Why Do Traders Meditate – Does Meditation Actually Help With Trading?

There are a lot of misconceptions about meditation. Most people think it’s religious, but it’s really just brain exercise – and studies have shown its incredible benefits. For traders actively monitoring the market, meditation is a critical tool for peak performance.

In my experience, the vast majority of individuals who attempt to trade completely overlook the psychological component. They choose to dabble, cut corners, and typically lose money with a random and shallow approach. Instead of developing an exceptional level of depth through the practice of meditation, they allow every passing thought and emotion to mindlessly impact their behaviors.

Meditation isn’t about suppressing or trying to completely eliminate your thoughts and emotions, as most people assume. It’s about noticing your thoughts and emotions, but choosing not to associate with them. You recognize them, but only as an objective observer. Through this practice of self-awareness, mindfulness, and detachment, you can develop increased patience, focus, and balance.

Establishing this new relationship with your thoughts is an incredible competitive advantage as a trader. Since the typical market participant is fearful, greedy, and anxious – and making irrational decisions because of it, there’s tremendous opportunity for you as a relaxed, rational, and controlled trader. Your poise and self-control allows you to identify and capitalize on the emotions of the masses.

Why do you think many hedge funds and big banks like Goldman Sachs have instituted meditation programs for their employees?

What is Trader Psychology and Why is it Important?

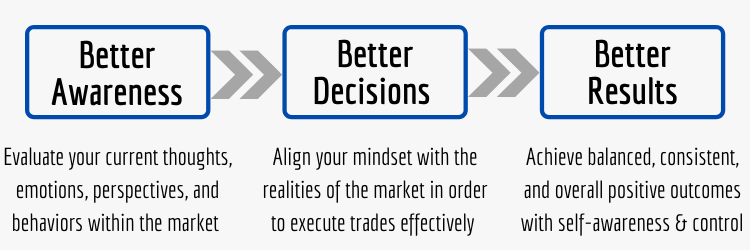

There’s a direct link between a trader’s mindset and his/her trading results, yet you don’t see many traders taking responsibility for their own results. Typically, the blame is projected outwardly toward alert services, newsletters, gurus, or even the market itself . But in almost all cases, traders should actually be looking internally at their own thoughts and emotions in order to fix their problems.

If you ask a struggling trader why they’re struggling, the answer will probably be something along the lines of how they haven’t found a good strategy or system. But are their trading woes really a result of a poor strategy or system – or their own ability to execute? For someone with poor emotional control, even the best strategies and systems can be compromised by impulsive behaviors.

This is why I personally believe that acquiring the proper mindset is the most important aspect of achieving consistent profitability. Of course you need a strategy or system with positive expectancy to go along with the mindset, but there’s plenty of edge available in the market. The hardest part, however, is developing the mental consistency and discipline to support your statistical edge.

But developing an increased level of self-awareness and self-control is only one side of the trading psychology coin. Not only will you benefit from your new objective mindset, but you also benefit from understanding the herd. Since you were once part of the impulsive and irrational group, you understand how they think, feel, and behave – which provides you with a well-rounded perspective.

What is the Best Trading Psychology Course Available Online?

When I mention trading psychology and trading mindset, I think most people get the wrong idea. They usually think trading mindset has to do with constantly pushing in an attempt to force a result – like most people in business or entrepreneurship talk about. But in trading, the mindset is different. Success within the market environment requires a unique set of mental skills.

This is why trading mindset is so important, and why these trading mindset courses exist – because nobody is born with the right mindset to behave appropriately within the market environment. It has special characteristics that we simply aren’t used to dealing with. So we have to find practical and effective ways to overcome our natural cognitive biases (negativity bias, loss aversion, etc.).

#1 Trading Psychology Course – The Advanced Traders Mindset Course

The Advanced Traders Mindset Course was created by Chris Capre at 2ndSkiesTrading. With nearly two decades of consistently profitable trading and a background in neuroscience, Chris Capre brings some unique experiences to the table. His students not only benefit from the technical skills he teaches within his courses, but the mental skills as well.

Far too many trading educators focus solely on patterns and setups, while sidestepping the mental component, which only handicaps their students’ long-term success. But unlike these other teachers, Chris Capre puts an incredible emphasis on legitimate training and building an exceptional mindset. In addition to the 20 main lessons of The Advanced Traders Mindset Course, there’s a strong meditation component added to the end of it as well (an extra 12 lessons).

Two other great trading psychology courses worth mentioning are The Trading Psychology Mastery Course by Yvan Byeajee at Trading Composure and Trader Compass 2.0 by Richard Friesen at Mind Muscles For Traders. The Advanced Traders Mindset Course and The Trading Psychology Mastery Course both offer meditation lessons, but Compass 2.0 does not – it offers guided visualizations instead.

Conclusion – Meditation Can Help You Develop the Mindset of a Consistently Profitable Trader:

Not every trader chooses to work a meditation practice into their daily routine, but in my own personal opinion that’s a big mistake.

I know it seems like an abstract concept and an exercise that’s hard to measure. But many people, including myself, have experienced some incredible benefits from it. And I would have to say with a high degree of certainty that it’s had a direct impact on my trading profits. In my opinion, mindfulness is one of the most important self-improvement habits for everybody – not just traders.

But especially for traders, you don’t really have a chance at durable success without a strong mindset. The market will throw mental tests at you every single day – and how you respond to them will determine your results. Your beliefs about money, risk, loss, and uncertainty will undoubtedly be revealed. So having self-awareness along with the flexibility to adapt those beliefs is paramount.

Unfortunately, most traders are money-obsessed instead of mindset obsessed. Results-focused instead of process-focused. But with this approach, you’re only setting yourself up for pain and failure. Without the proper mental framework, trading can be an emotionally and financially afflictive undertaking. But it doesn’t have to be. Not if you focus on developing the appropriate mindset first.

In the end, successful traders are masters at sacrificing short-term emotional gratification (not giving in to their impulses) in order to achieve long-term success (executing on their statistical edge with consistency and discipline to produce steady gains over time).

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Values and Principles to Live By as a Trader – What’s Your Mission?

- What is Trading Mindset? The Central Component For Consistent Profits

- Combine Mindfulness Meditation and Stock Trading For Consistent Results

- Rewire Your Brain For Successful Trading With the Help of Neuroplasticity

- What is Trading Composure? Acquire a Heightened Level of Trading Insight

Okay I get this at a strong emotional level and sure could have used it in my ‘dabbling with Forex’ days.

Will this help me with prepping for a currency trading session? My wife does yoga and it really helped her health AND her mood, but it was not for me. I found your page in a search and had never though about meditation to get my head right for the markets. I’m done with forex, but now into stocks and options. You think this course will help me? thx!

Hi Dwayne – I appreciate you sharing your experiences.

In general, I personally think that meditation is the best peak-performance habit for anybody to develop. A consistent practice has benefits in all aspects of life – not just trading. And even for individuals who don’t want to strongly pursue a deep meditation practice, mindfulness is still a critical component to long-term market success.

Being aware of your own impulsive and irrational thoughts can help you make better decisions within the chaotic market environment. And it doesn’t matter what market, time frame, or product/instrument is being traded – mindfulness can help traders of all kinds. Overall, meditation is one of the best tools to build our “mindfulness muscles”, if you will. As much as it tends to get ignored in favor of more “exciting” topics like magical indicators and foolproof systems (which don’t actually exist), trading is mainly a mental game.

In my personal opinion, The Advanced Traders Mindset Course by Chris Capre at 2ndSkies is the best trading psychology course currently available online. But I also highly recommend The Trading Psychology Mastery Course by Yvan Byeajee at Trading Composure and Compass 2.0 by Rich Friesen at Mind Muscles For Traders. The first 2 courses mentioned have meditation components to them, but Compass 2.0 does not – there are guided visualizations and other mental exercises instead. You can’t really go wrong with any of these courses, but they’re not automatic remedies just from watching and listening to recorded videos. It takes legitimate work to cultivate a more balanced mental framework.