puts you on the right track, in my opinion, in terms of market framework (being rooted in auction market theory, volume profile, and futures trading). But it’s only an introductory course.

|Take Your Trading Approach From 1D to 3D With the Volume Profile Formula|

|Learn a Reliable Market Methodology and Become a Consistently Profitable Trader|

|Learn a Reliable Market Methodology and Become a Consistently Profitable Trader|

If you actually have ambitions to make trading a significant portion of your income or potentially trade for a living, then next-level training is required. Don’t expect free YouTube content or a basic $47 course to magically turn you into a millionaire trader.

Volume Profile Formula is a great starting point (it’s virtually risk-free because of the price – and on top of that offers a 30-day money back guarantee), but the Profile Method is where the real training is. The Volume Profile Formula is merely a primer.

Overall, I highly recommend Korbs YouTube and the Volume Profile Formula course for starting to build yourself a robust market framework. But please don’t expect it to be some push-button system that automatically generates massive profits in perpetuity.

Volume profile is simply a tool (albeit a powerful one) that takes time and effort to build competence and skill around.

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- How is Tradacc Trading For Beginners – My Personal Take

- What is Trade With Profile – Best Trader Training Program?

- Best Futures Trading Method – The Volume Profile Method

- Free Futures Trading Education – Top 5 Educational Resources

- What is the Volume Profile Method With Aaron Korbs? [REVIEW]

Thanks for sharing this detailed review of Aaron Korbs’ Volume Profile Formula course. It’s refreshing to see someone dive into the actual content of the course, as opposed to simply critiquing surface-level marketing tactics.

From what you’ve outlined, it seems that Aaron Korbs has a unique perspective on volume profile trading. It’s interesting how he doesn’t even categorize volume profile as a traditional technical indicator/chart study, which seems to indicate his departure from the typical approaches to trading. As you noted, this adds a unique dimension to market analysis which could potentially help traders avoid the pitfalls of relying solely on standard indicators.

Hi Anoth – thanks for the comment!

It’s semantics, but as a trader who relies on both volume profile & market profile as primary analysis tools – I completely understand what he’s getting at with this. Volume profile is much different from most standard/traditional technical indicators because it’s not lagging or making some sort of complicated calculation and then plotting a fairly arbitrary line on a chart. Instead, profiling tools provide real-time, meaningful market-generated information concerning the structure of the market (volume at price & time/opportunity at price). In other words, these tools expose the “quality” of price (where market participants are and aren’t interested in doing business). I think some beginner-level traders are finally starting to come around to these powerful tools in larger quantities thanks to traders/trading mentors like Aaron Korbs, Josh Schuler, Jim Dalton, Merritt Black, etc. But they’re still not anywhere close to used at the level that I think they should. Everyone tends to get swept up by “price action” analysis and all kinds of other indicators. But all of that is surface-level in comparison to profiling, which allows you to see what’s going on inside the bars/candles.

The Volume Profile Formula course by Aaron Korbs at Tradacc is a game-changer in my opinion. It goes beyond traditional indicators, focusing on real-time market-generated information. Aaron’s YouTube channel showcases his expertise through live case studies and trading challenges. Positive reviews on TrustPilot speak to the course’s value and Aaron’s teaching skills. I think starting with the Volume Profile Formula is great for a solid foundation and then consider the Profile Method for advanced training. Keep in mind that mastering volume profile takes time and effort. Kudos to Aaron Korbs and Tradacc for offering these educational resources.