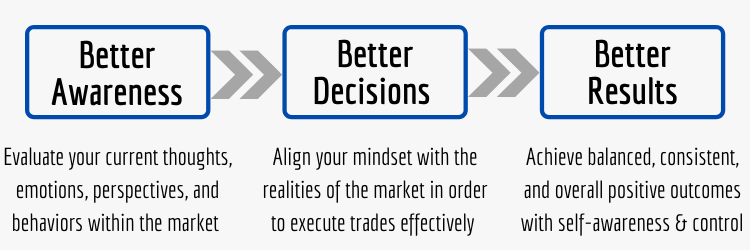

Recognize the Connection Between Day Trading Psychology and Your Results:

I’m sure you know the old adages: “buy low and sell high” and “cut your losses quickly and let your winners run”. These sound simple enough, right? But the reality is that the majority of traders do the exact opposite – they buy high and sell low, and cut their wins quickly and let their losers run. The most basic explanation for this is that they’re operating from a fear-based perspective, which is the reason why over 90% of traders fail. In winning trades, the fear of losing causes them to focus solely on information that they perceive will diminish the unrealized gains currently sitting in their account, so they cut their profitable trades short. In losing trades, they focus solely on information that they perceive as validation that the trade should be a winner, and as a result, they let their losers run.

Obviously, this fear-based approach to trading is not the path to consistent profitability. It’s the path to inconsistency and a completely drained account. If you’re operating in the market out of fear, then you engage natural defense mechanisms that reduce your field of perception and limit your choices. Just think about it: imagine that you’re walking around outside and all of a sudden a tiger appears ten feet in front of you. The only options in that moment are to run from the tiger, fight the tiger, or freeze up. Everything else around you in that moment no longer matters and is not being perceived – only the threat of the tiger. Similarly, traders behave the same way within the market, treating specific pieces of information that the market generates like mortal threats. It’s no wonder most traders experience inconsistent and overall negative results. So in order to achieve consistency, you need to build confidence and trust.

If You Want Control, Be Accountable For Your Mindset, Methods & Results:

There’s no doubt that most market participants trade randomly so that they don’t have to confront their own irrational behaviors. If they chose to implement more structure in their approach, it would force them to confront their own impulses, biases, and insecurities. So instead, they shift blame to external forces when their expectations and desires aren’t fulfilled. It’s not their own fault, it’s the “guru” who sent them the “hot stock pick” or the “expert” who sent them the “special report”. Even the market itself receives tremendous blame when all it does is provide information. In fact, the market is completely neutral and objective, but it’s the collective group of market participants who make it “volatile” and “irrational”. If we want trading success, we can’t relinquish our power to external forces.

Knowing that we can’t individually control the market (that power is reserved for only a small number of individuals and institutions), we have to realize that what we do actually have control over is our reactions to it (this is where all of our power is). It’s like the saying goes: “you can’t control the wind, but you can certainly adjust your sails”. If we can’t control the market (the wind) and also fail to control our reactions to it (the sails), then there’s no question that our results will be mysterious and random. But when we adjust our perceptions and reactions to the market, then we can finally be in harmony with it instead of fighting it. There’s nothing “bad” or “threatening” about any particular market movement – those are only perceptions. A one cent move in a stock could be one trader’s perfect opportunity to enter and another trader’s perfect opportunity to exit, but objectively it’s nothing more than a one cent move. The bottom line is that we have to take full responsibility for controllable factors – our mindset, methods, and subsequent results.

Who You Are Right Now is Not Capable of Achieving Consistent Profitability in the Market:

The harsh truth is that you are almost certainly incapable of achieving consistent profitability in the market with your current mindset. I know this because over 90% of traders fail, so if you’re a trader and currently reading this, then there’s nearly a 100% chance that your current mindset is ineffective within the market environment. The good news, however, is that the proper mindset can definitely be developed. In fact, every successful trader has had to transform their mental resources in order to survive and thrive in the market. These aren’t traits you’re born with – they’re attitudes, beliefs, and perspectives that you have to acquire. You have to understand that this environment displays unique characteristics which requires you to change and grow in order to become effective within it.

What you experience on the outside (in the market) is shaped by what is on the inside (your thoughts, emotions, beliefs, etc.). In other words, the market basically just reflects back to you what’s going on inside your own mind. So what you perceive is merely an illusion – an individual view of reality. But it’s not everybody’s reality – it’s just your perception. A market move you label as “bad” and “threatening” can be another trader’s label of “good” and “attractive”. The lesson here is that you have to take a more objective view on the market. Right now, you can take an active role in your self-transformation by becoming aware of any emotional discomfort you feel while trading. This pain is a sign that your current mindset is out of alignment with the realities of the market. The higher the discomfort level, the more critical it is for you to change in order to trade without fear, anxiety, worry, doubt, and regret.

The Fantasy Gap – Traders Want Consistent Profits, But Don’t Want to Change, Grow, and Develop:

It’s undeniable that there are millions of traders out there who like the idea of achieving consistent profitability in the market. The cars, mansions, and everything else money can buy becomes a bright and bold fantasy in their head. But when it comes to performing the actions that it actually takes to become a successful trader, they’re not willing to put the effort in. This is what I call the “fantasy gap”. Most traders enter the market with false beliefs and high expectations. They think trading is simple since it requires no physical work and it’s possible to make large amounts of money in a matter of seconds. But then it ends up being one of the most difficult endeavors of their lives because they’re ill-prepared mentally. The self-awareness and self-control required to be consistently profitable is just too intangible for people to grasp. Attaining the proper mindset is too perplexing. Profits are always so close, yet so elusive.

But if struggling traders choose not to change, then they subject themselves to the same recurring negative experiences within the market over-and-over again. They’ll just continue to strategy-hop in fear of missing out, remove stop loss orders in fear of losing, double-down on losing positions in fear of being wrong, exit winning trades too late in fear of leaving money on the table, and the list goes on-and-on. All of their trading decisions are completely driven by their impulsive and irrational thoughts, emotions, and behaviors, and then they expect great results, but it just doesn’t work that way. If you can’t define market behavior with a validated system and control your own behavior with the proper mindset, then you can’t make meaningful progress toward repeating winning trades and avoiding losing ones. Overall, there’s no question that trading is mostly a mental discipline that many traders aren’t willing to accept.

You must accept the psychological aspect of trading if you ever want to achieve consistent profitability within the market environment.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- What is Meditation For Trading – Peak Performance Habits

- Can People Make Money Day Trading? It Starts With Self-Awareness

- What is Trading Composure? Acquire a Heightened Level of Trading Insight

- 3 Critical Mindset Attributes That Traders Can Develop From Navy SEALs

- Rewire Your Brain For Successful Trading With the Help of Neuroplasticity

I just began trading on the stock market. I am a novice and feeling a bit overwhelmed by it all. Fear is a big factor (I am discovering) in trader’s decision making. This clouds level headed buying and selling of stocks. After reading your post about day trading psychology, I am rethinking my day trading strategies. I can’t let fear give me tunnel vision and take my eyes off the ultimate goal (long term financial success) in the market. Thanks for your trading wisdom!

No problem – happy to help!

You’re exactly right – fear plays a huge role in the decision-making process of most traders. It tends to make them impulsive and irrational – which isn’t how you want to operate within the market environment. Instead, you want to be able to operate with clarity, balance, and confidence – and that requires a statistical edge and the ability to execute on that edge with consistency and discipline.

At the end of the day, that’s what good trading is all about – putting the odds in your favor, controlling risk, and managing your mindset. But it’s much easier said than done. Much of what it takes to be a successful trader goes against our natural instincts and inherent biases – which is why mindset/psychology is so critical. Every successful trader has had to acquire new attitudes, beliefs, perspectives, and habits in order to operate effectively – there are no exceptions.

How important is the mental aspects of trading – I have been struggling to become profitable and I have discovered that my main issue is that I’m resisting the mindset component of trading. I feel that until I’m able to grab this mindset, I will always end in red.

Hi Ann – you’re definitely not alone in that struggle. So many people avoid/ignore the mental aspect of trading, but it’s a great sign that you’ve accepted it. I personally resisted it for the first few years of my own trading journey and that was a huge mistake. The good news is that there are a handful of great resources covering trading psychology. My personal favorites are Trading Composure, 2ndSkies Trading, and Mind Muscles For Traders.

I’ve also written numerous posts covering the topic of Trading Psychology.

Hope these resources help – take care!

Hi, Matt. I agree with a lot that you say here. I’ve been a victim of my emotions when it comes to making the right trading decisions. Psychology plays a very big part in influencing our next moves. And unless you break free from the normal way of thinking it’s always going to be an impediment to progress. It’s very easy to conclude that trading is not one’s cup of coffee and give up completely.

Hi Steve – thanks for sharing your thoughts!

Emotions play such a large role in trading success. As beginners, we tend not to have the self-awareness and self-control necessary to be successful. This is why new traders are prone to strategy-hopping, overtrading, and all kinds of impulsive behaviors – which doesn’t produce favorable results in the long run, and in the short run it’s quite emotionally-taxing. This is where balance, structure, and patience have to come into play if you want to have any chance at success. The vast majority of people get caught up in the exciting things like setups, strategies, and the potential rewards, but fail to develop the proper mental framework – and as a result, even the best strategies get compromised.

Day trading seems like a mental game, it’s all about strategy, research, getting into the minds of business executives who make decisions, and anticipating what those people, as well as other traders, might do. It makes complete since that you would want to prepare yourself mentally and work on this skill in between trades. All athletes work on their physical abilities, mentally this is the same concept.

Traders are indeed mental athletes. Which is why it’s so concerning that so many people don’t take the psychological component of trading seriously. It would be like a baseball, basketball, or football player never working out or training, but then expecting to be highly successful – it’s just not going to happen.

I swear the universe must have gotten tired of me thinking abut day trading, but never acting on it. I have been wanting to get into trading for months now, but am totally lost on how to start, where to start, or what to do. I read a small amount of your content and already I can tell I’m going to learn so much from this site.

I love the simple design and layout. It allows me to focus solely on the content instead of fancy pictures or other distractions. I don’t like to be bombarded with paid ads or flashy banners like many other websites do. I can tell that you are passionate about trading and trading psychology, and I look forward to learning day trading here!

Hi Kimberly – I appreciate the comments! The FAQ and Free Resources pages are great places to get started. I’ve filled them with the most important information and resources for individuals just starting out. Unfortunately, there’s a lot of bad information out there when it comes to trading (like gurus/programs/services promising explosive profits from foolproof systems or alerts), but I hope I can help guide traders more in the direction of building core skills and the proper mindset right from the start. If you have any additional questions, don’t hesitate to reach out.

I’ve been wanting to get into day trading for months now, but don’t know my ups from my downs or my ins from my outs! Thank you for providing some awesome information!

Hi Matt – Have you changed your mind on which trading psychology course you would recommend most? This post says Trading Composure Is the #1 Recommendation while the drop down on top of your web page “Top Rated Education” shows 2ndSky’s trading Psyche course as #1. I will be buying one of these two courses based on your recommendation and am now a little confused. Thanks in advance for your help!

Hi Mark – great question and thanks for asking. I can see why some of my previous posts could have caused some confusion. When I have the chance, I’ll have to go back and update some of those posts as best I can.

The Trading Psychology Mastery Course at Trading Composure was my top recommendation for a few years up until I came across The Advanced Traders Mindset Course at 2ndSkies Trading a couple months ago. I think both are great, but my top recommendation at this point in time is definitely the ATM course at 2ndSkies.

The 2ndSkies course provides much more insight into understanding your brain: covering topics such as neuroplasticity, flow states, comfort zones, self-image/subconscious, and how all of this relates back to your trading. There are also specific exercises for mental rehearsal, rewiring the negativity bias, building routines, acquiring specific trading skills, and much more. This part of the course is a 20-lesson series, but there’s also an additional 12-lesson series focused entirely on meditation. In addition to that, you’ll have access to monthly webinars for ongoing training (including all previously recorded webinars dating back to 2017).

If you join, be sure to use this coupon code at checkout for 15% off: M9KPE94R. It would also be great if you returned at some point in the future to leave your thoughts regarding your experiences with the ATM course. Your feedback would be greatly appreciated. Take care!

I’ve considered day trading but am, quite honestly, a bit afraid of creating a disaster, rather than increasing our bank account. But the points you make about mindset (psychology) are interesting and seem to have validity. I can see how thinking clearly and in the right mindset influences so much of our lives, so it makes sense that it would affect us in the stock market, too. Given the information you’ve shared in this article, as well as the other articles (yes, I’ve been looking around!) I might have to try it. Thanks for giving me the confidence to give day trading a go!

Hi Diane – I appreciate your comments! Unfortunately, most traders who enter the market do so with a fear-based approach – and 90% of traders ultimately fail because of it. I can’t and won’t tell you what to do, but if you’re afraid then you probably want to avoid day trading for the time being. The good news is that understanding the two core components necessary to achieve consistent success in the market will help you build confidence and trust in your potential approach. Those two components working in tandem – a validated system and the proper mindset – are what produce consistent results. Fear, greed, and other heavy emotions simply lead to impulsive, irrational, and inconsistent behaviors, and ultimately – negative results. There’s no rush so don’t jump in unprepared – the market will still be there whenever your foundation is set.

You have really gone more in depth than anything else that I have read on daytrading. You have gone into the absolute psychology of it. I’ll admit I haven’t gone into actual books of trading so you might’ve gotten this knowledge from there, I don’t know, but you definitely have outlined day trading psychology well and I find this so interesting. I am going to start trading soon and I am trying to read as much about it as possible

Hi Misael – I’m glad you’re starting in the right spot by focusing on the psychological aspect of trading. It’s the most critical part, by far. Trading is 80% mental and 20% tactics. Much of the information here I certainly didn’t come up with all on my own. I certainly wasn’t born with this information in my mind – I acquired it through learning and experience. With that being said, much of what I’m sharing here on this site comes from numerous books that I’ve read, courses I’ve gone through, and personal experiences I’ve had.

There are great books written specifically on trading psychology like The Disciplined Trader and Trading in the Zone by Mark Douglas, but I’ve also been able to make many associations and distinctions from books/courses/experiences that have nothing to do with trading. I’ve read a number of books on habits, psychology, health, history, business, etc. that didn’t specifically focus on trading, but many concepts still apply in certain circumstances. With all of this “research” coupled with my own experiences, it’s clear that traders on the whole are doing it wrong – how else could over 90% of traders be failing? It’s undeniable that they resist the mindset component and it’s a huge mistake. Because those who embrace developing the proper mindset are able to eventually achieve their goal of consistent trading success.

This is amazing information. For people like me who are willing to enter the market and day trade, it is not easy battling with the emotional stress that accompanies it. It’s nice to know that one can develop into a more stable, calm, consistent, and balanced trader, and really make the most out of our mindset thanks to our inherent potential for growth.

Hi Kyle – I appreciate your comments. So many people resist or refuse the mindset component of trading, so it’s no wonder 90%+ traders fail. Having the proper attitudes, beliefs, and perspectives is the foundation for successful trading. Without it, traders will only continue to sabotage themselves over and over again. Even if they follow a system or strategy that should theoretically work, their improper mindset will sabotage it. It’s sad to see, and it’s my goal to make it known to as many traders (and hopeful traders) as possible that it doesn’t have to be the emotionally and financially agonizing experience they often make it. I personally had to learn the hard way, but hopefully I can divert some traders from that painful path.