Losses and Mistakes Are Just Learning Opportunities For Growth and Development:

As a new trader, you are going to lose often, be wrong a lot, and make numerous mistakes. That’s just how it goes. But if you cultivate the right perspective on these losses, weaknesses, and mistakes – then these “negatives” can be turned into “positives”.

You have one of two choices. Your losses, shortcomings, and missteps can be used as excuses to give up and quit. Or they can be used as learning experiences for change, adaptation, and growth – stepping stones on the path toward achieving your ultimate goal.

The market won’t just comply with all of your dreams and desires. You will inevitably come up against resistance over-and-over again. But this struggle exposes your passion and commitment. And if you stick with it, trading forces you to become your very best.

Pain serves a purpose. It exists for a reason. Not to freeze you in fear, but force you to take constructive action. When you face emotional pain head on without trying to distort or escape it, it can teach you everything about yourself and what needs adjusting.

No event (like a losing trade, for example) is objectively bad. If you view it negatively, then that’s what your reality will be (and it won’t serve you very well). But it can also be viewed as a good opportunity to improve yourself or your strategy/system/methodology.

Losses, mistakes, and failures are just data points that help lead you toward success. Welcome the guidance that they provide.

Losing is a Routine Event For All Traders – Even Experienced Market Veterans:

If you don’t know how to handle losses constructively, then becoming a successful trader is virtually impossible. Every trader in existence – from beginner to veteran – has losing trades. There’s no such thing as perfection here (always being right/winning).

This can be hard for “high-achievers” and “perfectionists” to adjust to without getting frustrated and discouraged. Treating a loss as an ordinary/routine event doesn’t feel right. They’re so used to winning all the time that they don’t typically handle losing well.

I’m not saying that being competitive and constantly pushing toward perfection is a bad thing – because it’s not. But that energy has to be channeled appropriately. You can’t go into trading thinking it’s some sort of school exam where a 100% grade is possible.

Trading runs contrary to the classic academic system that most people are used to. We’re conditioned to think that being right 90-100% of the time is what we need to shoot for in order to earn an “A”. But taking this mentality into the market is often detrimental.

It’s not about being right 90-100% of the time. In most cases, that’s completely unrealistic. It’s about having a strategy/system with positive expectancy and executing on it with consistency. You can be wrong over 50% of the time and still make money.

This isn’t an invitation to be passive and accept being a net loser – that’s not what I mean. The message here is that losses aren’t entirely avoidable. So you have to be willing to fail (drawdown) in order to eventually prevail (make new equity highs).

Conclusion – Long-Lasting, Sustainable Trading Success Relies on Being Able to Fail Well:

If I were to ask you what your first impression of a trading loss was – good or bad (especially before reading this article) – I bet your answer would be “bad”. But we have to be careful about our in-the-moment perceptions on positive/negative experiences.

An experience that would typically be deemed “positive” – like winning on 5 trades in a row – can potentially lead to overconfidence, mismanagement of risk, and as a result, future losses that wipe out the gains generated on those 5 trades and more.

Just like an experience that would typically be deemed “negative” – like losing on 5 trades in a row – can lead to self-introspection and trade analysis that can help improve your mindset and methodology – and make you a stronger, more profitable trader in the future.

We tend to put too much weight into what we perceive as good/bad and positive/negative in the current moment, instead of how it might impact us in the future. But bad/negative events can actually be good/positive if we focus on the lessons that they provide.

In the end, trading isn’t about perfection (and neither is life for that matter). It’s about making mistakes, learning from them, and course-correcting as you go. If you’re not making mistakes, then you’re probably not pursuing something worthwhile.

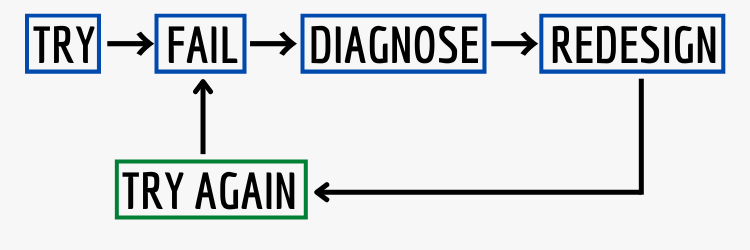

The process is simple: Try → Fail → Diagnose → Redesign → Try Again → Fail → Diagnose → Redesign (over-and-over again).

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- 10 Biggest Mistakes That New Traders Make in the Markets

- Become a Consistently Profitable Trader – The Success Formula

- The Market is a Mirror – Your Experience is a Reflection of You

- Transform Yourself Into the Trader You Want to Be in 3 Steps

- Have You Failed at Trading? You’re Actually One Step Closer to Success

These are some great points because so many people look at failure and loss as just that….failure and loss. Instead, looking at each failure as a stepping stone to success and gain is the best approach. I’m so glad that you pointed out that losses even happen to people with a lot of experience. That is a shot of realism right there, which means perfection is never possible in either trading or anything else for that matter.

Hi Lynn – I really appreciate your comment!

Trading is an endeavor that involves quite a bit of loss – it’s unavoidable. In fact, many of the best traders don’t even have win rates over 50% (the 30-40% range is completely normal). But a lot of money/profits can still be made over time with asymmetric risk-reward. It’s really quite ironic how most people who enter the markets want to avoid losses so badly, but by doing so – they actually tend to attract even more losses (for example: removing stop losses and adding to losing trades often leads to even larger losses).

Overall, trading is a game that requires rules, plans, and structure so that you can win long-term despite losses. Unfortunately, however, most people can’t handle the short-term uncertainty and loss involved – and it leads to all sorts of impulsive, erratic, and negative behavior. This is why shifting perspective on losses, mistakes, and failure is so important. You can either let these things spiral into something much larger and destructive, or use them constructively for growth and development (to improve your mindset/psychology or trading strategy/system).