The Trading “Fantasy Gap” – A Common Phenomenon Amongst New Traders:

The trading “fantasy gap” is a common phenomenon amongst new, inexperienced traders characterized by a major disconnect between the desire for rewards (money/profits) and the desire to actually put the time, hard work, and sacrifice into achieving that result.

To put it simply – most people who choose to pursue trading want the rewards but not the work. They think there’s some sort of holy-grail or foolproof system when there isn’t. They have the wrong idea of what it takes to become a consistently profitable trader.

As a result, the vast majority fall into the abyss of alert services, newsletters, and chat rooms looking to blindly copy hot picks from so-called gurus. I’m no exception to this phenomenon – this is the exact path I went down at first. But it was largely ineffective.

These shortcuts sound nice in theory, but they undermine your personal development as a trader. I’m not saying that all of these types of services hold zero value because that’s not true. But alerts/signals/hot picks can’t replace real trading skills and experience.

Ultimately, you have to develop a high level of self-sufficiency if you want to achieve long-lasting, sustainable success. Dependency on anyone else to “alert” you on when and what to trade within dynamic, ever-evolving markets is extremely dangerous.

Your focus has to be on training/skill-building, which requires quite a bit of time and effort. That’s what the market demands.

Becoming Elite is Not Natural, But Required in Order to Become a Successful Trader:

Human nature is to be lazy – to expend the least amount of effort possible. But this lack of effort doesn’t align with becoming elite – and by necessity, you essentially have to become elite in order to become a successful trader (the “average” trader loses money).

So if you want to be a successful trader, then you have to treat trading like the skill-based, peak performance endeavor that it is. Going through a basic course on technical analysis and watching a few YouTube videos on setups is nowhere near enough.

Even when you have a strategy/system/methodology with positive expected value – that’s not even enough. You still have to have the mental stability, self-control, and overall mindset/psychology to actually execute it. Putting all this together is no small feat.

It’s really interesting how people tend to think that becoming a trader is easy. Sure, it’s easy to open up a brokerage account and randomly start pushing buy/sell buttons. But there’s a drastic difference between being a market participant and being a serious trader.

Doctors have go to medical school. Lawyers have go to law school. Elite athletes train, practice, build skills, and gain experience for years before turning pro. So why would you expect the path to becoming a consistently profitable trader to be any different?

The only “shortcuts” to success are hard work, sacrifice, and high-quality coaching/mentorship. You can’t cheat the process.

Conclusion – The Market Environment Demands That You Become a New Version of Yourself:

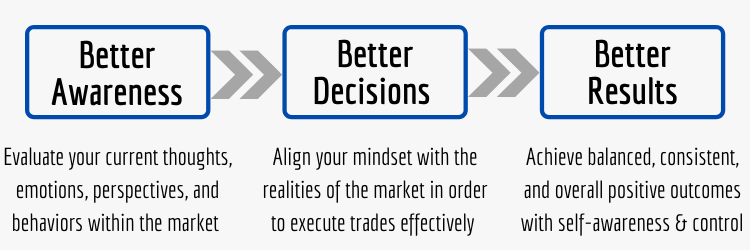

If you’re a new trader just starting out – you might not want to hear this – but who you are right now simply isn’t capable of achieving consistent profitability in the markets. You have to make a paradigm shift in order to become a new, better version of yourself.

There are no natural-born traders who generate immediate, automatic, and never-ending profits – that’s nonsense. Without training and experience, every human starts off as a bad trader. Some people might get lucky at first, but luck isn’t sustainable.

Those who decide to become traders have to evolve. Entering a new environment with unique characteristics requires changes – and since you can’t control the market environment, you have to adapt. It requires changes in certain attitudes, beliefs, and perspectives.

If you’re willing to listen to your own thoughts and emotions, markets can teach you more about yourself in a short period of time than almost any other endeavor can do in years. Your ineffective beliefs in regard to money, risk, loss, and uncertainty will be exposed.

Overall, it’s extremely easy to want the “trader lifestyle” you so often see in advertisements/promotions. But it’s hard to perform the actions required to actually achieve that result. The potential rewards are enticing (and possible), but not without the work.

If you’re against studying, training, and non-stop personal improvement, then long-term, sustainable trading success will elude you.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- How to Get Started Trading With the Right Expectations

- Trading is a Skill – Knowledge Will Only Get You So Far

- Entertainment vs. Training in the “Trading Education” Space

- 10 Biggest Mistakes That New Traders Make in the Markets

- Why is Day Trading So Hard – The Realities of Day Trading

To become a successful trader takes time and consistent work. Unfortunately many people do think that trading is easy money and you just need to buy and sell a a few trades and make a profit. But there are far more technicalities involved with trading. And it is not a get-rich-quick scheme.

Do you have your favourite training program or platform that you can recommend for a beginner? Would it be a good idea to have a mentor to guide you when you start trading? Tank you.

Hi LC – I appreciate your comment. I completely agree that trading is not a get-rich-quick scheme and shouldn’t be treated as such. It’s a craft that requires months and years of education/training/skill-building.

For beginners, I would highly recommend going through my Trading Success Framework course in order to understand what trading truly entails. This course isn’t designed to cover basic technical analysis (like most other trading courses) – it’s designed to cover the essential values, qualities, concepts, principles, and habits/skills required to become a consistently profitable trader. It’s the foundation for long-lasting, sustainable market success. At the very least, it will help beginners realize what it actually means to be a trader and if it’s an endeavor they truly want to pursue. It’s not just about money and other material items (like most fake gurus try to make you think) – there’s legitimate time, hard work, and persistence that has to go into it.

I definitely think coaching and mentorship are extremely valuable – so I’ll be sharing my recommendations for top trading coaches/mentors/services at the end of the course for those interested in taking their training to the next level. But I think it’s best for complete beginners to understand what trading is truly all about first before deciding to take that next step. For those who are serious about their pursuit of trading, there are definitely some great training programs out there. But I don’t necessarily think it’s wise for a beginner to dive into a $1,000-$10,000+ program before realizing what the realities of trading are. Too many people dive into trading courses/programs expecting automatic success just because they paid for it. But just like a gym membership, simply paying for it won’t produce any results. You still have to put the work into training and building new habits/skills.

I agree with you that when we are new at trading we just think that it will be easy to make money as a trader. And the market quickly proves us wrong. It takes a lot of training and effort to be able to master the skills required to live from trading. But most are not willing to put in the effort!

Yes, there’s a big difference between merely being a market participant (randomly pushing buttons, making impulsive decisions, etc.) and being a trader (regularly pulling profits out of the market because you have edge and skill). Everyone wants the rewards that trading can provide, but they typically enter the market without a clear understanding of what good trading actually entails. There’s hard work involved in order to achieve consistent and sustainable gains.