What is Trading Psychology and What is the Best Trading Psychology Course?

Every single human being is naturally wired to be a terrible trader – that’s an undeniable fact.

Sure, people vary in personality and have different levels of patience, organization, objectivity, and overall mental balance. But everybody, no matter their background or accomplishments, has natural defensive mechanisms that lead to irrational behaviors.

When you boil it down, trading is simple. It’s just a statistical and mental game. You find or develop a statistical edge and then execute on it with consistency. The execution component is almost entirely mental – and that’s where fear and greed creep in.

This is why live trading is far more stressful and difficult than most people initially realize. They wrongfully assume trading is all about patterns, setups, and other technical aspects, while overlooking the most important thing – their own mental framework.

So it’s no surprise that trading is a financially and emotionally afflictive experience for the vast majority of individuals who attempt it. But the good news is that it doesn’t have to be this way. With the proper training, trading can be a smooth and enjoyable endeavor.

If your own impulsive tendencies are causing you harm in the market, I highly recommend these top 3 trading psychology courses.

Best Trading Psychology Course Online → The Advanced Traders Mindset Course

I’ve been through dozens of trading courses and programs over the years, and most of them barely even mention trading mindset or psychology. Many don’t even cover the topic at all. They just sweep it under the rug as if it doesn’t exist.

Not so surprisingly, the vast majority of these services weren’t very effective in helping me improve my trading process and results. It wasn’t until I stumbled across The Trading Psychology Mastery Course by Yvan Byeajee when my trading noticeably improved.

This course provided me with my first real understanding of trading psychology at a practical level – and it made a massive difference. It’s not as exciting as advertisements for hot stock alerts or foolproof systems. But proper mindset is essential for success.

Even though trading psychology is a critical component for durable success – just ask any professional-level trader and they’ll tell you the same thing – courses on the topic are virtually nonexistent. To this day, I’ve only found a handful of high-quality ones.

The sad reality is that people are far more drawn to the flashy and stimulating aspects of trading that they think will automatically produce massive profits with little to no effort. As a result, there’s not much money in selling trading psychology courses.

For this reason, I have incredible respect for the individuals who have created the best ones: Rich Friesen at Mind Muscles, Yvan Byeajee at Trading Composure, and Chris Capre at 2ndSkies Trading – the creator of The Advanced Traders Mindset Course.

Benefits of Going Through The Advanced Traders Mindset Course By Chris Capre at 2ndSkies:

The Advanced Traders Mindset Course takes a much deeper dive into trading psychology than any other I’ve come across.

As previously mentioned, the typical trading course or program out there barely mentions it, and if they do, it’s usually some surface-level advice like “be more disciplined”. But this doesn’t help traders pinpoint and correct the root cause of their issues.

It’s easy to tell someone to be more disciplined, but that doesn’t change their underlying beliefs and perspectives. Without changes in these beliefs, it’s close to impossible to stay disciplined forever. Constantly fighting urges will take its emotional toll.

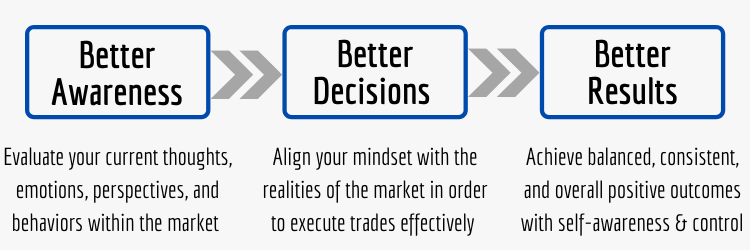

Below I’ll discuss 2 main benefits that The Advanced Traders Mindset Course provides so that you can stop repeating the same mistakes over-and-over again and overcome your inner challenges to ultimately achieve consistent performance.

1. STOP OPERATING OUT OF A SURVIVAL MINDSET

Our natural survival mindset is what makes every single human an absolutely terrible trader – at least at first.

But the difference between those who succeed over the long-term as traders and those who fail has everything to do with mindset evolution. There are of course other technical and analytical aspects that matter, but an improper mindset sabotages all of that.

What our survival mindset does is mainly focus on the negative, which understandably is for our own protection. But with our natural tendency to search for threatening or negative stimuli, it instills high levels of stress, overwhelm, and fear inside of us.

When we enter such states of stress and fear, our logical thinking process is greatly diminished and sometimes completely shuts down. This leads to impulsive and irrational responses – actions like removing stop losses, revenge trading, and overall breaking rules.

Even though our natural survival mindset is meant to protect us and preserve our own lives, bringing it into the market environment is nothing but a recipe for disaster. After all, the market can’t hurt us – only we can with our own perspectives and behaviors.

This course provides practical tools for rewiring our inherent biases (like the negativity bias) that make us such bad traders.

2. START FOCUSING ON THE PROCESS INSTEAD OF THE RESULTS

Focusing on results (money, cars, boats, mansions, etc.) over the necessary process is another trap for new and inexperienced traders.

This is an easy trap for people to fall into because the end goal of trading is to make money. Every market participant wants to increase their trading account. Nobody would be doing it if there wasn’t the potential for massive financial gains.

But the problem is that most people want the rewards without putting in the work. This usually leads them down the path of chat rooms or alert services with self-proclaimed gurus making ridiculous claims. As a result, most beginners have unrealistic expectations.

But what almost nobody talks about, especially within all the flashy trading advertisements you see on social media these days, is that trading is a difficult endeavor. But outright saying that doesn’t help gurus sell their courses, programs, platforms, and services.

As enticing as the potential rewards can be, professional-level traders understand that their results are a direct result of their process. Without a strong process, good results won’t follow. But with a strong process, results take care of themselves.

It’s rare to find traders implementing robust techniques in all 3 critical phases: Preparation, Execution, and Review.

Fully Accept That Trading is a Skill-Based, Peak-Performance Endeavor:

It usually takes some time for new traders to understand that trading is indeed a skill-based, peak-performance endeavor.

Much like a brain surgeon, there are specific skills that traders need to succeed. The confusing part is that if you choose a random person to perform a brain surgery, there’s absolutely no chance they would succeed without the proper training and skill-development. In the market, however, it’s relatively easy for a random person to make money on an individual trade out of sheer luck or chance.

Right off the bat, this tricks people into thinking that trading is far easier than it actually is. But over time, they realize that their results are chaotic and mostly negative. The truth is that consistently profitable traders look at the market differently than the average person. It’s not about making market predictions. It’s about identifying a statistical edge and executing on it with consistency.

Executing with consistency requires the proper market and mental framework – something most market participants simply don’t have.

Please share your comments or questions about trading psychology courses or anything trading psychology-related below.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Who is Richard Friesen and What is Compass 2.0?

- What is Meditation For Trading – Peak Performance Habits

- What is Good Stock Trading – Good vs. Bad Stock Trading

- Best Day Trading Mentorship – Top 2 Day Trading Mentors

- What is 2ndSkies Trading? Change the Way You Think, Trade, and Perform

I appreciate how you emphasized that trading success is linked to mindset evolution. Early this year, I had a survival mindset that made me afraid and stressed, thinking that I wouldn’t be able to succeed in the market. But, step by step, I’ve slowly been able to overcome it to a certain level. I also like how you say it’s important to focus on the process, since most of the time, we fail because we’re too focused on the end goal like you indicated with money, cars, and homes. I’m thinking of taking Chris Capre’s advanced traders’ mindset course one of these days, as you suggested. Thank you very much.

Thanks for sharing your experiences, Lionel!

Durable trading success is 100% linked to mindset evolution. The reality is that nobody is a natural-born consistently profitable trader. We all have wiring that simply doesn’t work very well when operating within the market environment. Our survival mindset often leads to stress and irrational decisions if it goes unchecked.

I think the most important aspect of trading success is developing the appropriate internal (mental) and external (market) framework – and a great starting point for that is to view trading as a statistical game. In other words, it’s not about predicting the market or being right every single time. But rather, it’s about putting the odds in your favor over a large number of trades. This usually helps new/inexperienced traders separate their emotions and self-worth, for example, from the outcome of each individual trade.

Overall, trading doesn’t have to be an emotionally and financially afflictive roller coaster ride unless we let it.