These Concepts Drive Your Thoughts and Behaviors Within the Market:

Most people fear the market, but if we understand and embrace the following principles, then our fears will dissipate. What makes the market seem so scary is the uncertainty of it. As outsiders or even as beginners, everything can seem so random and chaotic, but with knowledge and experience comes clarity and pattern recognition. From the patterns, we can start thinking in probabilities in order to find ourselves an edge. And once we have an edge to capitalize on, it’s our mindset that determines whether or not we execute on that edge. Without a deep understanding of these principles, we lack the framework required to think and behave effectively within the market. Close to zero traders naturally come into the market with the proper perspectives and principles, but the successful ones end up adopting a completely new paradigm because they know how critical it is to do so.

Far too many people enter the market for thrill and excitement even if it correlates with poor results, but that’s not what good trading is all about. That’s just a gambling addiction and no long-lasting success will ever be attained in the market if we can’t consistently act in our own best interest. There’s no cheating cause and effect, yet most traders act as if this doesn’t apply to them. They act irrational and impulsive, and still expect consistent, positive results. But those actions simply won’t lead to those results. What we need is a complete overhaul of our thoughts and perspectives, which is 100% possible thanks to neuroplasticity. Our brains actually have the ability to physically change by making new neural pathways and connections when we learn something new, choose to think differently, or act a certain way. We just have to be willing to put the work in. By aligning the realities of the market with our perspectives and behaviors, it then becomes possible to generate long-term, consistent trading success.

The 4 Main Trading Principles:

1) Anything Can Happen on Any Given Trade

There are plenty of people out there willing to share their opinions and predictions about the market, including those who we may consider to be experts, but the reality is that anything can happen on any given trade. As much as we may trust somebody else’s predictions or even our own gut instinct, there’s never a guarantee on what will happen next. There are simply too many unknown variables for any trader to know for certain that they will be on the right side of an individual trade.

Just think about all the potentialities of any particular market. There are thousands, if not millions of people within them, all with varying sums of money. Any of which can add to or close their positions at any time. Then there are the thousands or millions of people on the sidelines who may or may not enter the market whenever they choose. Knowing when all of those people with current positions will add to, reduce, or completely close their positions, as well as when those people on the sidelines will enter and exit, and how large any of their positions will be, is simply impossible to know. So the point of this principle is that losses are an unavoidable aspect of trading, making the management of downside risk an essential component to our overall success.

2) You Don’t Need to Know What Will Happen Next in Order to Make Money

This may seem paradoxical, but even though anything can happen on any given trade, we don’t need to know what will happen next in order to consistently make money. The easiest way to understand this is by thinking about a coin flip. There’s no possible way to know for sure on any individual toss whether the coin will land on heads or tails. But over a large sequence of flips, like one thousand, we know that 500 will be heads and 500 will be tails (or extremely close to it). But that doesn’t mean long streaks of just heads or long streaks of just tails can’t happen within the sequence because that’s certainly a possibility. But the probabilities always work themselves out if given enough opportunities, which is why all consistently profitable traders are interested in systems with positive expectancy.

When we boil down the markets to their purest form, it’s simply human behavior, and human behavior generates patterns that tend to repeat over time. Thanks to these patterns, we are presented with trading opportunities based on certain setups, market conditions, or some form of trigger that can potentially put the odds in our favor. What the best traders do is treat their operations like a never-ending science experiment, essentially collecting “data points” or information along the way, usually in some sort of trading journal or spreadsheet. Based off that data, they are able to find and refine their systems. Unfortunately, most people go through their trading journey repeating the same mistakes over-and-over again expecting a different outcome (isn’t that the definition of insanity?). But if we can understand what we can and can’t control, and that we don’t need to be able to control everything in order to consistently make money, there’s freedom in that knowledge.

3) Focus on Following Your System With the Highest Possible Degree of Discipline

A trading system is made up of rules for when to enter and exit a position, and we need those rules to help guide our behavior in the limitless world of the market. Why do we need to have rules, you ask? Because the market will not behave according to our own personal needs and desires. So we need to put that internal structure into place for our own protection. Inconsistent trading leads to inconsistent results, but with our rules we can become consistent traders that generate consistent results. Most people blame the market for their results, but it’s their behavior that led to those results. We can’t control what the market does, but we need to take complete control and accountability over how we react to it.

If we’ve taken the time to validate that our system has a positive expectancy, then as long as we follow our system with the highest degree of discipline, we should make money over a long series of trades. Trading doesn’t need to be any more complicated than that. It’s really that simple. But the problem we tend to run into is with our minds. Our thoughts hijack us with fear and anxiety in these periods of high stress with money on the line, and then we start behaving in irrational and erratic ways that are incompatible with our rules. Proper mindset is what determines whether or not we trade our system the way it’s supposed to be traded. If we don’t train ourselves on how to think, then our behaviors will never be in line with our rules. Our untrained minds want instant gratification, but we have to have the ability to delay gratification and focus on our long-term goals, and that means following our rules instead of surrendering to our in-the-moment convictions.

4) Drop Your Expectations and Concentrate on the Current Moment

One of the biggest problems with beginner traders is that they have unrealistic expectations, and it’s hard to blame them with all of the get-rich-quick nonsense circulating the internet these days. But one of the best things a trader can do is completely drop their expectations and allow themselves to fully focus on the adherence to their system without distraction or resistance. It’s all about the process over the outcome. Traders unnecessarily worry themselves over the returns, but assuming we have a positive expectancy system, the returns will take care of themselves as long as proper discipline is implemented. If we can execute our system without error, then we can have the confidence that we’ll be profitable in the long run.

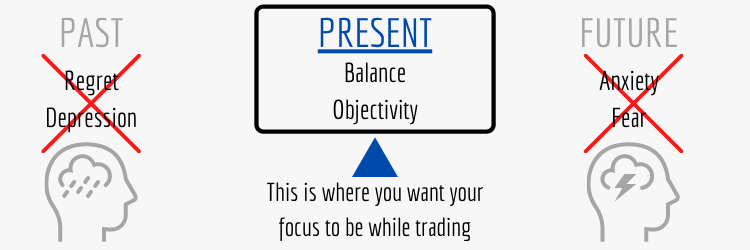

Generally speaking, attachment to outcomes tends to bring suffering. When we look to the past, we become depressed, and when we look to the future, we become anxious. But we don’t naturally seem to spend much time in the present moment. We’re physically there, but our thoughts are elsewhere. We get distracted by thoughts of past losses, future profits, or fear of missing out, among many other things. But actually being able to concentrate on the present moment can bring a sense of clarity to our trading that can keep it controlled and consistent. So it begs the question: what can be done to improve our mental clarity and concentration, and detach from our unhelpful thoughts and emotions? Some practical options for achieving these improvements range from simple yet often overlooked things like sleep, nutrition, and staying hydrated, to physical habits like yoga, breathing exercises, and strength training, all the way to mental practices like visualization, prayer and meditation.

Traders Should Be Flat Out Mindset-Obsessed:

The takeaway from all of this is that traders need to understand the realities of the market and align their mindset with those realities. Our thoughts, perceptions, and emotions greatly impact our behavior. So if we bring feelings of frustration, fear, anxiety, regret, rejection, disappointment or any other insecurities into the market, it will only lead to irrational and impulsive behavior. Traders often wonder why their results are so inconsistent, but it’s clear that the consistency they seek is within their own minds. Being calm and consistent in the mind leads to consistent behaviors which generates consistent results. We all want the freedom and limitless opportunity that the market has to offer, but we need to impose upon ourselves a framework of principles and rules in order to deal with the uncertainty.

Life itself is uncertain, so why would the market be free from uncertainty? In both life and the market, change is the only constant, but adapting and having to overcome obstacles is what makes them fun. The only difference is that in life, we’re born into structured environments with laws and social values already in place. But in the market, we need to have the knowledge and discipline to create that structure for ourselves and follow it. The rules we impose on ourselves are needed to protect us from our inherent irrational and impulsive tendencies. Unfortunately, most traders don’t have the proper perspective and understanding to do this and then end up blaming the market for their poor results. So what we need to do in order to be consistently successful in the markets is make a complete paradigm shift. The biggest source of our trading problems is our own minds, but it’s very possible to turn them into our greatest assets with proper understanding and practice.

Don’t you think it’s time to eliminate your impulsive behaviors and self-sabotaging tendencies? Your trading results depend on it.

Holy crap! I seriously love this website. I love the valuable information you give on trading. More people would find a lot of value in these articles because they do not know how to trade correctly. Everybody I know does it emotionally. It’s really annoying because people complain about losing money but never take the time to learn about what they’re doing wrong. Your article and other articles too are very valuable and I will be sharing them.

Hi Misael – I appreciate the kind words! It’s unfortunate that so many people trade based on their in-the-moment emotions and impulses. Because the reality of that type of approach is that it quickly becomes an afflictive experience – both financially and emotionally. The “highs” of winning might feel great, but the “lows” of losing are even worse. And having our self-esteem riding on the result of every individual trade is an extremely destructive thing to do. I’ve been there in the past so I know what the rollercoaster is like. But it’s simply the wrong way to approach trading if we actually want to be consistently profitable long-term. It might seem fun and exciting to trade just for the “thrill of it” and hit some random wins at first, but eventually that luck will run out if we’re simply trading randomly, impulsively, erratically, irrationally, etc. If there’s no consistency in our mindset and in our approach, then there won’t be any consistency in our results either. Ultimately, over 90% of traders fail and it’s because of their destructive thought patterns, false beliefs, and self-sabotaging tendencies. They sacrifice their long-term desire to be a consistently profitable trader in return for short-term emotional gratification because their mind is weak and undisciplined. The good news, however, is that the mind can be trained to become strong and disciplined, so there’s still hope for all of those struggling traders out there.

The truth is that the result of any individual trade is completely uncertain. There are just too many unknown variables on any given trade to guarantee the result. But it is possible, however, to discover edges in the market that can be taken advantage of over a large number of trades. This is what’s known as having a system with positive expected value or expectancy. But again, the edge won’t work out in our favor every single time, so there will be losses along the way, and that’s why risk management is critical as well. The best example I can give so that people understand the concept of expected value is to imagine that we had a fair coin and flipped it only 5 times. If it lands on heads, I give you $20, and if it lands on tails, you give me $10. This would be an unfair game that puts the odds in your favor (your expected value = 5). In other words, you can expect to make $5 on every flip, on average. This is the type of edge you want to locate in the market because you’re virtually guaranteed to make money over a large series of flips, so you should want to play this game as much as possible. The result of any 1 flip, or even 5, is completely random though. That small of a number is statistically insignificant. There could be a streak of 5 tails right from the start, which might lead you to believe that the game wasn’t in your favor at all. But if we flipped the coin one thousand times or more, the results would be quite close to 500 heads and 500 tails (a 50/50 split) – thanks to the law of large numbers. Overall, results can seem chaotic when you’re looking at a small sample size, but edges work themselves out over a large number of trials/flips/trades. So when we combine a positive expectancy system with the proper mindset, those two pillars are really all we need to be consistently profitable in the market. And best of all, our trading becomes an enjoyable, fluid, and consistent experience instead of an agonizing, stressful, and inconsistent one.

I would also like to share what I have learnt in my own experience. Trading Is not gambling. Some traders think that trading is gambling. You need to plan Your Trading and Stick to the Plan. You need to learn to lose. And you must define trading objectives.

As a trader, my favorite principle is that anything can happen at any given time, but we don’t need to know what will happen next in order to make money.

This is very resourceful information and has been really useful for me. Trading is something that you need to understand completely before putting your money into it. I’ve shared some of these principles with my friends and it’s gonna be helpful to them.