Best Futures Trading Indicators For Generating Robust Market Edge:

I – like many other individuals – got introduced to trading through guru alert services, newsletters, and chat rooms.

The thought was that I could simply mirror the trade-by-trade actions of others with seemingly good track records. But this copy-cat approach simply doesn’t work (for a number of reasons) – and it took me far too long (roughly 2 years) to realize it.

At that point, it was clear to me that I could no longer outsource my own competence, skill-development, and overall decision-making process. I had to take full control/accountability. And this is where my search for “trading indicators that work” began.

I tested the waters using various popular indicators: simple moving averages, exponential moving averages, stochastic oscillators, Bollinger Bands, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Fibonacci retracement, etc.

You name it and I probably had it showing on my charts at some point. And it got to a point where I was looking at so many different indicators at once that there was no real meaning to any of it. My charts were bombarded with countless lines and shapes.

It was time to simplify and refine my market view. And with the 2 indicators below, I’ve been able to make order out of chaos.

Top 2 Futures Trading Indicators That I Use to Execute High-Quality Trades:

I eventually achieved moderate success pairing some of the indicators mentioned above with key price levels (horizontal support & resistance) and other structures (like flags/triangles). But I never had much trust/confidence in any of them.

I’m not saying that those particular indicators hold zero merit, but they never really worked for me in any reliable or consistent way. It wasn’t until I came across profiling when things finally “clicked” and market movement actually started to make sense.

#1 Futures Trading Indicator → Volume Profile and/or Market Profile

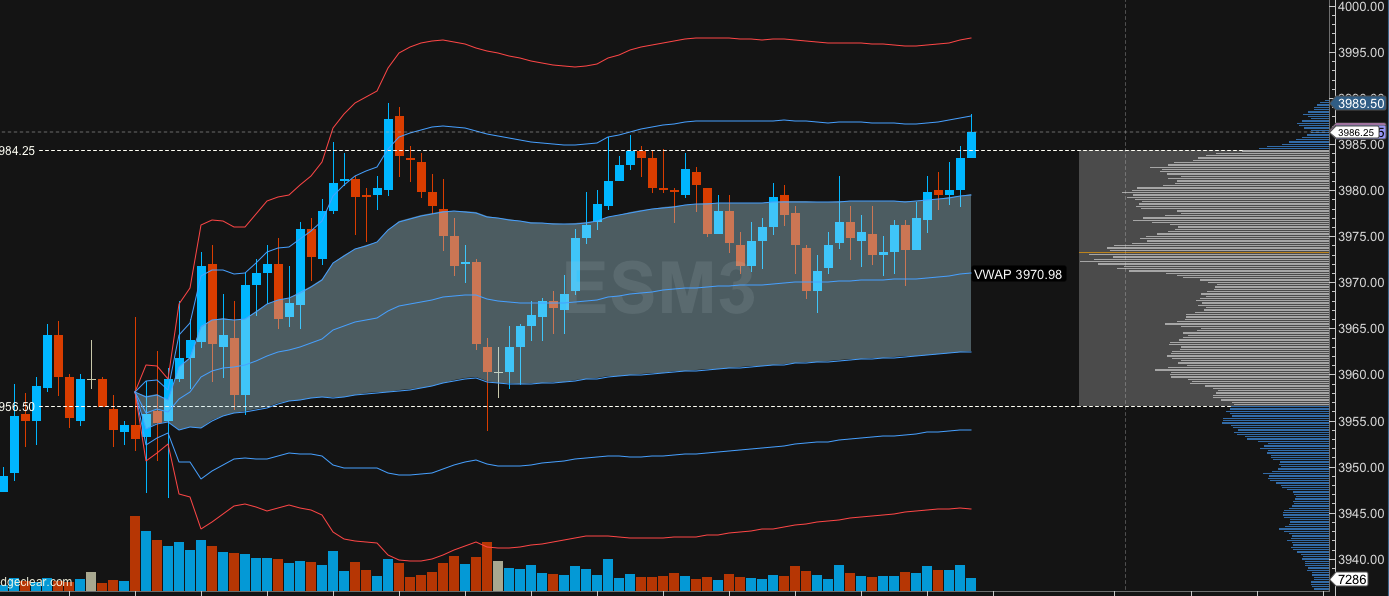

The primary tool that I use to observe and analyze markets is volume profile.

In my opinion, it provides the most robust market view – and no other indicator or charting study can even come close to matching it (except maybe market profile). These profiling tools essentially display what’s going on “under the hood” of price movement.

The conventional way for retail traders to monitor volume is at the bottom of their charts – where it displays volume per bar or candle. But volume profile is unique in that it flips volume up to the y-axis, so that you can see cumulative volume at specific prices.

This might not sound earth-shattering, but it’s extremely significant. Participation is everything in trading – it’s literally what makes markets. So understanding which prices attract the most interest/participation (or the opposite: reject it) is critical.

When I think about how I used to trade, there was a major lack of legitimate contextual analysis. I was basically relying on lagging indicators to “trigger” my entries/exits (like a line crossing another). But there’s no edge in that type of approach – no “depth”.

Profiling displays the 3 main components of “value” (time, price, and volume) in ways that no other indicators can replicate.

#2 Futures Trading Indicator → Volume-Weighted Average Price (VWAP)

If I had to, I could capture consistent profits with nothing other than volume profile on my charts.

But a secondary indicator that I use is volume-weighted average price (VWAP) – which calculates the average price, adjusted for volume, over a specific time period. It’s dynamically calculated/plotted on a chart by dividing total dollars traded by total shares traded.

It looks kind of like a moving average line, but the difference is that moving averages don’t take volume into account – only price and time. And what makes VWAP even more significant is that it’s a key reference level for large traders and institutions.

When there’s an indicator that pretty much all of the biggest “players” in the market are monitoring, then it’s clearly something worth paying attention to. It often acts as strong support/resistance – and can potentially create actionable trade opportunities.

I don’t personally make any entry decisions based solely on VWAP, but if it lines up with other key reference levels from the volume profile – that confluence strengthens the trade. And I’ll often scale-out a portion of profits if approaching VWAP.

The typical use for VWAP is on a daily timeframe, but it can be “anchored” to any starting point for your chosen time period.

The Best Futures Trading Indicators Are Multi-Dimensional and Expose the “Quality” of Price:

You’ve probably recognized the critical ingredient amongst these top trading indicators by now → VOLUME.

Volume is participation – which is what makes and moves markets. So if you use tools like volume profile and VWAP to observe and analyze market context/structure/posture, it provides meaningful edge. You can see markets with a clarity that many others don’t.

|Learn More About the 1 Tool That Will Completely Change the Way You View Markets|

|Discover 5 Resources That Can Help You Become a Consistently Profitable, Six-Figure Trader|

These indicators eliminate noise so that you can gauge where buyers and sellers are actually willing/not willing to do business. Being deceived by price becomes a thing of the past because these powerful tools allow you to see beyond the bars/candles.

There’s no question that retail traders are prone to blindly chasing price up-and-down – entering positions randomly without any regard to value/quality. They have no idea what makes for an actionable price level and overall high-quality trade idea.

The analogy I like to use for this is trying to play a ball sport, like basketball for example, without being able to see any of the other players on the court. All you can see is the ball as it gets bounced and thrown all over the place at random (seemingly).

Sadly, this is the foggy view of price action that many market participants have – which leads to negative trading results. But the good news is that this clouded vision can be fixed by acquiring competence and skill around profiling and VWAP.

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- What is Korbs YouTube – Who is Aaron Korbs?

- Best Futures Trading Method – The Volume Profile Method

- What is Trade With Profile – Best Trader Training Program?

- Volume Profile Formula Review – What is Volume Profile Formula?

- Molding Your Market Framework – How Do You View Markets?

I know virtually nothing about trading, so I was curious when I read this article about indicators. I found it immensely helpful and descriptive. For someone like me who has interest in learning about trading but is a complete beginner, it sounds like the tools and resources you’ve mentioned here will be extremely helpful. Thank you for sharing your experience.

Hi Marissa – happy to help. I’m glad you found value in this post as a complete beginner.

I’ve spent years trading and using/testing various indicators – and volume/market profile & VWAP are by far the best, in my opinion. They’re pretty much the only tools that I use to come up with trade ideas and manage my entries/exits. A lot of new/struggling traders complicate their process with all sorts of lagging and redundant indicators that don’t display what’s really happening “under the hood” so to speak. Profiling, however, allows me to see meaningful market structure that can’t be observed/interpreted through any other tools. To a large degree, it’s like having x-ray market vision. It provides an extra dimension to market analysis.

In addition to this content centering around futures, auction market theory, and profiling – I would also suggest going through my free Trading Success Framework course. I created it because it’s a resource that I wish I would’ve had at the beginning of my own trading journey (instead, it took me years to put all the pieces together on my own) – and it lays out the details of what “being a trader” (a real/skilled/self-sufficient/consistently profitable trader) means on a foundational level. A lot of people take the content within this course for granted, but it’s critical to internalize all of the concepts, principles, values, qualities, habits, and skills for long-term, sustainable trading success.