The Non-Trading Elements Are Leading Indicators of Your Performance:

When it comes to trading, most novices only worry about the trading session itself – when the actual buying and selling takes place. They roll out of bed 2 minutes before the open, power up their trading station, and think they’re in a position to succeed.

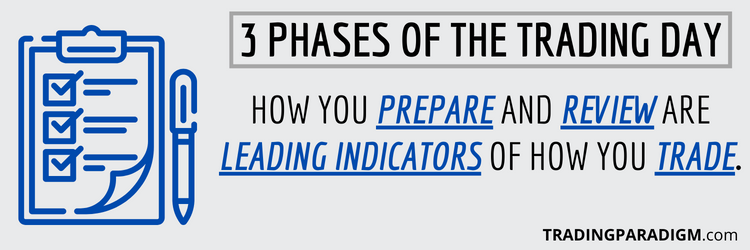

But I can tell you right now that without a consistent daily routine of preparation and review, your trading (the entering/exiting of positions during market hours) most likely won’t be very good. I don’t know any successful traders who don’t prepare and review.

Preparation before the trading session and review after the trading session (both times when no real-time trading decisions are being made) are leading indicators of your trading performance. These phases are really where the bulk of the work is done.

I’m not trying to downplay the importance of the trading session itself – because proper execution during this phase is extremely significant. But what I’m saying is that proper execution is next to impossible without strong elements of preparation and review.

As a trader, you’re an elite performer – much like that of a professional athlete – and if you’re just showing up at “game time” (market hours) without consistent study, practice, and training, then good luck competing and succeeding at a high level.

Breaking Down the Trading Day Into 3 Critical Phases – Prep, Trade, and Review:

On a daily basis, the repetition of these 3 phases – if approached correctly – allow you to efficiently gain experience, learn new things, build meaningful habits/skills, and continuously improve over time. So it’s imperative to take full advantage of these opportunities:

PREPARATION

The preparation phase is your routine before the market opens. This, of course, should include your contextual analysis – what are market conditions? What’s the posture of the market in various time frames? What are the most critical reference areas/zones/levels?

In addition to your high-level contextual analysis, you should also be crafting specific plans/hypos based on situations that are likely to occur. You might have 4 or 5 different plans based on various scenarios (how the market opens, what levels get tested, etc.).

Writing these different scenarios down and running through how you would handle them in your mind prior to them even happening prepares you for whatever the market throws at you. This is a great way to proactively avoid impulsive/irrational trading.

The preparation phase also includes many performance multipliers that often get ignored – like sleep, hydration, nutrition, meditation, exercise, and more. These components are highly-correlated to mindset and overall health – and shouldn’t be neglected.

Overall, the market isn’t a good place to be spontaneous or search for thrills – even though many people do just that. But if you want long-lasting, sustainable success, you have to have a solid routine/checklist/launch sequence for structure and consistency.

TRADING

The trading phase should be devoted to executing the plans/hypos generated within the preparation phase. When properly prepared, there should be little to no strenuous decision-making taking place during market hours. Multiple scenarios are accounted for.

If a scenario outside of what you’ve planned for in the preparation phase occurs, then it’s probably a good idea to stay on the sidelines. Sometimes “no trade” is a good trade. But with that being said, in-the-moment discretion can be improved with skill/experience.

Many people trade for thrills and excitement, but this short-term emotional gratification often comes at the expense of long-term, sustainable success. Trading requires a great deal of poise and patience – waiting for things to align – and then effectively executing.

It really all comes down to following your process – which is much easier said than done. The market is a provocative environment – and having money (and oftentimes your ego) on the line can bring up all sorts of destructive thoughts and emotions.

This is why I highly recommend mindset journaling throughout the session – to release any thoughts/feelings of anger, frustration, joy, sadness, etc. before they manifest themselves into impulsive actions. This documentation also supports the next phase…

REVIEWING

The last phase, and probably the most important (in my opinion) is review. This is the time when you reflect upon your trade plans/hypos generated within the preparation phase in comparison to how you executed them within the trading phase.

Were your plans detailed enough? Did you notice something that you might want to add as a potential trigger for entries/exits? Do you have ideas for a new setup/strategy? Did you follow all your rules – or make some impulse/FOMO/revenge trades?

The overarching goal of review/reflection is to take the data/information generated by the market and how you personally interacted with it throughout the session – and use that feedback to find areas for improvement/refinement.

It’s an in-depth, honest look at your entire process in order to get better every single day. This is what accountability means – this is what it takes to be a professional-level trader. A surface-level, hobbyist approach to trading just isn’t going to work.

There are no “leagues” separating participants by age and talent-level in the markets – everything is the “majors”. You’re competing against elite performers – and if you’re not an elite performer yourself, then your long-term performance won’t be very good.

Trading Requires Hard Work and Dedication Both Inside and Outside of Trading Hours:

Most people don’t realize the hard work and dedication that good trading requires because it’s so easy to get involved. There are virtually no barriers to entry – almost anyone can easily open up a brokerage account and fund it within a day or two.

And after that, all it takes is the push of a button to enter/exit positions – it doesn’t get much simpler. But there’s a gigantic difference between the mere act of trading (randomly pushing buttons) and being a consistently profitable trader.

So while it’s easy to gain access to markets and start trading – trading right/effectively/sustainably is an entirely different story. Most people simply aren’t willing to put the time and effort into proper education, training, and habit/skill-building.

They want easy answers to trading success (guru alert services, newsletters, and chat rooms to tell them exactly what trades to make). But these services are largely ineffective because they stunt trader development (promoting dependency over self-sufficiency).

In other words, most people just use them as crutches to avoid personal behavior change. But behavior change is actually what’s required to be successful. Please don’t undercut your personal development as a trader by avoiding what’s required for it (change).

In the end, you can’t control the market. But you can control your own behaviors and processes that support high performance.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Become a Consistently Profitable Trader – The Success Formula

- Transform Yourself Into the Trader You Want to Be in 3 Steps

- Molding Your Market Framework – How Do You View Markets?

- There Are No “Naturals” – Great Trader’s Aren’t Born, They’re Made

- Values and Principles to Live By as a Trader – What’s Your Mission?