Top 10 New Trader Mistakes – Learn Them So That You Can Avoid Them:

There are a ton of mistakes that new traders make, so this certainly wasn’t a hard list to compile. But I think it’s important for anybody just starting out to completely understand these common pitfalls. They’ll probably save you from at least a few painful lessons.

Personally, I made pretty much every mistake on this list. So the good news is that they can be overcome. But the bad news is that they made my path harder, longer, and more expensive. It didn’t have to be that way if I had been aware of these dangers from the start.

To a certain degree, I think that all traders need to learn some of these lessons on their own through personal experience. But having a general overview of what to look out for right at the beginning can help you realize where most missteps take place.

With that being said, let’s get right into it. Here are some of the most frequent and dangerous mistakes that new traders make:

1. Inappropriately Managing Risk

I don’t think there’s one trader in the universe that never made the mistake of inappropriately managing risk. This has to be the most common mistake in the book – and one where traders have to experience the pain for themselves in order to truly internalize it.

From a logical perspective, I think everyone understands the importance of managing risk. But from an emotional perspective – especially as beginners with get-rich-quick mentalities – taking smart, calculated risks with discipline is much easier said than done.

It usually takes a few occurrences of going “all-in” on trades and subsequently losing before new traders finally realize the importance of risk management. The short-term profits mean nothing when you eventually wipe out your entire account on one bad trade.

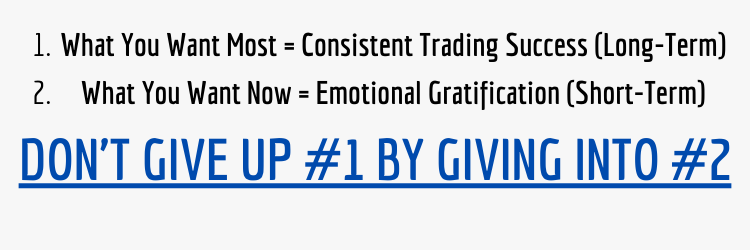

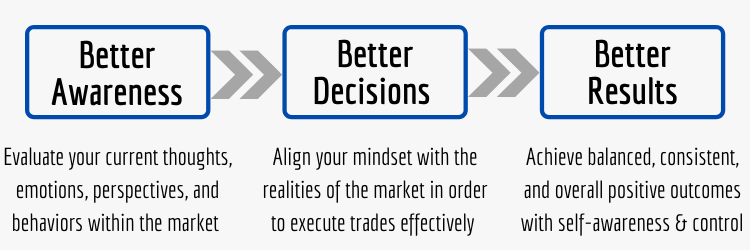

2. Disregarding Trading Psychology

Disregarding proper trading mindset/psychology is another area where most new traders fall short. They’re usually so caught up in the “exciting/enticing” components of trading like “foolproof” strategies and systems that they overlook their own internal framework.

But without the proper mental framework, even the best strategies and systems will be compromised. The mental component, in my opinion, is what makes most of the difference between traders who end up becoming consistently profitable and those who don’t.

Trading is much more of a mental game than most people realize or would like to admit. People love to throw around the old adages like “buy low and sell high” and “keep your losses small and let your winners run”. But in practice, it’s not quite as easy as it sounds.

3. Having Unrealistic Expectations

Thanks to widespread misinformation and tempting online advertisements from shady “trading gurus”, many new traders get involved with markets thinking they can become millionaires within just a few days, weeks, or months – with little to no effort.

But the reality is that trading is one of the hardest endeavors most people ever pursue. It takes months/years of proper education, training, and mentorship just to acquire an adequate level of skills and experience – not to even mention becoming elite.

This level of hard work and dedication isn’t what most people are expecting. They think that they can watch a few YouTube videos or take a basic course and start making money like clockwork. But that’s an extremely shallow view of what it takes to succeed.

4. Obsessing on Profits Over Process

This sort of piggy-backs on the issue of unrealistic expectations, but I think this particular problem is absolutely necessary to discuss. If I had to pick one piece of advice to give to new traders, focusing on process over profits would most likely be it.

In essence, the process is what trading is all about. This includes critical components like risk management, trading psychology, tracking trades, and everything that goes into increased performance. If inputs are strong, then outputs take care of themselves.

The problem, however, is that most new traders obsessively focus on short-term results while overlooking their process – and then wonder why they never achieve any level of consistent profitability. Basically, they want the rewards without the work.

5. Chasing Holy-Grail Indicators and Systems

It’s nice to believe that that there’s some sort of indicator, strategy, or system out there that generates huge profits nearly 100% of the time – and once you find it, you’ll be rich and never have to work again. But this just isn’t how the markets work.

You want to find and exploit an indicator, strategy, or system that “works”, but every single one both works and doesn’t work sometimes depending on market conditions, as well as your particular approach (specific entries/exits, stop losses/profit targets, etc.).

The only holy-grail, in my opinion, is the development of skills to adapt to ever-changing markets, analyze context, and implement the right strategies/systems at the appropriate times. Nothing is foolproof – it’s all about playing probabilities and managing risk.

6. Jumping Straight Into Real Money Trading

Almost all new traders have an intense fear of missing out on opportunities, which leads many into trading with real money far too early. But without any sort of preparation/training, all you’re missing out on is pain – from both an emotional and financial perspective.

It’s true that some beginners will get lucky and make some money in the early stages without any clue as to what they’re doing. But eventually the beginners luck runs out – and it’s all the more painful losing a large amount of money than a small amount.

This is why I often say that luck in trading is more of a curse than a blessing. If you lose early, you learn to respect the market and learn your lessons at relatively low costs. There are also plenty of realistic market simulators/demo platforms available for practicing.

7. Failing to Accurately Label and Track Trades

Again, this is part of the process of trading properly. Accurately labeling and tracking your trades is how you figure out which setups/strategies work best for you, and allow you to analyze your specific trade data in order to refine and improve over time.

Unfortunately, most new traders are lazy and aren’t committed to putting in this level of effort and time into their approach. They’d rather join a chat room or alert service and be told exactly what to do from some guru – even though blind copying is dangerous.

Without becoming self-sufficient, you’re doomed for failure. It’s certainly fine to learn from mentors and take pieces of strategies/systems here and there, but when it comes down to your trading decisions – it has to be you in full control.

8. Using Trading as a Platform For Thrills and Excitement

When you enter the markets, it’s extremely enticing to simply use them as a platform for thrills and excitement – essentially for gambling. But that’s not what professional-level traders do. It’s not about short-term emotional gratification – it’s about making money.

And the professionals don’t do this by obsessing over the profits (remember what we talked about earlier: process over profits) – they do this by capitalizing on a mathematical edge with consistency and discipline. In-the-moment impulses and desires take a backseat.

Even though active trading is short-term in nature, it requires a long-term focus. The result of one individual trade doesn’t matter – it’s essentially just random. What matters is putting the odds in your favor over the long run (hundreds/thousands of trades).

9. Comparing Themselves to Other Traders

Another issue that many new traders face is constantly comparing themselves to others. With the rise of social media, there are a ton of self-proclaimed trading gurus out there boasting about their profits – which makes many beginners feel frustrated and inadequate.

Whether the profits these gurus are showcasing are real or not – the fact of the matter is that the constant comparisons are unhealthy. Especially when the comparisons are results-oriented only – which they very often are (nearly 100% of the time).

If the comparisons were process-based – like things related to risk management, trading psychology, tracking trade data, etc. – that would be much better. But the bottom line is that most new traders do too much worrying about other traders instead of themselves.

10. Quitting Job Prematurely to Trade Full-Time

This particular error probably doesn’t occur with as much frequency as the others, but making this mistake can be extremely costly. I personally don’t think any new trader should impulsively quit their current job to pursue trading on their own full-time.

If you’re interested in trading full-time, you should fully understand the realities of day trading for a living first – and take the time to properly prepare, educate, train, and build experience. Jumping into it without a proven track record is asking for trouble.

When trading for a living, I don’t think most people understand the performance anxiety that can materialize when you’re relying on your trading profits to live on. That psychological strain will only work against you during your learning process.

Avoid These New Trader Mistakes if You Want to Fast-Track Your Path to Success:

The typical “shortcuts” that many new traders fall for are just traps that actually make their path to consistent profitability longer, harder, and more expensive. I know from personal experience that most chat rooms and alert services are ineffective.

I’m not saying that every single service that offers a chat room and alerts is terrible – because there are some decent ones out there – but for the most part it comes down to how you personally use them (for blind copying or for developing your own process).

In my opinion, the only shortcuts available are to learn from the mistakes of other traders and try not to make them yourself. But even armed with this information – chances are you’ll still make many of them anyway. Trading is a constant learning experience.

As long as you take the feedback that the market gives you as an opportunity to learn lessons and better refine your approach, then you’re on the right path. And the cheaper you make it to learn those lessons, the better (using paper trading/demo/simulators).

Please share your thoughts with any of these new trader mistakes or additional ones that you’ve personally experienced below.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Day Trading vs. Gambling – Is Day Trading Gambling?

- Trading is a Skill – Knowledge Will Only Get You So Far

- How to Get Started Trading With the Right Expectations

- Why is Day Trading So Hard – The Realities of Day Trading

- What is Trade With Profile – Best Trader Training Program?

I feel so bad for the families of people who get a little cocky with the trading and commit sin #10, lose their entire life savings and run the whole entire family under the bus. These trading gurus are pretty terrible people for convincing folks to do things like that. I agree that in order to be a good trader, you have to be smart with your investments and understand risk management. The truth is that traders make money by studying the market by themselves. You can get some good value out of certain gurus but at the end of the day, no one is truly going to teach you how to understand the market except yourself! The best teachers never have success at the craft they teach.

Hi David – I appreciate your comments!

I certainly wish more trading gurus and other individuals (and companies) that sell trading-related course, programs, services, and tools were more upfront about how difficult trading is. I think that would eliminate a handful of mistakes on this list – especially number ten. But the reality is that highlighting how “easy” and “profitable” trading can be sells better. And while trading can seem easy in the short-term due to the limited barriers to entry and how simple it is to click some random buttons to place trades – becoming a consistently profitable trader over the long-term is a completely different story. It’s kind of like how casinos will feature the top 5 slot machine winners for the month on their big screens, but fail to mention the thousands of losers. And even the featured winners will eventually become net losers (if not already) if they continue coming back and gambling. That’s what many trading services do – they highlight pure luck on a short-term basis, but these services aren’t often effective for subscribers in the long-run.

In order to trade appropriately (in my personal opinion), traders need to act like the casino (who has a statistical edge in every game) rather than the casino patrons (who don’t have an edge and have no chance of winning in the long-run). Unfortunately – usually due to emotional urges – many traders treat markets like an opportunity for thrills, excitement, and gambling – but that’s not what good trading is all about. Good trading is about continuously putting the probabilities in your favor, appropriately managing risk, and going through endless cycles of personal improvement (mainly from a psychological perspective). In the end, trading can be extremely constructive or destructive (from both a financial and emotional perspective) depending on how each individual market participant decides to approach it. The constructive approach sounds much better to me.

In response to the last sentence of your comment, I don’t necessarily agree with the sentiment that “those who can’t do – teach” because there are certainly exceptions to that. Many great traders have taught/coached/mentored many other great traders, and so on and so forth. But I do agree that there are many fake gurus out there who highlight the so-called “trading lifestyle” but only achieved that lifestyle by selling courses, services, etc. In most instances, the greatest traders are actually extremely humble and silent about their success – and don’t often (if ever) showcase their lifestyle – because they understand the importance of process over profits. Overall, the financial benefits of trading can potentially be immense, but it doesn’t just manifest out of thin air – it’s generated by a strong process – and that’s what great traders tend to obsess over.