Mindful Trading Wins Over Mindless Trading – How to Become More Self-Aware:

Mindful trading involves conscious awareness of your thoughts, emotions, and behaviors. Without even realizing it, most traders have numerous biases, insecurities, habits, expectations and survival mechanisms that are inhibiting their success.

As a beginner, it’s completely normal to feel fear of loss or being wrong, doubt about open positions, regret over impulsive actions, among many other difficult emotions. Some traders even feel personal rejection based on the negative result of one individual trade. But attaching your self-esteem and self-worth to your most recent trade is dangerous and destructive. This is where mindfulness comes into play, allowing you to simply notice your thoughts and emotions while trading and how they impact your decisions.

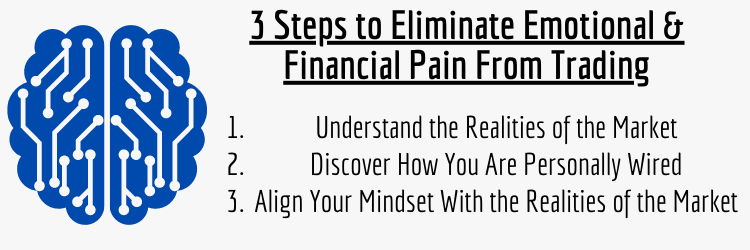

The reality is that every single person on earth who hasn’t done any specific mindset training geared toward operating within the market environment is a bad trader. There are no naturals. Nobody can bypass the mental training process if they want to ultimately generate consistent profits. Much of your current programming constrains you. Many patterns of thought and emotion that served you outside the market in the past might not serve you within the market environment. These can be deep-rooted, hidden issues.

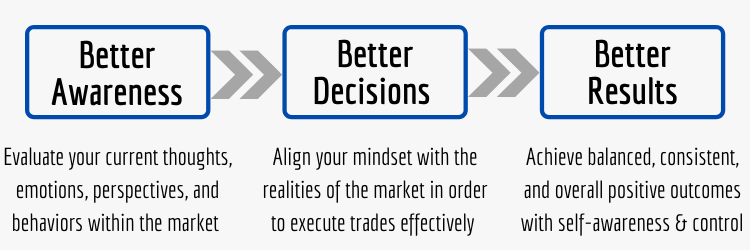

Mindfulness is a tool that allows you to first understand yourself, and then reframe your thoughts and perspectives for success.

How to Become a Mindful Trader and Resolve Your Ineffective Programming:

Becoming a mindful trader requires self-awareness. It involves taking in-the-moment audits of your thoughts, emotions, and physical sensations while trading. But before doing so, remember to accept whatever you find. This isn’t a time to harshly judge or criticize yourself for having impulsive thoughts or emotions. Because the reality is that there is positive intention behind them.

It might seem hard to imagine, but many of your thought and emotional patterns were developed in childhood, deeply imprinted by your social circle, mainly family and friends, throughout your formative years. So when you decide to enter the market environment, you have to ask yourself: are my old patterns still serving me? If they’re not serving you as a trader, know that it’s possible to change.

A common phenomenon amongst traders is having conflicted views on money. For example, many people grow up hearing the same remarks continuously: “money is the root of all evil” or “only greedy people are rich”. But when you decide to become a trader, you don’t realize the psychological impact of repetitively hearing those statements. Even though the sayings aren’t true, they become your subconscious beliefs. Now you’ve consciously decided to be a trader, where the objective is to make money, and you’re in conflict.

Subconscious vs. Conscious battles like this typically go undetected and unacknowledged, but can be resolved with mindfulness.

Concentrate on the Present Moment – Keep Your Focus on the Process Instead of Results:

The major problem for all traders, especially new ones, is a tendency to focus on results. They zone-in on potential profits, recognition, and social approval right from the start. Psychologically, the tricky thing about trading is that achieving your wildest dreams of wealth and status are always just one trade away. But an overwhelming focus on results will impede you from ever achieving those dreams. Your desires have to take a backseat to the process so that your focus is on what matters – proper mindset and a statistical edge.

One gigantic mistake that most traders make is either having no goals or the wrong goals. You might think that you should make results-oriented goals, like specific profit targets on a weekly, monthly, quarterly, and yearly basis. But results-oriented goals will only create frustration and stress when the market doesn’t conform to your desires. What you should be heavily focused on instead are process-oriented goals, like making sure you follow your pre-trade rules, plan, or system, and then reinforce your good behavior.

By focusing on consistency in your process, and reinforcing that consistency over-and-over again, that consistency will show up in your results. You get out what you put in. When your process is strong and stable, then the results take care of themselves.

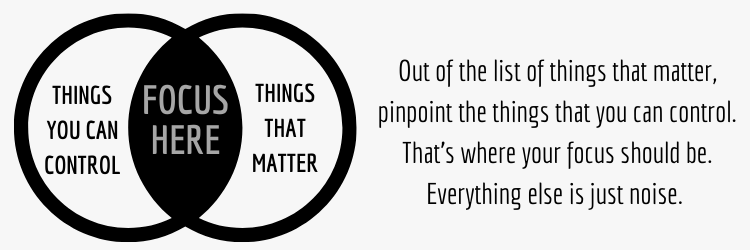

Understand What You Can and Can’t Control – Stop Worrying About What You Can’t Control:

This is a critical concept that usually creates a shift within the mental framework of most traders. The first step is to understand what matters, and then within the realm of what matters, understand what you can control. That’s where your focus should be. If something doesn’t matter or you can’t control it, then there’s no use worrying about it. This might seem wildly simple, but based on how most traders operate, it’s clear that they don’t hold a true understanding of this concept.

The fact is: we can’t control the market. That power is reserved for a small few super-wealthy individuals and institutions. But for some reason, it’s difficult for us to release control over it. We want so badly for it to conform to all our wants and desires. To make us win and always be right. Yet certainty doesn’t exist within the market environment. So we have to accept uncertainty, risk, and loss as a natural part of doing business. What we can control, however, is our process. In other words, we can control our reactions to the market.

Controlling our process allows us to be in harmony with the market instead of fighting it, like using sails on a boat to adjust to the wind.

How Meditation Can Increase Mindfulness By Improving Concentration and Patience:

A key component to improving mindfulness is the practice of meditation. Lots of people don’t think trading and meditation are so closely intertwined, but mental clarity, focus, and awareness are the central components for both. This secret weapon is highly underutilized by retail traders. Your mental edge in trading is arguably more important than anything else.

It’s truly shocking how often mindset, mindfulness, meditation, and the overall psychological aspect of trading gets ignored and overlooked by the trading industry itself, even though it’s a foundational element of success. I’ve personally used and reviewed dozens of stock trading programs over the years, and virtually none of them offer more than a quick blog post or video on the subject. But it’s nothing that can have a substantial impact on members. The only two I’ve come across so far offering strong mindset trainings, which shows that they legitimately care about your trading success, are 2ndSkies Trading and Trading Composure.

The mindset courses they offer are The Advanced Traders Mindset Course and The Trading Psychology Mastery Course, respectively.

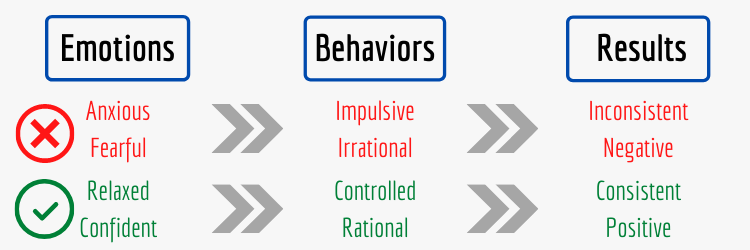

Conclusion – Mindless Traders Are Impulsive and Mindful Traders are Consistent:

Mindless traders are impulsive and irrational, which leads to negative results. Mindful traders, on the other hand, are consistent and objective, which leads to positive results. Which group do you want to be in?

Not only are the results more beneficial for mindful traders, but the process as well. Mindless traders are in constant conflict with the market, which makes their experience afflictive and painful. Mindful traders, on the other hand, are in harmony with the market, which makes their experience smooth and enjoyable. Your decision on which group to be in should be an easy choice.

Unfortunately, most traders choose the impulsive, impatient, and undisciplined route, which puts them in the group of traders who fail (over 90%). But those who are focused on growth and development, and choose the route of patience, balance and consistency, eventually end up in the exclusive group that succeed (less than 10%). Your odds of trading success truly depend on how you choose to approach it from a psychological perspective. In the end, mindset is the most important, yet most overlooked component.

If you aren’t a mindful trader, then you aren’t a consistently profitable trader. There’s no way around training your mind for success.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- What is the Foundation For Stock Trading Success?

- How to For the Stock Market – 5 Steps to Consistent Profits

- How to Eliminate Bad Trading Habits and Develop Good Ones

- A How to Guide For the Stock Market – Achieving Consistent Profitability

- Can People Make Money Day Trading? It Starts With Self Awareness