Is Day Trading the Same as Gambling – What Are the Similarities and Differences?

“Is day trading gambling?” is a popular question. But it’s not one that can be answered appropriately with a simple yes or no answer.

Gambling – by the general definition – is the activity of playing a game of chance for money or other stakes – a definition that certainly fits trading as well. But there’s often a negative connotation of recklessness associated with gambling, which isn’t necessarily true.

I would agree that the majority of people who choose to gamble do so out of impulse (an emotional desire for thrills and excitement) – and financial markets are incredibly easy-to-access platforms available to virtually anyone looking to feed their impulses.

But there’s a massive difference between “good” (player advantage) gambling/trading and “bad” (impulsive, irrational, and reckless) gambling/trading. Bad gambling/trading is all too common, but good gambling/trading is extremely rare.

So simply saying that “trading is gambling” based on the general definition of gambling kind of misses the point – in my opinion – because that sort of generic answer would probably make you assume that trading is entirely luck-based (which it is not).

Instead of: “Is trading gambling?” – I think the more meaningful question is: “What’s the difference between good and bad trading?”

3 Main Ways That a “Good” Gambler or Trader Differentiates Themselves From the Pack:

To better understand the distinction between good and bad trading, here are 3 major ways that good traders set themselves apart:

1. POSITIVE EXPECTED VALUE

Having a strategy or system with positive expected value means that the gambler/trader has good reason to believe that their methodology will be profitable over the long-term (based on trade data/statistics, journaling, backtesting, etc.).

There’s a specific formula that can be used in order to calculate expectancy, which includes win rate (%), loss rate (%), average win ($), and average loss ($). In essence, this calculation tells you in objective terms whether or not you have a legitimate edge.

Day trading often tricks people into thinking it’s all about immediate, short-term rewards. But even though it’s a short-term approach, it still requires a long-term outlook. Good trading puts the odds in your favor – bad trading does not.

2. PROPER RISK & MONEY MANAGEMENT

In addition to a system with positive expected value, good traders implement proper risk and money management tactics so that no single trade or losing streak leads to ruin. Long-term survival is far more important than any short-term gains.

This is why most successful traders put no more than 1-2% of their entire account value into individual trades. It’s not about the result of any single trade, it’s about the results over hundreds and thousands of trades (with consideration to the law of large numbers).

Comparatively, it’s common to see people put 20-100% into individual trades – which is an eventual recipe for disaster. No matter how smart you think you are or how much conviction you have – there’s always the possibility that you can be wrong.

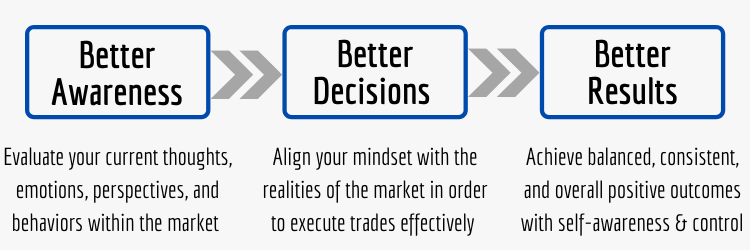

3. STRONG MINDSET/PSYCHOLOGY

An effective mental framework is the glue that brings everything together. It’s what allows you to think from a probabilistic perspective and execute on your edge (the criteria/triggers/rules that make up your system/methodology) with consistency and discipline.

In my personal opinion, this is the main reason why the vast majority of traders end up quitting/failing (over 90%). Typically, new traders are so caught up in trying to find holy-grail systems that they completely overlook their own attitudes and beliefs.

No matter who you are – long-term, sustainable trading success requires a paradigm shift. Instead of rejecting loss, risk, and uncertainty, you have to embrace them (with structure and discipline, of course) if you want the potential rewards they can provide.

Conclusion – Good Traders Are Process-Focused and Play the Long-Term Game:

Overall, all traders are gamblers in the sense that they’re playing a game of probabilities for money. But not all traders are compulsive gamblers addicted to the action – looking for quick dopamine hits. That’s just not how good traders operate.

#1 Training Program For Skill & Edge Development → THE PROFILE TRADING DEVELOPMENT PATHWAY

Instead, good traders sacrifice short-term emotional gratification for long-term profitability. Getting stopped out of a trade might not feel good in-the-moment, but it protects against large losses. They’re process-focused rather than results-focused.

I fully understand why these gambling misconceptions exist – because most market participants treat trading like an opportunity to impulsively gamble. But again, that’s simply not what good traders do – they have a completely different approach.

The tricky part to grasp is that any random person (regardless of skill and experience level) can win big on any single trade or short series of trades out of sheer luck/variance (sometimes making them think they have some sort of special gift/talent).

But without a statistical edge, proper risk & money management, and strong mindset/psychology – luck eventually runs out.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- How to Get Started Trading With the Right Expectations

- Trading is a Skill – Knowledge Will Only Get You So Far

- Become a Consistently Profitable Trader – The Success Formula

- Values and Principles to Live By as a Trader – What’s Your Mission?

- Why is Day Trading So Hard – The Realities of Day Trading

It sounds like day trading takes some practice and a good strategy. For someone just starting out how much money would you recommend they have to invest before starting? Any investment can be risky. But I feel like a good plan is to have money saved up to practice with so I don’t have to worry about a loss.

Hi Kim – good day trading should definitely include proper education, practice, and training, as well as the implementation of a solid strategy, system, or methodology with positive expected value. But most market participants simply don’t treat it this way – they essentially just use markets to express themselves in all sorts of impulsive and irrational ways. But this discrepancy between good and bad gambling/trading is extremely important to understand. Take a casino, for example: they can certainly lose on a bunch of rolls, spins, or hands to some “lucky” gamblers/patrons in the short-term, but the casino wins in the long-term because every game puts the odds in their favor (positive expected value). As the saying goes – “the house always wins”. When considering getting into trading, people need to think more like the casino.

To answer your question, I don’t think absolute beginners need to put any of their own money at risk in the markets until they’ve set proper expectations and understood the realities of active trading. One of the biggest mistakes new traders make is jumping straight into the markets unprepared with real money – thinking that they’re missing out on opportunities. But all they’re really missing out on is emotional and financial pain because they have no clue what they’re doing. There are plenty of resources to learn the basics and even start experiencing live markets (through demo trading) for free or relatively low cost. In my personal opinion – if people approach active trading the right way – the biggest expense should be proper education, training, coaching, and mentorship. And after that (assuming you acquire the right skills and develop a solid methodology), you don’t even necessarily need your own capital to trade with thanks to the many funded trader programs that exist these days. So from a financial perspective, trading doesn’t necessarily have to be this gigantic risk that most people make it out to be. The biggest expense will be your time and effort building skills, gaining experience, and constantly adapting to the ever-changing market environment.

A very interesting discussion to get to the bottom of whether or not day trading should be considered gambling. It’s a bit of a loaded question because since you could lose your investment, it could definitely be called risky and labeled as a gamble. However, most purchases have some sort of inherent risk and aren’t 100% safe, yet we wouldn’t normally label them as gambling (e.g. reasonable house purchases for living in). For me, day trading would feel like a gamble, but others may have found a system to mitigate their risks.

Hi Aly – I appreciate your comment.

You make some great points. There’s risk involved with every decision and action we take in life, but we don’t really stop and think that they’re a “gamble” – at least not the same sort of way as playing a slot machine or roulette at a casino, for example. But the risks we take don’t even have to be casino games or purchases (like vehicles, real estate, etc.) – they can simply be a decision to drive somewhere (taking the risk of getting into a car accident) or choosing one job over another (opportunity cost) or even doing nothing at all is a risk (no new experiences or enjoyment). So from this “risk” point of view – everything is a gamble. The risk-reward concept doesn’t just apply to trading – it applies to everything in life. Risk and reward go hand in hand.

When it comes down to it (in both trading and life) – in my opinion – it’s about taking “good” bets (ones with positive expectancy), not allowing any one bet or losing streak lead to ruin (with proper risk management), and having the right mental framework to capitalize on good opportunities with consistency and discipline (strong mindset/psychology). Due to randomness/variance, there will certainly be times when people take “bad” bets and they pay off, as well as people who take “good” bets and they don’t (in the short-term) – but over the long-term the numbers work themselves out. In general, we aren’t great at thinking in probabilities because we crave certainty and control. But the truth is that we’re constantly dealing with uncertainty, so understanding how to deal with it properly would probably go a long way for a lot of people.