Develop a Mental Framework That Harmonizes With Market Characteristics:

When it comes to trading, I reference “effective mindset/psychology” quite a bit. So I often get asked questions like: What do you mean by a paradigm shift? Can you explain in detail the mental framework required for long-lasting, sustainable trading success?

These are incredible questions. But they can’t be comprehensively answered in a short sentence or two. There are certainly some major overarching components that we’ll cover in this post. But there are also personal nuances that you have to figure out on your own.

I’ve already written about the 4 main market characteristics and how to adapt to them in this detailed guide. But I think these characteristics deserve a concentrated article of their own. Deeply understanding them will help you realize why change is required.

People often confuse the proper mindset I’m talking about here with the mindset that many self-help and business gurus teach – like being optimistic (the power of positive thinking) or working yourself to the bone (the “I’ll sleep when I’m dead” type of attitude).

But these philosophies aren’t exactly what I’m referring to when it comes to trading mindset/psychology. Instead, what I’m trying to get across is the importance of probabilistic thinking and having a healthy perspective on change, risk, loss, variance, and uncertainty.

Overall, successful trading requires operating effectively in an environment that we’re not naturally used to – so be prepared to adapt.

The 4 Main Market Characteristics You Must Embrace For Durable Trading Success:

These 4 inherent characteristics go straight to the root of why adaptation is absolutely necessary for every single trader who enters the market environment (assuming every trader actually wants to achieve long-term profitability). So let’s dig right into them:

1. The Market is Dynamic. Prices and Participants Are Constantly Changing/Shifting.

The ever-evolving nature of the market can stymie even some of the best traders of the past. Individuals who are unwilling to grow and adapt eventually end up getting wiped out. Trying to fight the truth (market generated information) is a recipe for disaster.

This is why I don’t often talk about specific trading strategies and systems because: 1) there are thousands of them, 2) the ones you choose should fit your individual personality and preferences, and 3) they all go in and out of favor based on market conditions.

New traders are often in search of a magical/foolproof setup that will print them money without fail in perpetuity – but no such setup exists. What long-term success actually comes down to is developing the personal attributes and skills to effectively adapt.

There are plenty of patterns, setups, indicators, strategies, systems, and overall methods that might’ve worked in the past but no longer do. Or don’t occur with as much frequency as they used to. Or work extremely well in nonvolatile markets but not so well otherwise.

The bottom line is that there is no fixed/static answer to what works and what doesn’t when it comes to strategies and systems. Market context can change in an instant – rendering your current strategies and systems ineffective. So you have to be able to adapt.

2. The Market is Uncertain. Anything Can Happen at Any Given Moment in Time.

When it comes to the market, you have to embrace the fact that every moment is entirely unique. So no mathematical formula or model based on historical data can have 100% predictive power. The amount of randomness at play is probably much larger than you realize.

Just because everything aligns to create an opportunity that you deem an A+ setup (it hits on every piece of technical and fundamental criteria you look for in an “ideal” trade) doesn’t mean that the trade will automatically move in your favor and produce a profit.

Trading is a game of incomplete information. There are far too many factors at play to comprehensively compute them all. You will never be in a situation where you know the positions and intentions of every single current and potential market participant.

Think about it. There have probably even been situations where you were in a trade yourself and didn’t have a plan or know what you were going to do next. So how can you know with certainty what millions of others are going to do? The reality is you can’t.

This is why you shouldn’t attach your happiness/self-worth to the outcome of individual trades. Losing is an unavoidable aspect of trading – and trying to avoid it often does more harm than good. The key is to keep losses controlled and smaller than your winners.

3. The Market is Limitless. Various Strategies, Instruments, and Time Frames Offer Endless Opportunities.

The number of markets, strategies, instruments, and time frames available to trade offers an endless assortment of possibilities. There are US/European/Asian markets, scalp/day/swing/position trading, stocks/bonds/options/futures/forex, and more.

The sheer magnitude of choices can be confusing and overwhelming. This often leads most new traders into a surface-level, generalist approach where they continuously trade impulsively, get distracted, and strategy-hop from one “shiny object” to the next.

But to become a great trader, you have to specialize in certain methods. This doesn’t mean that it’s impossible to be both a day trader and long-term investor or that you shouldn’t have multiple strategies in place to take advantage of various market regimes.

But you have to be reasonable – you can’t do it all. Especially as a beginner who has limited to no knowledge, skills, and experience to work with. After some sampling to see what approach might suit you best, you have to start small and expand your arsenal from there.

As humans, we naturally want to be stimulated – and the markets as a whole do a great job of doing that for us. But getting into trading for thrills and excitement (short-term emotional gratification) often comes at the expense of our long-term financial goals.

4. The Market is Impersonal. It Does Not Care About What Happens to You and Your Account.

For some, the impersonal nature of the market is harsh; for others, it’s liberating. But the reality is that the market doesn’t care about you. Your intelligence, certificates/degrees, and past accomplishments have no bearing on how the market behaves.

So if you think the market will feed you automatic winners just because you studied the charts for months or put in countless hours of fundamental research, then you’re in for a rude awakening. If you have a sense of entitlement, the market will humble you.

This game is about positive expected value, risk management, and effectively executing with consistency and discipline. The market doesn’t care whether or not it helps or hurts you, so you have to have procedures in place to act in your own best interest.

The market is nothing more than a feedback mechanism that provides information/data – and it’s your job to use that feedback in order to properly adapt, refine, and grow. From this perspective, mistakes and losses turn from negatives into positive learning opportunities.

Generally speaking, we’re so used to controlling our environment (adjusting the thermostat when we’re hot/cold, turning on the TV when we’re bored, etc.) that an environment we can’t control is difficult to accept. All we can control is how we behave within it.

Navigate the Dynamic, Uncertain, Limitless, and Impersonal Market Environment:

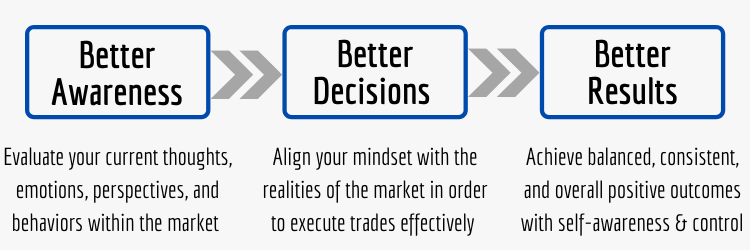

Overall, these inherent market characteristics are significant and have to be properly embraced for long-lasting success.

And the best way to properly embrace them is in the form of new attitudes, perspectives, and beliefs (probabilistic thinking, the market is a feedback mechanism, etc.) and structure in the form of rules and plans (in relation to entries/exits, risk/money management, etc.).

Without the necessary structure in your mind and in your strategies and systems, there’s nothing stopping you from expressing yourself in the market in all kinds of negative ways (taking impulse/revenge trades, removing stops, adding to losers, etc.).

As you move forward with your trading, keep in mind that any emotional pain you feel is a sign that your mental framework is out of alignment with market characteristics. Journaling is a great way to build self-awareness and come up with solutions for adjustment.

In the end, the market will undoubtedly reveal your attitudes, beliefs, and perspectives in regard to money, risk, loss, change, uncertainty, and indifference – and how effectively you use that feedback will ultimately determine whether or not you succeed.

So don’t spend your time fighting the market – it will only waste your emotional and financial capital. Align with it instead.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Day Trading vs. Gambling – Is Day Trading Gambling?

- Trading is a Skill – Knowledge Will Only Get You So Far

- 10 Biggest Mistakes That New Traders Make in the Markets

- Why is Day Trading So Hard – The Realities of Day Trading

- Become a Consistently Profitable Trader – The Success Formula

I think your first point is crucial for traders and investors. People don’t understand that with the market changing all the time they will have to adapt accordingly. But to do this you will have to be always one step ahead and pay attention to the changes. Many people just want to know how to make money like there is a single magic button to press and voila. Unfortunately it doesn’t work that way.

Hi Stratos – thanks for sharing your thoughts!

You’re definitely right that most new traders think there’s some sort of mathematical formula or holy-grail system that will produce consistent, never-ending profits for all eternity – and all they have to do in order to become a millionaire or perhaps even a billionaire is figure out what that precise pattern, setup, or algorithm is. But that’s just not how markets work – they’re dynamic, complex, and infinite systems. So all trading strategies are constantly going in and out of favor based on market conditions. Some work better in trending markets and others work better in range-bound markets. Some work better in volatile markets and others work better in non-volatile markets. Some work better in bullish markets and others work better in bearish markets. If nothing else, they all need to at least be tweaked/refined over time as markets evolve (or possibly even completely replaced until the edge it exploits shows up again).

This is why we often see cases – in bullish/trending markets, for example – when everyone thinks they’re great traders/investors because all they have to do is buy and hold. They start latching on to slogans like buy the dip (BTFD!), diamond hands, and all kinds of other nonsense. And for a short period of time (and sometimes even long periods of time) – they get away with it. It seems like no matter what they buy at almost any price – their trades/investments increase in value. But when the market regime changes to bearish, they typically have no idea what to do and panic – most likely acting too late and losing all of their unrealized gains in the process. This is what happened with the tech bubble. Virtually everyone was making money buying pretty much any tech-related stocks. That was good for them, of course, until the bubble burst – and all of their investments went up in flames.

Experienced and skilled traders, on the other hand, have various strategies and systems that are market context-dependent – and they also possess the analytical skills necessary to adapt. This adaptation is what makes trading so difficult. There’s no automatic, set-it-and-forget-it approach that generates the same exact results every single day in every type of market environment. So you have to have some sort of reliable methodology that allows you to read the markets and flow with them. There are certainly technical skills that all successful traders must possess, but effective adaption is the ultimate sign of a great trader.