What is Tradacc.com – Accelerate Your Path to Consistent Trading Profits:

Tradacc (short for “trading accelerator”) is a trading education company founded by Aaron Korbs – an active intraday trader and trading coach who specializes in auction market theory, volume profile methodology, and order flow analysis.

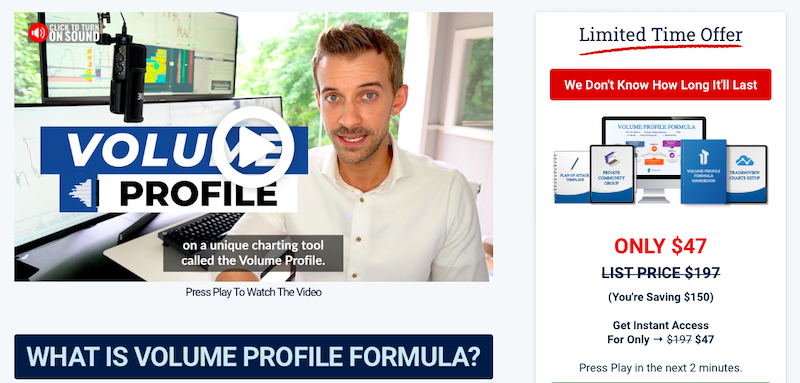

While Tradacc offers a handful of courses/programs and additional resources to help traders generate consistent trading profits, there are 2 main programs that stand out – Volume Profile Formula (introductory course) & Profile Method (advanced training).

Along with Aaron Korbs’ YouTube channel – which provides a ton of great content regularly (Apex Funded Account Challenge, The Daily Profile Show, Speculators Podcast, etc.) – I think Volume Profile Formula is an ideal starting point for new traders.

It’s only an introductory course, but I believe it to be well worth the cost because it points developing traders in the right direction in terms of futures trading, auction market theory, volume profiling, risk management, and proper mindset/psychology.

But most importantly, it lays a strong foundation for those who are fully committed to their own personal growth and skill development – and choose to pursue next-level training and mentorship through the Profile Method program.

The Tradacc mission is to help students build $10,000 – $15,000+ per month trading businesses using just one single method.

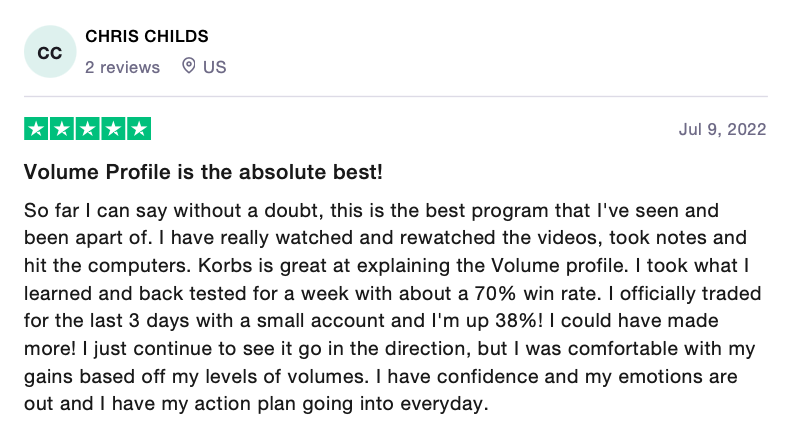

Tradacc Reviews and Testimonials – How is Tradacc (Trading Accelerator) For Beginners?

I highly suggest checking out the 100+ Tradacc reviews on TrustPilot (with a cumulative rating of 4.7/5 stars – “Excellent”).

But as someone with personal experience with the Tradacc programs (as well as dozens of other trading-related courses, platforms, and services over the past 10 years), there are a couple things I want to specifically point out from my own perspective.

I think the biggest and pretty much only negative that I’ve come across with Tradacc is the marketing on some of their sales pages (like with Volume Profile Formula, for example). It just has a feel to it where I automatically thought it was a scam.

It was hard for me to look past this initially, but luckily I did because Profile Method is undoubtedly one of the best trader training programs available online. This goes to show how tricky it can be to differentiate legitimate programs vs. scams in this space.

But I don’t think the (relatively few) Tradacc complaints and negative reviews hold much merit. Things are definitely a bit sales-y, but at least it’s not in a “lifestyle marketing” type of way (with displays of exotic cars, mansions, stacks of cash, etc.).

What validates Tradacc in my eyes is the focus on the right things (futures trading, auction market framework, volume profile methodology, risk & money management, etc.) and the real, legitimate training offered through the Profile Method.

My Final Thoughts on Tradacc.com, Aaron Korbs, Volume Profile Formula, and Profile Method:

Overall, I believe Aaron Korbs to be one of the best day trading mentors currently available online – and I suggest checking out his free Korbs YouTube channel and low-cost Volume Profile Formula course to see for yourself.

|Check Out Korbs YouTube to Learn More About Aaron Korbs’ Volume Profile Methodology|

|Start Laying the Foundation For Your Six-Figure Trading Business With the Volume Profile Formula|

But don’t have improper expectations about these two resources. Yes, I absolutely think they’re valuable – but free YouTube content and a $47 introductory course aren’t going to automatically turn you into a consistently profitable, six-figure trader.

If trading for a living or at least making trading a substantial portion of your income is something you truly desire, then the real training and mentorship is with the Profile Method. Volume Profile Formula merely lays the foundation for this advanced training.

You could theoretically bypass the Volume Profile Formula and skip right to the Profile Method if you’re in search of advanced training. But the Volume Profile Formula essentially serves as a low-cost trial to see what Aaron Korbs and his methodology are about.

So starting with the Volume Profile Formula is a no-brainer (it’s less than $50 and offers a 30-day money-back guarantee). If Aaron Korbs’ trading methodology resonates with you, that’s when you can consider leveling up to the Profile Method.

The training offered by Aaron Korbs at Tradacc is definitely something I wish I had available to me nearly a decade ago.

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- What is Korbs YouTube – Who is Aaron Korbs?

- Day Trading Futures – Beginners Guide to Intraday Futures

- 3 Free Ways to Learn From Josh Schuler at Trade With Profile

- What is Trade With Profile – Best Trader Training Program?

- Volume Profile Formula Review – What is Volume Profile Formula?

Hi Matt,

It is great to cross paths with your posts about Korbs method of volume profile intraday futures trading which I am interested in as my near objective. It is a great place to try with less than fifty bucks with a 30-day guarantee of money back.

I have read this post and searched the internet about intraday trading. I was wondering do they cover which equity they choose to trade on an intraday basis or it will be your decision? Are there any hidden costs that have to know when you seem to trade free?

Hi Anusuya – great questions.

Aaron Korbs mainly trades index futures contracts (e-mini S&P 500, e-mini Nasdaq 100, etc.) – as do I – but it’s entirely up to you to decide what markets/products you want to trade. I personally agree with Korbs that futures are superior products (in comparison to stocks, options, forex, cryptocurrencies, etc.), but the ultimate decision of what you trade is up to you. His volume profile methodology can be applied to any market/product with accurate/sufficient volume data.

I wouldn’t necessarily call them hidden costs, but there are certainly some costs associated with trading other than the money you put toward education and training. For example, the platform/charting tools you choose to trade with probably won’t be free (like TradingView, EdgeProX, Sierra Chart, etc.). There are various packages to choose from, but you can probably expect to pay at least $20 per month for one of those. There are also live market data fees to consider for around $100 per month. And of course there are broker commissions/fees (which should be relatively minimal, but depend on your trading activity). Don’t forget that you also need capital to start trading with, but micro futures contracts are a good place to begin with relatively low risk (they’re 1/10 the size of standard futures contracts) – or possibly even just a simulator/demo account with zero risk as you build competence, skill, and consistency. Funded trader programs like Topstep are also a great, cost-friendly option for beginners. Many offer their own in-house trading platforms (Topstep has TSTrader) and cover the data fees (at least during the tryout – Topstep calls theirs a Combine).

Those are some ideas of the potential costs involved and potential paths to go down, so I hope that helps. Please also keep in mind that the $50 cost of Volume Profile Formula is certainly a good value – it provides great information and resources for the cost. But it’s not enough to become consistently profitable. Expect to pay at least $1,000 – $3,000 for an advanced training program like the Profile Method if you’re serious about making trading a substantial portion of your income or possibly even pursuing it full-time. Legitimate training is often what I see new traders bypass because of the cost, but then they proceed to lose even more in the markets essentially trading blind – which just doesn’t make any sense to me. Overall, trading has costs and expenses associated with it just like any other business, so “free”/”risk-free” isn’t a realistic option.

Thank you for a good review. I have thought about day trading a couple of times. But don’t you need a lot of money before hand, so you can invest in something? I would take the advanced option if I could, because I want the best information to get going the right way.

Hi Martin – that’s a great question that a lot of other people are probably wondering as well.

The first thing we need to distinguish is the difference between trading and investing. These terms are often used synonymously, but there’s a drastic difference between active day trading and long-term investing. There’s a bit of overlap between them, but they’re wildly different. In regard to this website (TradingParadigm.com), as well as Tradacc (Tradacc.com) – the focus leans heavily toward active/short-term day trading (buying and selling positions within the same day).

Back when I first started trading, I started small out of necessity and used my own money because I wasn’t aware of any other way to do it. But it’s hard to make any meaningful dollar gains with a relatively small $1,000-$5,000 account. With a $1,000 account for example, even if I made a 200% return (for a total dollar return of $2,000) – that’s a far cry from a meaningful part-time or full-time income. I’m not saying that starting small is bad because that’s what everyone without any skill and experience yet should be doing. But once skill is developed and consistency is reached, capitalization is definitely important for growth. These days, luckily, there’s a ton of opportunity available with funded trader programs like Topstep, in which you can get funded with five, six, and sometimes even seven-figure trading accounts if you can prove yourself in a tryout/combine (simulated environment). There are rules and profit splits involved, but these are programs that I believe the vast majority of traders (at pretty much every level from amateur to veteran) should be taking advantage of. There’s such limited risk (small tryout fees) for large potential rewards.

So to answer your question directly – you definitely don’t need a lot of money beforehand to be able to potentially trade for a living or at least make it a substantial portion of your income. You can become a fully funded trader for as little as a few hundred dollars through a funded trader program tryout. But keep in mind that you need the competence and skill for long-lasting, sustainable market success – and that’s where advanced training programs like Profile Method come into play. When people do it right, their training is the most expensive (yet well worth it) aspect of their trading journey. But when people do it wrong, they pay much higher “tuition” in trading losses and emotional pain by diving in unskilled/unprepared.