Why is Day Trading So Stressful? Because Your Approach is Overloaded With Fear:

The simple answer to why day trading is so stressful is that there’s something about the activity that you fear. And when I say “something” – I actually mean many things. Because in reality, you probably have an abundance of fears. Rarely is it ever just one.

The most common fear amongst traders is the fear of losing money – that’s a pretty obvious one. But there are many additional fears that often come into play as well: the fear of being wrong, looking stupid, missing out, non-linear growth, competition, etc.

Right now – consciously – you might not recognize the impact that these fears are having on your trades. But deep down – on a subconscious level – these fears are dictating your thoughts, feelings, and ultimately your behaviors within the markets.

Our individual fears can be deep-rooted and extremely complicated. Believe it or not, for example, some people will actually sabotage their own trading results because of their beliefs about money (“all rich people are bad”, “money is the root of all evil”, etc).

The bottom line is that markets will undoubtedly expose your beliefs about money, risk, loss, randomness, and uncertainty. And if you fail to adapt your attitudes, beliefs, and perspectives in order to better align with markets, then the stress will never go away.

The good news is that it’s possible to change and make day trading a lot less stressful. But the bad news is that it’s far from easy.

Eliminate Stress and Anxiety From Day Trading With These 3 Core Components:

From a high-level viewpoint, there are 3 main components of a strong trading process – that if understood and properly implemented – can drastically reduce the stress and anxiety that you’re feeling in the markets. So let’s dive right into each of them.

1. Mathematical Edge

Trading is a game of probabilities. So you have to have a strategy, system, or overall methodology that exhibits positive expected value. If you don’t put the odds in your favor on a consistent basis, then you simply won’t achieve long-term, sustainable success.

Most market participants act like a typical gambler/casino patron – in constant search of thrills and excitement. But the key to success is actually acting more like the casino itself – setting rules, limits, and payout structures that guarantee long-term profits.

The casino doesn’t win on every hand of cards, spin of the roulette wheel, or pull of the slot machine handle – but they have a small edge on every single event. So over a large sample size, they make money. It’s like the saying goes: “the house always wins”.

Casino owners simply aren’t concerned about patrons who hit lucky winning streaks because they know the numbers will work themselves out in the long-run. All they care about is keeping the players playing in order to capitalize on their mathematical edge.

2. Risk/Money Management

In my mind, I typically group risk/money management into the mathematical edge component that we just discussed. But for the sake of this particular article that covers the topic of reducing stress in trading, I definitely think it deserves its own discussion.

Nothing in the market is absolutely certain – there are no 100% probabilities. So if you go all-in and risk your entire account on one individual trade – even if you think the probability of winning is 99.99% – you still run the risk of blowing up your account.

The bottom line is that anything can happen on any single trade. It’s impossible to know the motives and actions of every single market participant and potential market participant in advance. You’re essentially playing a game of incomplete information.

Because of this uncertainty, randomness, and inability to calculate exact probabilities in the markets – you need proper risk/money management protocols in place to protect your emotional and financial capital from adverse circumstances.

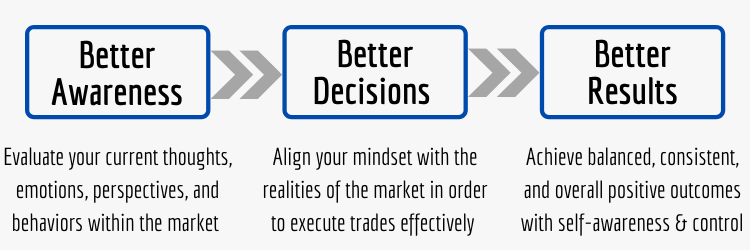

3. Mindset/Psychology

Your mathematical edge, risk/money management, and mindset/psychology all need to be woven together into a cohesive, effective whole – and in my opinion – the mindset/psychology component is the glue that brings everything together.

There are a lot of arguments over which aspect of trading is most important, but my personal perspective is that it has to be mindset/psychology because it trickles into every other phase. There’s no avoiding it – even with automated strategies/systems.

For example, creating and executing on a mathematical edge requires probabilistic thinking. So the whole idea of putting the odds in your favor and embracing short-term losses/drawdowns for long-term gains requires the right mindset/psychology.

And on top of that, risk doesn’t get managed properly if you’re not in the proper head space. If you’re tired, frustrated, or feeling impulsive – you’re more apt to remove stop losses, add to losing positions, and otherwise make poor, emotionally-charged decisions.

Conclusion – Day Trading Doesn’t Have to Be All That Stressful Unless You Want it to Be:

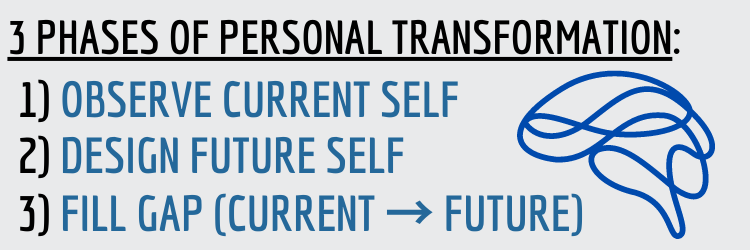

As a beginner, day trading is definitely stressful. There are so many different markets, instruments, and timeframes to potentially trade that it can seem overwhelming. And the learning/training process is probably longer and harder than you initially realized.

But once you pinpoint a methodology with edge that fits your personality and preferences, employ proper risk management, and have the right mental framework to follow your rules with limited to no internal struggle – it doesn’t have to be all that stressful.

With money on the line, however, these three core components often get overshadowed by short-term emotional desires. Right now you might distrust your methodology, feel uncomfortable taking losses, and lack confidence in your ability to follow rules.

But this is where the hard work is in becoming a consistently profitable, elite-level trader. Almost by definition, you can’t be a successful trader by being average. And nobody is a natural-born trader – new attitudes, beliefs, and perspectives have to be wired in.

Trading is just like Ed Seykota says: “Win or lose, everybody gets what they want out of the market. Some people seem to like to lose, so they win by losing money”. Ultimately, it’s up to you to decide what it is that you want out of trading and act accordingly.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Day Trading vs. Gambling – Is Day Trading Gambling?

- Trading is a Skill – Knowledge Will Only Get You So Far

- What is a Trading Mindset Journal – Why You Truly Need One

- The Market is a Mirror – Your Experience is a Reflection of You

- Why is Day Trading So Hard – The Realities of Day Trading

I loved this article. I don’t recall ever seeing something as concise and accurate. Yet because people are accustomed to seeing loads of nonsense on trading and investing, I suspect not everyone will be able to appreciate what you have done here.

I have been trading for decades, and each of these 3 main points you make I have learned in the school of hard knocks. It really takes some serious soul searching and discipline to routinely get in the proper space mentally and emotionally.

I have a friend who keeps falling prey to one of the fears you mentioned, FOMO (fear of missing out). Do you have any practical advice that I could pass along dealing with overcoming FOMO specifically?

Hi George – thanks for sharing your thoughts!

To answer your question about the fear of missing out (FOMO), I think it can be best overcome by fully understanding and accepting the expected value formula. The statement that he “keeps falling prey” to FOMO trades seems to indicate that his approach isn’t working and he’s consistently losing money – which is to be expected because trading randomly and impulsively very often doesn’t put the odds in your favor. He might get lucky on some of them, but it’s not a winning long-term strategy.

What I think can help the most (and this could help traders with issues of all kinds – not just FOMO) is adopting a longer-term outlook. People often put far too much emphasis on their in-the-moment desires and short-term results – which leads to all kinds of impulsive and irrational behaviors. But one individual trade or even a small sample size of trades is virtually meaningless in the long-run. Anybody can get lucky in the short-term by mere chance, but long-term trading success is the result of having edge, skills, and experience. Just because day trading is short-term in nature, it still requires long-term, probabilistic thinking.

In the end, deeply internalizing the concept of expected value can hopefully help your friend understand that FOMO trades are the result of him sacrificing his long-term success for short-term emotional gratification – and continuously doing so is only costing him in the long-run.