2ndSkies Trading Review – Can 2ndSkies Teach You the Skills to Become a Full-Time Trader?

2ndSkies Trading is run by verified profitable trader, Chris Capre. Not only does Chris have prior experience as both a Forex broker and trader for a hedge fund, but he’s also been teaching his own trading students since 2007. In addition to that, he studied Neuroscience at University and has kept a daily meditation and yoga practice over the past two decades. With his experiences on Wall Street, in school, and in his personal life, it’s safe to say that Chris has unique knowledge to share as a mentor to his trading students.

Chris specializes in trading based on price action context, so that’s one of the core skills he concentrates on teaching within his popular Trading Masterclass. The incredible thing about price action context is that it applies to any instrument, time frame, or environment So even though Chris himself mainly focuses on day and swing trading stocks, options, forex, and cryptocurrencies, these price-action skills are critical for trading within any market environment. Overall, the objective of 2ndSkies Trading is simple: Change the Way You Think, Trade, and Perform.

Below I’ll share my own personal experiences with 2ndSkies Trading through one of their free courses: Intro to Trading School, as well as one of their premium courses: Advanced Traders Mindset.

2 Significant Lessons Learned From 2ndSkies Trading Courses Based on Personal Experience:

1. Trading is a Skill-Based Endeavor, Not a Lottery

One of the things Chris Capre makes exceptionally clear through the 2ndSkies website and courses is that trading is a skill-based endeavor. Trading success is not about luck or chance, it’s about attaining the actual skills required to become a consistently profitable trader. One big winning trade is fleeting, but consistent wins over time are what produce long-lasting success.

Unfortunately, the way most people treat trading is with shortcuts and get-rich-quick programs. But as is the case with any skill-based endeavor, like playing instruments or sports, there are particular skills that need to be developed in order to excel at the craft. These skills take time, repetition, and sacrifice to develop. There’s no cheating cause-and-effect. You have to put the work in.

Even still, jumping into live trading without foundational skills is typical for new traders. Alarmingly, one of the most common practices amongst inexperienced traders is trying to blindly copy trades from self-proclaimed gurus through text/email alerts. But this particular approach would be like trying to play in a Major League Baseball game without any, or very little, previous baseball experience.

Imagine being at-bat in a situation like this against a pitcher who throws 100 miles per hour. The pitch is coming your way, your coach yells “swing” to help you, and you blindly follow the command. Do you really think the coach’s alert to “swing” is going to help you hit the ball if you don’t already have the requisite skills to do so (hand-eye coordination, bat speed, bat trajectory, balance, timing, etc.)?

The answer is a resounding no. Sure, you might be able to stick the bat out over the plate, get lucky and make contact, or maybe even get a hit. But you certainly don’t have the skills for consistent, repeatable success. In fact, it would be downright dangerous for you to be in a position like this, completely unprepared to perform, or even just protect yourself for that matter.

Luckily, there are barriers to entry in the MLB to keep this sort of situation from ever taking place. But those barriers don’t exist in the market – virtually anyone can enter and start trading regardless of talent level. With so many eager traders entering the market with a lack of core skills and proper mindset, there’s no surprise why the success rate is so low.

2. You Have to Wire Your Brain For Trading Success

The mindset component of trading is completely ignored in most cases, but it’s absolutely critical for achieving consistent profitability. The reality of the situation is that you have to fight against your natural programming in order to become the trader you want to be. This might sound harsh, but the person you are right now simply isn’t capable of achieving your trading goals.

Changing the way you think isn’t just something that would be nice to do – it’s essential. Many of your current thoughts, feelings, perspectives, and behaviors are ineffective within the market environment. Your brain actually prefers these common ways of thinking because it’s convenient. So the challenge is in interrupting your old, deeply ingrained patterns of thought and behavior, and then replacing them with new, effective ones. Wouldn’t you rather your habits serve you in the market as opposed to hurt you?

One of the major hurdles every successful trader must overcome is the natural programming of the negativity bias. On average, we’re instinctively wired with a 500% larger capacity to focus on negative circumstances compared to positive ones. In other words, we have to fight against our pessimistic nature. The impact this can have on us as traders, if unrecognized and unmanaged, can be disastrous.

Just think about it: when a position moves a tick or two in your favor, how do you feel? Probably indifferent for the most part. But if the position moves a tick or two against you, fear starts to settle in. Then it sheds a few more ticks and the negative thoughts are racing – you’re irritated, worried, and stressed about the possibility being wrong and losing money.

As your position continues to deteriorate, your response turns into a full-out panic. Your fight-or-flight response kicks in, narrowing your focus, and you start acting impulsively. You break your risk management rules – removing your stop loss and doubling-down on the position hoping for a rebound that never comes. Eventually, it turns into a gigantic emotionally and financially afflictive loss.

This can’t be the way you operate within the market if you actually want to be a successful trader. Through self-directed neuroplasticity, however, you have the ability to wire your brain in order to achieve specific goals. Why not learn how to use this powerful tool to your advantage? Your inner landscape shouldn’t be ignored when it comes to trading. Your ultimate trading success (or failure) depends on it. Thankfully, 2ndSkies is teaching this better than any other program I’ve come across thus far.

The Advanced Traders Mindset Course Should Be Required Training For All Traders:

I’ve personally used countless trading programs over the years and not one of them has concentrated on mindset anywhere close to what Chris Capre is doing at 2ndSkies. It’s truthfully shocking how often other services simply ignore mindset training because you just can’t win in the market consistently without the proper mental framework in place.

Unfortunately, almost all new traders have the wrong idea about where trading success comes from. They continuously search outside themselves for the answers, which typically leads them down the treacherous paths of “foolproof systems” and “hot stock alerts”.

But what they don’t realize is that the consistency and discipline they seek has to come from within themselves. It sounds lame, especially when compared to over-the-top promises of “explosive returns in 1 day!”, but success has to start within your own mind.

It’s mostly sad, but also a little bit comical how the typical beginning experience for a trader plays out. They get so excited about the money-making potential that the next thing you know they’ve subscribed to multiple sketchy penny stock newsletters hoping to make a quick fortune without putting in any effort. All they have to do to “make money” is buy the “hot pick of the month”.

Understand that I’m not putting anybody down because I fell for this route too. But now I’m here to caution you about the dangers of it. These services exist because it’s what people want (or at least it’s what they think they want at first) – the easy route; a shortcut. But it actually ends up being the harder, more expensive route.

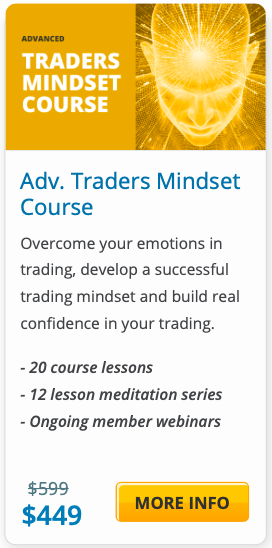

Overall, the Advanced Traders Mindset Course is the missing component in every trader’s path to consistent profitability. I honestly can’t believe how much of a bargain this course is compared to other programs I’ve paid 10X for (and they didn’t provide anywhere near the value of just this one course). Considering the impact it can have on your trading results, and life in general, it’s a no-brainer.

2ndSkies Trading Pros and Cons – Who Can Gain the Most From Using These Courses?

In my opinion, 2ndSkies Trading is designed for traders who are past the get-rich-quick phase of their trading journeys, and are finally committed to building their mental and tactical trading skills. If you want to be spoon-fed hot stock tips or alerts that you can then attempt to blindly (and dangerously) copy, then don’t use these courses. But if you’re serious about achieving consistent profitability and becoming a self-sufficient operator within the market, then these courses are for you.

| PROS | CONS |

|---|---|

|

|

I can’t stress this enough, but I’ve seen so many novice traders pay thousands of dollars for training that doesn’t even come close to matching the depth offered here at 2ndSkies. Actually, calling those expensive and ineffective programs “training” would be a stretch. I’ve personally spent thousands of dollars in the past on trading services that were nothing more than deceptive marketing gimmicks promising explosive returns. But, of course, they never came through on their lofty promises.

Not only have I, and many others, lost thousands of dollars on these ineffective course purchases, but many of us have then jumped into the market thinking we were prepared and then ended up losing even more due to improper guidance and mentorship.

Looking back, there was no depth to those courses. They were nothing but surface-level information and marketing hype. Please do me a favor and don’t fall for the “shiny objects” out there promising instant riches. You might think hot stock alerts and tips are what you want just like I did seven years ago, but getting pulled down that path will only lead to pain.

In the end, successful traders have to acquire the proper mindset, core skills, and ability to be entirely self-sufficient. These truths aren’t as captivating and enticing as the promises of overnight success and foolproof systems, but it’s the authentic reality.

*Special Bonuses* – 2 Free Courses Plus 15% Discount on Premium Courses:

There are four main courses at 2ndSkies: Trading Masterclass, Advanced Traders Mindset, Options Bootcamp, and Advanced Ichimoku.

Free Courses: Beginners Stock Trading Course & Beginners Options Trading Course

Most Popular Course: Trading Masterclass – Get 15% Off (Use Coupon Code TRADINGPARADIGMTTM15)

My Personal Recommendation: Advanced Traders Mindset – Get 15% Off (Use Coupon Code TRADINGPARADIGMATM15)

Additional Courses: Options Bootcamp – Get 15% Off (Use Coupon Code TRADINGPARADIGMOB15) & Advanced Ichimoku

Conclusion – You Won’t Be the Same Trader After Taking a 2ndSkies Course:

After taking a course at 2ndSkies, you’ll realize just how weak most other trading courses are (assuming you’ve had experiences with other ones in the past). Consistent trading success isn’t about being a copy-cat or follower. It’s about self-growth and development. It’s an evolution from being an impulsive, ineffective trader to becoming a disciplined, effective trader.

Nobody is naturally good at trading. Much of what you need to learn and implement will go against your current programming. Achieving consistent profitability in the market, and even reaching full-time trader status, truly comes down to changing the way you think, trade, and perform. Stop wasting your time trying to find consistency in some outside source – it comes from within you.

Once the fruitless searching and mindless complaining stops, you can finally make space for learning and developing the core trading skills and mindset that will actually move the needle in favor of consistent success. Blaming the market and other outside sources for trading woes is what losing traders do. The winners take complete accountability for their trading operations.

Random, impulsive, and irrational trading might lead to hitting big winners every now and then, but have those occasional winners made up for all of the losers? My guess is that they haven’t. Trading this way is an unnecessary emotional and financial roller coaster ride. Do yourself a favor and choose to approach trading the right way if you’re expecting to achieve consistent profitability.

Be laser-focused on building your skills and mindset, and don’t get distracted by the misleading get-rich-quick promises out there.

Check Out My Free Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Become a Consistently Profitable Trader – The Success Formula

- Top 25 Quotes From Trading in the Zone By Mark Douglas

- What is Day Trading Psychology? The Foundation of Day Trading Success

- Can People Make Money Day Trading? It Starts With Self-Awareness

- Trading Composure Review – Learn the Importance of Mindfulness in Trading

I really appreciate how thorough this review is because through my own limited experience with trading and investing it is very clear that this is not a joke and is based on legitimate skills. I would have one question and that would be why do you think so many people follow these get-rich-quick schemes when it is clear that there is no proven way to get rich quickly and easily? I also love how you laid out all of the pros and cons of this training because now I feel so much more informed on what this trading program offers.

Hi Nicholas – great question. I think so many people fall for get-rich-quick schemes because it’s just human nature to want the largest reward for the least amount of effort. So when self-proclaimed trading gurus go around telling people that they can make millions of dollars by simply joining their chat rooms or following their alerts – people want so badly to believe it.

The sad reality is that many people are in tight spots financially or at least want to improve aspects of their jobs/lives. Even individuals who might have what would be considered attractive careers and relatively high incomes can be attracted to get-rich-quick schemes. These lousy services tend to market themselves as “magic pills” that can take you out of your current situation – long hours, an overbearing boss, a lack of fulfillment, and the list goes on and on. And there’s not many people that wouldn’t want to ditch these things and be able to make thousands of dollars like clockwork with little to no effort.

But the truth is that trading doesn’t work like that. Consistent success is not fast or easy to achieve – and merely subscribing to a chat room or alert service won’t produce the results you’re looking for. If it were that easy, a lot more people would be trading for a living. It takes the development of legitimate skills in order to ultimately become a consistent, self-sufficient trader – which takes time, effort, and experience to achieve.

Unfortunately, the vast majority of people actually avoid the legitimate training process because it sounds hard even though it’s the only real path to trading success. Instead, they opt for the “easy way” of chat rooms, newsletters, and alerts – which are largely ineffective in producing consistently profitable traders.

In the end, I see fault on both ends – the get-rich-quick service providers as well as the subscribers. While I think many trading services go too far with their marketing (with false promises and outrageous claims), it’s exactly what most people respond to. In my experiences with many trading gurus, courses, programs, and services over the years, it’s clear that over 80% of subscribers aren’t interested in training even if the resources are available for them to do it. For example, the watch lists, video lessons, and reports that specifically cover “hot picks” or “stocks primed to explode” are always drastically more popular than the material on risk management and trading psychology, for example.

I even see this phenomenon play out over-and-over again with this website. As much as I preach about the critical importance of trading psychology and point out some amazing courses specifically focused on this topic, such as The Advanced Traders Mindset Course by Chris Capre, The Trading Psychology Mastery Course by Yvan Byeajee, and Compass 2.0 by Richard Friesen – people rarely utilize them. For whatever reasons, the vast majority of individuals would much rather subscribe to a service that promises to spoon-feed them trades to blindly follow. I wish this wasn’t the case, but the actions taken by the majority of people don’t lie. There are only a small handful of individuals willing to take trading seriously and treat it like the skill-based, peak-performance endeavor that it is.

It’s good to see that you have tried many of these trading courses and understand the journey. Like you, I’m horrified when new traders come into trading with no skills and expect to follow the “gurus” and just copy their trades and make money. I really enjoyed your story, it perfectly highlighted why you need to spend the time learning, growing, and adapting to this new environment (the market).

I appreciate you sharing your thoughts, Lily. You’re completely right – rarely do traders break down trading into individual skills and then actually train in order to develop and refine those skills. I certainly didn’t at the beginning of my own journey. Like most other beginners entering the market, I didn’t know any better. I was one of those people who tried to blindly mirror fast-paced day trades from gurus, but quickly learned how dangerous and ineffective it was. Luckily, now I know better. Because of this tendency to seek out shortcuts instead of legitimate training, it’s no wonder why so many traders fail. It takes hard work to become a self-sufficient, consistently profitable trader.

Thank you for your review of 2ndSkies Trading. One of the coolest things I have learnt is that we should not go chasing “hot” stuff. I have learnt this recently. And it’s particularly applicable to trading. If we follow every shiny course that comes out, we’ll end up paralyzed. But I have made up my mind to focus on one thing at a time. And in this case, it will be 2ndSkies Trading.

I agree with you, discipline and consistency are significant values that someone must have while trading. The 2ndskies trading program seems one of the best courses to learn how to succeed and become a good trader. Not many others actually focus on mindset. If someone loves trading, wants to learn, change his mindset, and profit consistently in trading, I think something like the advanced mindset course is what he needs.

Chris sounds like a very interesting person with some amazing ideas. I’m definitely going to look into more of your work and will definitely be bookmarking your site so that I can see more of your amazing content. Have you got any more posts about this topic? I’d be very interested.

Hi Alex – thanks for your feedback. Yes, I’ve published quite a bit of content covering the psychological aspect of trading. You can find those types of articles here. The top 2 right now for evolving into a more disciplined and consistent trader are:

1. Rewire Your Brain For Successful Trading With the Help of Neuroplasticity

2. How to For the Stock Market – 5 Steps to Consistent Profits

2ndSkies is a unique service because every stock trading program I’ve come across dedicates zero (or very minimal) resources to teaching the psychological aspect of trading – even though it’s the main reason most traders fail. It’s honestly nothing more than a quick blog post or short video talking about “controlling emotions” or “being disciplined” in most cases, but changing our behavior within the market is much more complicated than that.

I highly recommended The Advanced Traders Mindset Course at 2ndSkies. It’s easily one of the best trading courses I’ve ever gone through and should be required for all new or struggling traders to take – especially if they actually want to achieve consistent profitability and not just gamble their money away by trading randomly or for thrills. Take care!

Hi Matt. I am trying trading myself for a while (with different luck) but Im surprised every day how much things I still need to learn. I haven’t heard before about 2ndSkies training, but looking at this review it seems as a great place to improve trading skills (not only for newbies). Price is really reasonable. Looking forward to test them in practice.

Thanks for this review of 2ndSkies Trading. I won’t lie, with the market as bad as it is, I would have assumed that this was a scam, and would not have dealt with them, until reading your review. I was happy to see that it is not a get rich quick scheme, which is something that we see so often, and I was also happy to see that the price is pretty affordable.

Hi Jessie – I appreciate your comments, but I’m truthfully a little bit confused about how you labeled the market as “bad”. In short-term trading, you have to acquire the perspective that the market isn’t good or bad – it simply provides information. If you’re labeling it as “bad”, that’s simply your personal perception projected onto the market – not the objective truth. And if you’re talking about the market as “bad” for long-term investors, I don’t quite understand that either because it literally hit all-time highs today (assuming we’re talking about the US stock market).

Also, even if the market hits your definition of “bad”, that doesn’t automatically make all stock trading courses, programs, and services out there scams. There are certainly many sketchy get-rich-quick programs out there – no doubt about that, but the low-quality and deceptive nature of those services aren’t based on how the market behaves. It’s based on how those particular services operate with false marketing promises, front-running their own stock alerts, etc. I truly don’t mean any disrespect in my response, so please don’t take it that way, but I’m just confused by the “bad” reference in relation to the market.

When I’m ready to try trading again, I’ll definitely be back to check out the Advanced Traders Mindset course. I’m currently in the depths of negativity bias, having made money, lost money, made it all back again and then crashed and burnt again!

As you say, there are so many courses out there offering to show you that one secret trick or system to trading and the truth is, no such thing exists. I know only too well, that you need a systematic approach coupled with the right mindset. The former, I nailed, but it was undone completely by having the wrong mindset!

When the wounds have healed, I’ll be back.

Hi Matt – thanks for sharing your experiences! It certainly goes to show how important the proper mindset is in trading – it can compromise even the best systems. I’ve been there in the past, trading setups that should’ve theoretically worked, but I couldn’t control my impulses. I’d end up removing stops, adding to losing positions, revenge trading, etc. It wasn’t until I really started focusing on the psychological aspect of my trading that things started to turn around. I’m glad I didn’t ignore or resist adapting my mindset like most other traders do otherwise I’d probably still be caught up in ineffective, destructive cycles of thought and behavior within the market.

Isn’t it so true that people always want to get rich quick. And so many think they know better themselves and think they know what they are doing without learning the proper skills. In a way they act like they are at the bookies.

Like any job, career, or craft, you need to learn it and build the proper skill set.

Mindset is also crucial. But you also need a plan and a process and you need to stick to it, at all times.