Why is Day Trading So Hard and What Can You Do to Be Successful at it?

If you’re asking yourself why day trading is so hard, it’s actually a really good sign – believe it or not – because it means that you’re past the point of thinking that it’s an easy cash-grab. So you’re in a position to actually overcome the hurdles to success.

Far too many new traders dive into the markets under the assumption that day trading is easy – and it rarely, if ever, ends well for these individuals. Some of them might get lucky in the beginning, but eventually it all comes tumbling back down.

The thing about trading is that the barriers to entry are virtually nonexistent, so pretty much anybody can get involved. And then on top of that there’s a lack of physical demands – all that’s required to place a live trade in the market is the click of a button.

As a result, many people show up unprepared. But just because it’s easy to get involved and place trades doesn’t mean it’s easy to pull consistent profits out of the market. Merely trading and being a consistently profitable trader are two entirely different things.

What people don’t tend to realize or seem to ignore is that day trading is a skill-based, peak-performance endeavor. Many treat it like gambling, but those are the people that fail. Alternatively, the ones who succeed put in tons of hours developing legitimate skills.

2 Main Reasons Why Day Trading is So Hard – See What’s Stopping You From Succeeding:

It personally took years for me to go from an impulsive copy-cat trader, to a semi-competent breakeven trader, to a self-sufficient consistently profitable trader. So I’ve already been through the struggles that most new traders are currently going through.

In my experience, these are the two main reasons why becoming a successful day trader is so difficult to accomplish:

1. The Psychological Component is Often Ignored or Not Taken Seriously

There’s no doubt in my mind that the psychological component is the difference between durable trading success and failure.

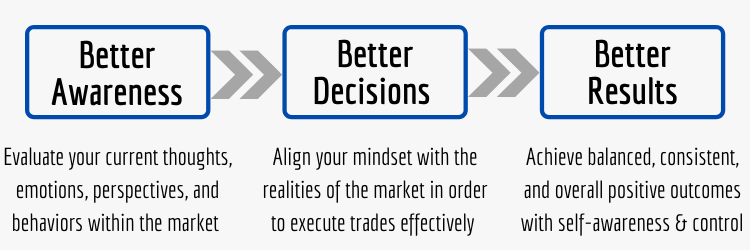

Those who achieve consistent success in the markets are individuals who have learned to adapt to true market characteristics. They’ve put in the work to deeply understand themselves, the markets, and how to create harmony between the two.

The reality is that nobody is naturally good at trading. We all have survival mechanisms and biases that simply don’t serve us well while operating within the markets. So in order to operate effectively, we have to adopt new attitudes, beliefs, and perspectives.

Our distaste for losses, aversion to risk, and craving for certainty needs to be replaced with a balanced, probabilistic mindset. Putting in the work to acquire this type of mindset, however, isn’t as exciting as learning setups, strategies, and systems.

The truth is that learning various setups, strategies, and systems isn’t all that difficult – almost anybody can do it. But this information/knowledge alone won’t produce success. Even the best systems can be compromised by an improper mindset.

2. There’s an Abundance of Misleading Information Online About Trading

The other reason why day trading seems so hard when you actually go to try it is because the vast majority of trading gurus pump the masses with false promises and unrealistic expectations. But it’s only because they’re trying to sell something.

Most people aren’t interested in pursuing something that sounds hard. So instead of being honest about the realities of trading, many advertisements for trading courses, programs, and services are filled with outright lies about how quick and easy it is.

Even if there are no lies or profit promises, they often focus heavily on the potential rewards – the money, cars, mansions, and overall lifestyle that can be achieved. But none of that is possible without an incredible amount of time and effort.

The sad reality is that most people don’t want to actually put in the work to become a self-sufficient trader. Instead, they prefer shortcuts. And there’s no shortage of self-proclaimed gurus willing to sell you these shortcuts (alert services, chat rooms, etc.).

But the bottom line is that most trading gurus are only selling dreams. It’s certainly possible to achieve financial freedom through trading, but it’s not passive or an immediate replacement for your nine to five job – especially in the beginning. It takes hard work.

Trading Only Becomes “Easy” After Years of Hard Work, Perseverance, and Training:

As much as some self-proclaimed trading gurus might want to sell you their products and services, becoming a consistently profitable trader simply isn’t easy. The potential rewards can be great – don’t get me wrong, but don’t overlook the work involved.

There’s no magical indicator or setup that works every time, so don’t get caught up in holy grail seeking. What produces long-term success in the markets are legitimate technical and mental skills – and that takes individual training and experience to acquire.

No newsletter, alert service, or chat room can automatically feed you these abilities. These offerings might sound nice because they make it seem like you can capture massive profits with limited to no effort, but they’re largely ineffective for subscribers.

In the end, what effective day trading ultimately comes down to is: 1) having a statistical edge, and 2) being able to consistently execute on that edge (which requires technical and mental skills). It sounds simple, but it’s much easier said than done.

Anybody can win on a single trade out of sheer luck, but only a small percentage are able to capture steady, consistent profits.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Best Trading Sites – Beginners Guide to Active Trading

- What is a Day Trading Course – Tips For Finding a Good One

- What is a Trading Simulator – Before You Risk Real Money

- Stock Market Terminology Definitions – Best Free Resources

- Best Day Trading Mentorship – Top 2 Day Trading Mentors

I have been trading stocks for several years, however, I have never really got into the day trading aspect. Even after reading the article, I believe the best method for most people is to select good companies and buy and hold for a long time. That being said, If you are up for a little adventure and your willing to put in the time, the information here could get you a good start in using a small portion of your portfolio for day trading.

Hi Mike – I appreciate the comments.

I definitely agree that day trading isn’t for everybody – there’s a big difference between day trading and buy-and-hold investing. Long-term investing is something that everybody should probably be doing, whether it be stocks, bonds, real estate, or some mix of these and many other assets. But day trading is a completely different story that requires more hard work and perseverance than most people realize. It’s easy to dollar-cost average into an index fund that tracks the entire market and have a high degree of confidence that your investment will increase in value over the span of ten or more years based on historical data – it’s nearly guaranteed. But the average annual return will be about 5-10% – which isn’t bad for a fairly passive approach. Day trading, however, isn’t passive at all. It requires a much larger time commitment and the acquisition of specific skills. The plus side is that the returns can be much larger if approached correctly (50-100%+ per year is possible).