Mental Toughness is the Cornerstone of Success as a Navy SEAL:

Navy SEALs are some of the most tough and courageous human beings on earth. They’re an elite special operations unit of the US military trained to execute missions in all environments (sea, air, and land). Some of the work they do involves reconnaissance missions, direct raids on enemy targets, and various actions against terrorist groups. Just to become a Navy SEAL requires passing a brutal 6-month long training program known as BUD/S (Basic Underwater Demolition/SEAL training). Due to the high standards of the Navy SEAL community and rigorous nature of the training itself, over 75% of candidates in BUD/S drop out.

From an outsider’s perspective, it might seem like physical fitness is all it takes to become a Navy SEAL. Every candidate has the outward appearance of a physical specimen, so they should just be able to muscle their way through the training, right? Especially since the physical aspects of the training are designed so that the average athletic male can handle them. The physical requirements are difficult, don’t get me wrong, but far from unachievable. So if all of the candidates are physically tough enough to be there in the first place, it begs the question: what qualities do the individuals who actually make it through the training have that the drop outs don’t? Just like the low success rate in trading, it’s the failure to cultivate the proper mindset that washes away the hopes and dreams of numerous SEAL candidates. In the end, it’s clearly the mental component that determines success or failure.

3 Critical Mindset Attributes That Traders Can Learn From Navy SEALs:

1) Poise Under Pressure

Comparing the experiences of a trader to that of a Navy SEAL really puts into perspective how ridiculous it is to feel any fear from the market itself. As traders, the fears we tend to generate as market participants are completely irrational. All the market does is objectively provide information. It has nothing against us personally. There are no real enemies except the ones we imagine. We sometimes treat every little move in the market as a life and death scenario when it’s not at all the case. As a Navy SEAL, however, there are countless situations where lives are legitimately at stake. Imagine taking on enemy fire in a real-life battle. Bullets flying everywhere and grenades being thrown – that makes for a much more justifiable environment for feeling stressed, doesn’t it? Yet SEALs are able to stay poised during even the most stimulating situations. After innumerable training evolutions, they’re able to effectively block negative self-talk, visualize success, and focus on working the problems in front of them. They understand that emotions like worry and fear simply aren’t productive when trying to find the best solutions and make high-quality decisions in dynamic environments.

2) Control vs. No Control

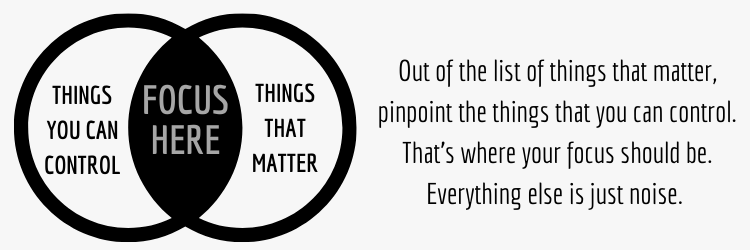

One of the major reasons SEALs are able to stay composed under pressure is by focusing their minds only on the tasks that can actually make an impact. Any element of the operation that they don’t have control over is just noise. And that noise is nothing but a potential distraction from the successful completion of the mission. They don’t sit around wasting time by blaming every outside force they can think of for their problems – how would that help them find solutions? They take complete ownership of the circumstances they face and the results they achieve. The parallels that this concept has to traders within the market environment are absolutely critical to understand. As traders, we must fully understand that we have no meaningful control over the market. But what we do have complete control over is how we react to it. Like the saying goes: “we can’t control the wind, but we can certainly adjust our sails”. So we have to take accountability for our perceptions and reactions, which requires a shift from focusing on external forces to internal forces. Most traders play mental tricks on themselves by blaming the market or other outside forces in a paltry effort to avoid personal responsibility for their trading woes. But if they want consistent success within the market, they must realize that the responsibility is internal.

3) Mission Over Ego

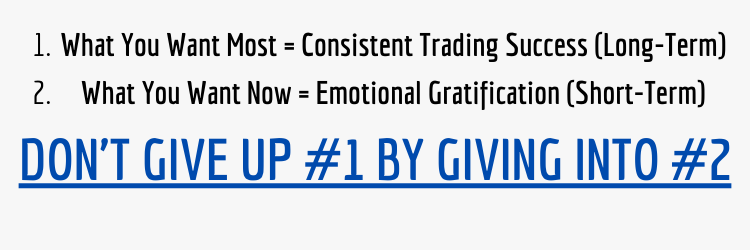

Great SEAL team members are disciplined, humble, and put the mission above their own personal egos. If they truly want to be elite, they’ll even explore their own weaknesses in order to train them, instead of merely focusing on their strengths. This team-first, growth-mindset approach puts the emphasis exactly where it should be – on accomplishing the overall mission. In trading, the majority of traders fail by falling victim to their own egos. Whether or not they consciously realize it, they often sacrifice their long-term goal of becoming a consistently profitable trader by giving into the short-term emotional gratification of following their impulses on a trade-by-trade basis. They might have a great system with rules in place to protect them, but lack the self-discipline to follow those rules in the moment, effectively rendering the system useless. Even though losses are an unavoidable aspect of trading, some traders mentally refuse to take them. As a result, they’ll remove stop losses, double-down on losing positions, and find all sorts of ways to rationalize their irresponsible actions. They do this in an effort to avoid “feeling like a loser” because they’ve attached their self-worth to the result of every individual trade, and they end up self-sabotaging their trading results due to faulty attitudes, beliefs, and perspectives. A complete mindset shift is often required because feeding egos should not come at the expense of ultimate mission success.

With Any Difficult Endeavor in Life, Proper Mindset is Paramount:

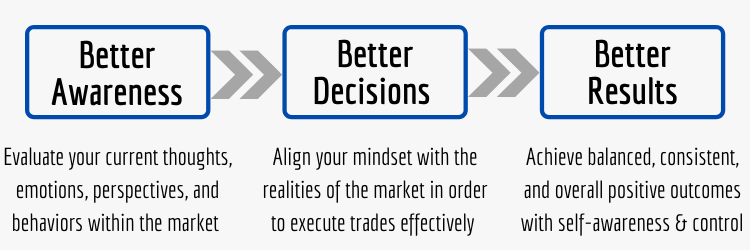

Operating as a trader and operating as a Navy SEAL are seemingly unrelated undertakings, but one thing is for certain: no individual can succeed in either without the proper mindset. The reality is that those who choose to go down these paths are entering new environments, and in order to operate effectively within these environments, it requires change. People fear change because it isn’t always easy. It usually requires real training and effort. But the good news is that mental attributes can most certainly be developed over time. The bad news is that failure to obtain the proper mindset to effectively operate in an unforgiving environment will only lead to pain and suffering. It’s interesting that people tend to associate change with pain. But what about the pain of not changing? What is our current mindset doing for us – is it helping us achieve our goals or detract from them? For survival, our mindset needs to be in harmony with the realities of the environment we’re operating in.

The market simply isn’t an environment most people are used to operating in. Just like being in a war zone probably doesn’t feel natural to most people. Anxieties and fears are bound to overtake us at first, especially if we haven’t taken the time upfront to develop self-awareness and an understanding for how to properly manage our emotions. But with practice and real-life experience, operating effectively in a new environment can eventually become second-nature. Becoming a consistently profitable trader is a challenge that most people approach from the completely wrong perspective. They search outside themselves for answers over-and-over again, thinking which “newsletter” will send me the best “hot stock tips”? What “guru” can send me the best “real-time alerts”? What “foolproof system” will help me “get-rich-quick”? When the reality is that the foundation for success, which often gets overshadowed or completed ignored, is entirely internal. Ultimately, the deciding factor between success and failure in any endeavor is mindset.

It’s your choice to either continue struggling in the market or make the necessary paradigm shift to become a more effective trader.

Learn More in the Trading Success Framework Course

Written by Matt Thomas (@MattThomasTP)

Related Pages:

- Hey Traders, Do You Like Emotional and Financial Torture?

- What is Trading Mindset? The Central Component For Consistent Profits

- Combine Mindfulness Meditation and Stock Trading For Consistent Results

- Rewire Your Brain For Successful Trading With the Help of Neuroplasticity

- Top 5 Trading Paradoxes – Learn Them to become a Better Trader

Im just starting my adventure with trading, and posts like this are extremely useful. To be fair I was never connecting navy seals training with trading but its really accurate observation. Without abilities to control emotions and act under pressure it is impossible to achieve success.

The comparison really drives home how important the psychology aspect to any difficult endeavor is. Navy SEALs go through such rigorous training that molds their mindset into something that a very small amount of people in the world have. They can operate effectively in extremely stressful situations – ones that are legitimately life and death. Yet traders have so much fear and worry in what they’re only perceiving as a stressful environment. The market never hurt anyone. If a trader feels hurt, it’s because of their own thoughts, emotions, and behaviors. All the market does is objectively provide information, and as traders we choose to perceive that information in various ways. Sometimes we take action on those perceptions and sometimes not. But it’s entirely up to us how we choose to perceive and react. Overall, there’s no actual “threat” as a trader, and there are so many mindset attributes that Navy SEALs display that we can learn from. The only threat as a trader is ignoring the psychological aspect of operating within the market environment – we have to evolve our mindset or we have no chance of success.