The Anatomy of a Powerful Market Framework/Methodology:

A Trading Paradigm Skool Community member asked me a great question recently via private message in regard to trading strategies/systems, which inspired me to create this article to clarify my thoughts on the subject. I think you’ll find it helpful.

Within the trading world (blogs, courses, forums, chat rooms, etc.), terms like “strategy” and “system” are often used quite loosely. So I fear that most developing traders have no real clue what having a robust market methodology actually entails.

To many, a “strategy” or “system” is simply a buy & sell indicator signal to follow (like a moving average crossover, for example). But to me, this type of thing is nowhere close to sufficient. It’s just a surface-level approach that has no sustainable edge.

So I want to take this opportunity to explain from my point of view what it means to have a holistic/comprehensive trading system with real, meaningful edge. In my experience, most market participants don’t have these 3 components firmly in place.

This will probably be eye-opening for many of you because the trading space is notorious for covering up the nuances/complexities of trading with things that sound easy (i.e. guru alert services, cookie-cutter candlestick patterns, etc.).

But trading is a challenging craft that requires real market competence and trading skill in order to achieve sustainable success.

1st Core Component → CONTEXT

WHY CONTEXT IS IMPORTANT: Markets Behave Consistently According to Posture/Context.

The first and most important component of a robust market methodology is contextual analysis.

This can vary a bit from trader-to-trader depending on scope (intraday trading, swing trading, position trading, etc.). But this analysis should start with longer-term phase/posture/context and cascade down to intermediate and shorter-term timeframes.

What story is the market is telling? What’s the structural narrative? Is it balanced (consolidating/sideways movement) or imbalanced (trending/directional movement)? What’s the market trying to do and how good of a job is it doing it?

This can be tricky because each individual timeframe isn’t always in perfect alignment with the others; they’re often conflicting. But this broad, comprehensive perspective helps gauge the strength/conviction of market movement/behavior.

For example: if long and medium-term timeframes are exhibiting acceptance of directional strength to the upside, but short-term is showing some weakness – the better trade opportunities probably favor joining the longs (even on an intraday basis).

Obviously, this is a fairly generalized statement that depends on a number of factors. But the point is: context is king.

Examples of How I Use Volume & Market Profiling For Contextual Analysis:

- Composite Volume Profiles (Weekly, Monthly, Quarterly, Yearly, etc.)

- Current Market Price in Relation to Composite Volume Points of Control

- Current Day vs. Prior Day/Multi-Session Value Relationships

- Price Magnets (High Volume Nodes on Composite Volume Profiles)

- Open Types (Open Drive, Open Auction Inside Range, Open Auction Outside Range, etc.)

- Day Types (Normal Day, Normal Variation Day, Neutral Center Day, Trend Day, etc.)

MAIN GOAL: Establish Bias and Identify/Prioritize Meaningful Decision Levels Across Timeframes.

Powerful Questions to Ask With These Reference Levels/Areas in Mind:

- How is Value Developing in Relation to Prior Day/Week/Month/Quarter/Year?

- What Phase is the Market Currently in and What Phase is Coming Next?

- What Are the Most Likely Scenarios Based on Current Market Posture/Context?

- Does Confluence Exist Across Timeframes to Support a Strong Directional Bias?

- What Would Have to Happen to Challenge/Shift That Bias (“If, Then…” Scenarios)?

- Who is in Control of the Market (Longs or Shorts) and How Aggressive Are They Behaving?

MAIN GOAL: Make Good Decisions Based on What is Currently Happening and Likely to Occur Next.

2nd Core Component → SETUP/STRATEGY

The next core component is a specific setup/strategy dictated by the phase/posture/context/narrative.

As we just discussed, contextual analysis is extremely important. But trading is more than just analysis; that analysis then has to be monetized through a probabilistic risk process. And this is where “playbook” trade setups/strategies come into play.

The “playbook” term was popularized by Mike Bellafiore in his trading classic, The Playbook. But the point of building a playbook is to have a set of consistent/repeatable/dependable setups to employ based on the overall context.

It’s one thing to be able to interpret market market posture/context, but then how do you go about expressing risk within that context in a consistent/repeatable way? Turning contextual analysis into an actionable trade plan is a critical trading skill.

What I often find with novice traders is that they learn extremely basic technical setups/strategies and think they have edge. But these setups offer no sustainable edge when they’re blindly implemented in a vacuum (without regard to context).

Simply asking whether or not a particular setup/strategy works is the wrong question to ask. Everything works sometimes, but never all the time; there is no holy-grail. What matters is the conditions present when certain setups/strategies work best.

Example Playbook Setup/Strategy Rooted in Volume & Market Profiling:

INITIAL BALANCE GO WITH (#IBGW)

The initial balance is the range of the first hour of the trading session. The stats are similar across futures products, but for the e-mini S&P 500 (ES) – this range typically gets extended in about 95% of sessions. Once extended to one side, there’s only about a 30% chance that the other side of the initial balance will be taken out. In addition to that, there’s about a 70% chance of 50% IB range extension, 40% chance of 100% IB range extension, and 10% chance of 200% IB range extension. These behavioral statistics set a framework for healthy expectations and can help me position based on likely/typical/probabilistic market behavior.

Some Criteria/Checklist Items for #IBGW:

- Initial Balance Has Been Extended to One Side

- Clear Slope in VWAP in Direction of Extension

- Bullish Skew in Profile in Direction of Extension

- 50% or More of the Expected Range of the Day Left

- Small Initial Balance Range Relative to the Average

- Clear/Strong Price Magnet Ahead Like a High Volume Composite Node

- Confluence of Balance on All Time Frames (Next Move → Imbalance)

MAIN GOAL: Categorize and Leverage Strong Patterns of Market Behavior in Varying Circumstances

Powerful Questions to Ask Regarding Your Setups/Strategies:

- Is the Trade That I’m About to Take a 4-Question Trade?

- Do I Want to Join/Go With the Current Move or Fade/Go Against it?

- Can I Lean on Any Behavioral Statistics to Anticipate Future Market Movement?

- Does the Open Type Provide Any Insight on the Likely Day Type That Will Follow?

- What is the Current Context and Which Setups/Strategies Work Best Within That Context?

MAIN GOAL: Layer Dependable Setups Within the Right Context For Consistent/Repeatable Results

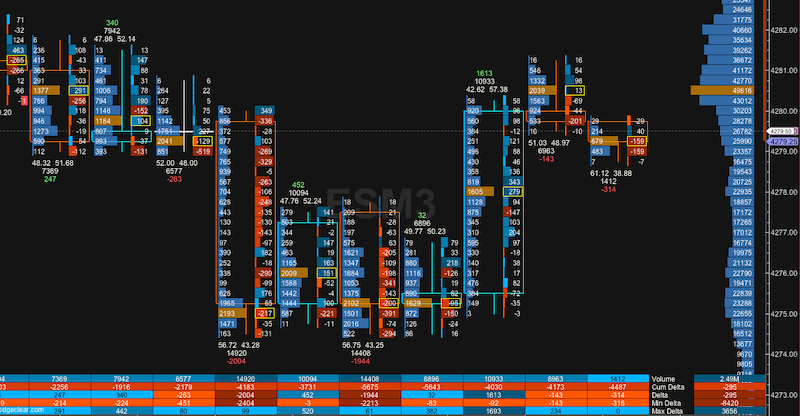

3rd Core Component → REAL-TIME ORDER FLOW

In my personal opinion, the first 2 components (Context & Setup/Strategy) are by far the most important. So if you’re a new trader, those areas are the best place to start. But for further refinement, short-term order flow can be a powerful supporting tool.

A lot of new traders come across order flow tools like depth of market, time & sales, cumulative delta, and more – and get consumed by them as if they’re the most important things. But you have to be careful not to lose the forest through the trees.

Generally speaking, short-term order flow is hard to follow/make sense of, changes incredibly fast, and produces a lot of fake-outs. So just like setups/strategies without context, blindly following order flow signals in a vacuum is problematic.

It’s only a tiny magnification of what’s going in the market, so allowing it to be the primary decision-making tool is backwards. It’s merely a supplemental piece to the puzzle once higher timeframe context and playbook setup(s) are already in place.

I personally don’t even look at my trigger charts (which display short-term order flow information) until posture/context pairs with a playbook setup and the market is at/approaching a key decision level. Otherwise, it does me no good (it only distracts).

But when used appropriately, real-time order flow can certainly help reduce risk, avoid bad trades, and refine entries & exits.

Examples of Short-Term Order Flow Tools:

- Depth of Market (DOM)

- Time & Sales

- Cumulative Delta

- Footprint-Style Charts

- Bookmap/Heatmap-Style Charts

MAIN GOAL: Monitor For Exceptional Activity at Key Decision Levels to Join/Defend

Powerful Questions to Ask Regarding Short-Term Order Flow:

- What’s the Quality of My Key Trigger/Decision/Reference Levels?

- Is There Strong Participation at My Levels in the Same Direction I Want to Go?

- Is Impulsive/Outsized/Exceptional Activity Getting Follow-Through?

- What’s the Pace/Flow/Tempo of Price Movement Relative to the Norm?

- What Kind of Short-Term Activity Can I Be Confident in Joining/Defending?

MAIN GOAL: Reduce Risk By Entering With Momentum and Monitoring For Continuation/Reversal

Final Thoughts – Is Your Current Trading System Sufficient or Woefully Lacking?

After reading this, how does your current trading system compare to what I’ve explained here? At a minimum, do you have a reliable way of viewing & analyzing context? And then are you layering playbook setups within that context?

Because this is the basis for legitimate market edge. You’re not going to find some setup, pattern, or trigger that magically works in all conditions. That’s just not how markets work. Good trading is nuanced and requires critical thinking.

When I talk about acquiring “deep market competence” and “legitimate trading skill” (which are terms that I use all the time), these 3 components are the foundation for that. Blending them all together equates to real competence/skill/edge.

No individual component on its own is sufficient. So you might want to reconsider your individual approach if it’s not hitting on the first two at a minimum. Blindly buying & selling based on generic/cookie-cutter setups, patterns, and indicators is not the answer.

Struggling traders rely on indicators to tell them exactly what to do because they don’t know how to generate and execute high-quality trade ideas on their own. This is a problem because most indicators are lagging, oversimplified, and offer no sustainable edge.

Overall, trading is a craft that requires real competence and skill through deliberate practice/experience/repetition with variation.

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- What is Profile Trading – Volume Profile & Market Profile

- Molding Your Market Framework – How Do You View Markets?

- Become a Consistently Profitable Trader – The Success Formula

- What is Trade With Profile – Best Trader Training Program?

- What is Aaron Korbs Trading With His Volume Profile Method?

As someone who is completely new to trading, I must say that it can be overwhelming to know where to start. There are so many different strategies and techniques to potentially learn, and it can be difficult to sort through all the information out there. However, there are a few key things that I think one can do to get started.

First, it’s important to set an initial foundation and generally educate yourself about trading. This means reading books, watching videos, and following blogs and forums that focus on trading. There are also many online courses and seminars available that can help you learn the basics of trading. I would especially like to point out out your Trading Success Framework Course and Community. Those are incredible resources.

Once a basic understanding of trading is in place, it’s important to start practicing, not just passively consuming information. This means opening a simulated, demo, or replay account and using virtual money to practice trading strategies. This will give you the opportunity to see how different strategies work in real-world situations, without risking any real money.

Hi Herman – I appreciate your comment.

Where to start can certainly be confusing/intimidating with all the options out there in regard to markets, products, strategies, and timeframes to trade. But one of the main reasons I created the Trading Success Framework course and the Trading Paradigm Community to go along with it was to provide beginners with an opportunity to understand what being/becoming a real (skilled, competent, and consistently profitable) trader truly entails from both an edge/methodology & mindset/psychology perspective. There’s no hype, gimmicks, or lifestyle marketing with these resources; it’s legitimate education that encourages safe application through deliberate practice using sim/demo/replay. So thank you for pointing these things out.

I also recently published a related article breaking down my thoughts on training for trading that you and others might find useful.

Feel free to check that out and let me know what you think. Take care!

As a complete noob to trading, I found your perspective very insightful. I have been interested in trading for a while but have had no idea where to start. Thank you for breaking down so much that a dummy can understand. It also helped to see in which ways you use volume and market profiling. You are very right, trading does require a great deal of competence and skill, there are no shortcuts and I appreciate your assistance in making the journey easier.

Hi Toheeb – I’m glad you found this post helpful. Understanding these components is critical for all traders to understand. More helpful content like this can be found in my free Trading Success Framework course – that’s a great place to get started if you haven’t checked it out already. Take care!