The Importance of Proper Expectation-Setting When You Get Started Trading:

There’s no doubt that most traders get involved in the markets with the wrong expectations. They view trading as some sort of easy cash-grab or get-rich-quick opportunity – and essentially just use the markets as a platform to gamble (for thrills and excitement).

But if you actually want to achieve a consistent and sustainable level of trading success, then random and impulsive trading isn’t going to get you there. Sadly, however, most hopeful traders choose short-term emotional gratification over their long-term goals.

I completely understand how difficult it is to go into trading with the proper expectations because to some degree we all want fast, easy money. And since that’s what most advertisements for trading programs and services make it out to be – that’s what we believe.

But these marketing messages that make ridiculous profit proclamations and highlight dream lifestyle components are doing it in order to get your attention and sell you something. The hard work required isn’t quite as enticing as stacks of cash and fancy cars.

As a result, many hopeful traders get into the market based on false promises and misguided perceptions – and end up losing quite a bit of emotional and financial capital before realizing that what they’ve been told previously was all nonsense.

So use this as an opportunity to discover the truth about trading – that it will probably be the most difficult endeavor you ever pursue.

Right Off the Bat – Take Full Responsibility For Your Trading Process and Results:

The first thing that every trader should do, in my opinion, is take full responsibility for their results up to this point in time.

If you’re completely new to trading and don’t have any results yet – that’s great. This is the perfect time for you to internalize this concept and get on the right track right from the start. But if you’re not new to trading – it’s time to hold yourself accountable.

For those of you not new to trading – you know exactly how it goes. In the past, I’ve been guilty myself of blaming the talking heads on CNBC for giving me a bad trade idea or some online trading guru for sending me an alert, signal, or pick that didn’t work.

But the reality is that blaming anybody/anything else for your own individual decisions and results is nonsense. It’s just an excuse – a psychological defense mechanism to deflect blame. It’s simply easier to deal with poor results when it’s not your fault.

But deflecting responsibility just isn’t helpful. All it does is surrender your power to change. And if you don’t change, you’ll never become a self-sufficient, consistently profitable trader. Complete ownership is required for long-lasting success.

So stop making excuses, blaming external forces, or playing the victim if you want sustainable success. Hold yourself accountable.

Direct Your Focus and Efforts on What Matters Most – Process Over Profits:

Most new traders get involved with trading for the money. They see the slick advertisements and marketing messages from self-proclaimed gurus and so badly want the stacks of cash, fancy cars, expensive yachts, and overall lifestyle they’re portraying.

But their obsession over material wealth and the dream lifestyle distracts them from what really matters – the process. The actual work and perseverance required to be a great trader isn’t typically as exciting as dreaming about Rolexes, Lamborghinis, etc.

As a result, most people direct their focus almost exclusively on the wrong things – the potential results. But what they fail to recognize is that it’s their process that will generate their results – so they never achieve the results they so desperately want.

If you put garbage in (fake gurus, blindly mirroring alerts, get-rich-quick programs, etc.), then you get garbage out (inconsistency, emotional pain, financial losses, etc.). There’s no cheating cause and effect. Your outputs will derive from your inputs.

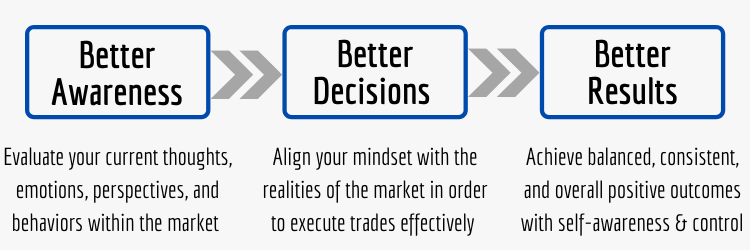

Instead of focusing on being spoon-fed hot picks or some other nonsense, traders should instead be focused on developing and refining their statistical edge and mindset/psychology. Everything related to these two main components is what I consider the process.

Things like mindfulness meditation, creating trade plans/hypos, executing trades within the confines of your rules/framework, journaling your thoughts and emotions, labeling and archiving your trades for analysis, and more – these are the things that matter.

Success is Not a Straight Line – Be Prepared For Mistakes, Losses, and Failures:

Unlike other ventures, trading success doesn’t take a clean, linear path. It might be nice to assume that you can make $200 per day, $500 per day, or $1,000+ per day like clockwork – but operating within the market environment comes with no guarantees.

Relying on trading profits isn’t the same as the typical job or career where you have a set hourly wage or salary – and you know exactly how much compensation to expect on a daily, weekly, monthly, and yearly basis. There will be losses and drawdowns along the way.

So if you try to force your wants and desires onto the market (especially on a short-term basis like intraday) – then you’re asking for trouble. Forcing trades with huge position sizes – hoping and wishing for a positive result – is a recipe for disaster.

Understand that there tends to be an inverse relationship between how much money you “need” and how much the market gives you. You’re putting yourself in a rough position if you think the market will conform to your cravings for money and certainty.

Ultimately, the key to success in the market is to embrace risk, loss, and uncertainty (with proper risk management and the execution of your edge with consistency and discipline) – and improve/refine your approach over time based on the lessons you learn.

Failure is not permanent unless you quit. Instead, why not use mistakes, losses, and failures as feedback for continuous growth?

Becoming a Consistently Profitable Trader is Probably Much Harder Than You Realize:

If you take nothing else away from this article except one thing, I would want it to be this: trading is a skill-based, peak-performance endeavor that requires proper education, training, and experience (much like that of a professional athlete).

#1 Training Program For Skill & Edge Development → PROFILE TRADING DEVELOPMENT PATHWAY

If you want to just dabble your way through it with a surface-level approach because it’s fun to talk about “bull markets” and “hot stocks” with your friends and family members at get-togethers – be my guest. But don’t expect to be profitable long-term.

Most people don’t treat trading like the skill-based, peak-performance endeavor that it is – and there are a couple main reasons for it. One is that there are virtually no barriers to entry. And two, there’s a high degree of randomness at play on a short-term basis.

If we contrast trading with football, for example, there are certain barriers to entry based on skill and experience for the NFL. You can’t just wake up one day, decide you want to play in the NFL, fill out some forms, and get started. It just doesn’t work like that.

Instead, almost all NFL players have been playing, building skills, and gaining experience since they were kids, continuing on through high school and college (where the training and competition become more intense) until eventually they make it to the NFL.

In trading, however, pretty much anybody (regardless of skill or experience) can easily open up a brokerage account, fund it with as much money as they want, and start “trading” almost immediately. As a result, most “traders” show up completely unprepared.

Top that off with a healthy serving of randomness – and the result is millions of people who can’t differentiate between luck and skill. There are plenty of traders who get lucky in the short-term, but trading success is almost entirely skill-based over the long-term.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Trading is a Skill – Knowledge Will Only Get You So Far

- Top 3 Reasons Why Traders Fail at Such a High Rate (~90%)

- 10 Biggest Mistakes That New Traders Make in the Markets

- Top 20 Trading Paradigm Tweets of 2021 – @MattThomasTP

- Top-Rated Training & Mentorship (Best Development Programs)

Trading is indeed an area that many people think is easy money but find it is harder than what they expect. I like the focus on a good mindset in your article as get this right and then you can make better decisions. What is your view on trading vs buy and hold strategies?

Hi Richard – great question.

I think there’s a place for both short-term trading and long-term investing – and it’s up to each individual person to decide which methods to take part in. Generally speaking, short-term trading (like day trading and swing trading) is more oriented toward technical analysis, requires close monitoring, and has the potential for much higher returns. Long-term investing (like value investing and buy-and-hold investing), on the other hand, is typically more oriented toward fundamental analysis, doesn’t require as much monitoring, but the potential percentage returns are lower in comparison. I personally take part in both short-term trading and long-term investing (and so do many others). But it really comes down to each individual trader/investor’s personality, cognitive strengths/weaknesses, risk tolerance, and overall preferences. Some people, for example, are slow thinkers and like to perform deep research before making decisions – this type of person might lean more toward longer-term investing. Others, however, might be fast thinkers who prefer making quick decisions – this type of person might lean more toward short-term trading. These are very basic examples, but the point is that people should try to match a trading/investing style to what suits their own unique personalities/strengths/preferences.

Many people have a negative view of short-term trading as opposed to long-term investing – or assume it’s more “risky” (which I don’t necessarily think is true). There is of course risk involved with both (without risk there would be no reward) – but the main task of any trader/investor is to manage their risk. That’s essentially what it all boils down to. The point of having rules and the proper mindset/psychology is to manage risk. Unfortunately, many people don’t do this correctly and their trading/investing operations turn more into compulsive gambling than taking smart, calculated “bets” with positive expectancy. There’s no way to completely avoid losses – that’s not what the focus should be. Instead, the focus should bo on probabilities and the magnitude of wins/losses. People often get fooled by short-term trading because it’s a faster in-and-out approach, but even though the average hold times are shorter – the overall approach stills requires a long-term, probabilistic outlook. In other words, even though day trading is short-term in nature – you can’t get wrapped up in short-term results (you need to let the probabilities/law of large numbers work).

This is a long answer already and there’s probably a lot more that I can say on the topic of trading vs. investing, but I’ll wrap up by saying this: many people get into short-term trading with improper expectations (get-rick-quick dreams) because theoretically you can take a small account (say $5,000) and grow it into hundreds of thousands relatively quickly – and some people have indeed done this. It’s not unreasonable for a great trader to grow their account 50-100%+ per year. The alternative is to use that $5,000 for longer-term investments – which will maybe return 10-20% per year on average. If you have $1,000,000 to invest, 10-20% per year is great and can produce a nice full-time income. But most individuals looking into trading aren’t in that position. So 10-20% on a $5,000 account doesn’t typically seem all that exciting. So with this being the case, prospective traders with small accounts often opt for short-term trading with dreams of wild success. But the problem is that they’re so obsessed with short-term returns/results that they overlook the proper process. They don’t really understand what it takes to be a great trader, and as a result – many fail.

In the end, I don’t necessarily think one form of trading/investing is better than another, but all should be pursued with proper expectations. The market environment is a unique environment that most people simply aren’t prepared to effectively operate in (especially from a psychological level).